In the ever-volatile world of cryptocurrencies, a bold prediction has emerged from a renowned crypto analyst Stockmoney Lizards, who has predicted a new bottom for Bitcoin price. According to a recent analysis, Bitcoin might have found a new floor at $40,000, marking a significant shift in market sentiment.

Notably, this prediction comes at a time when Bitcoin price has been experiencing roller-coaster movements, hitting highs and lows that keep investors on the edge of their seats.

Analyst Sets $40K As New Bottom For Bitcoin

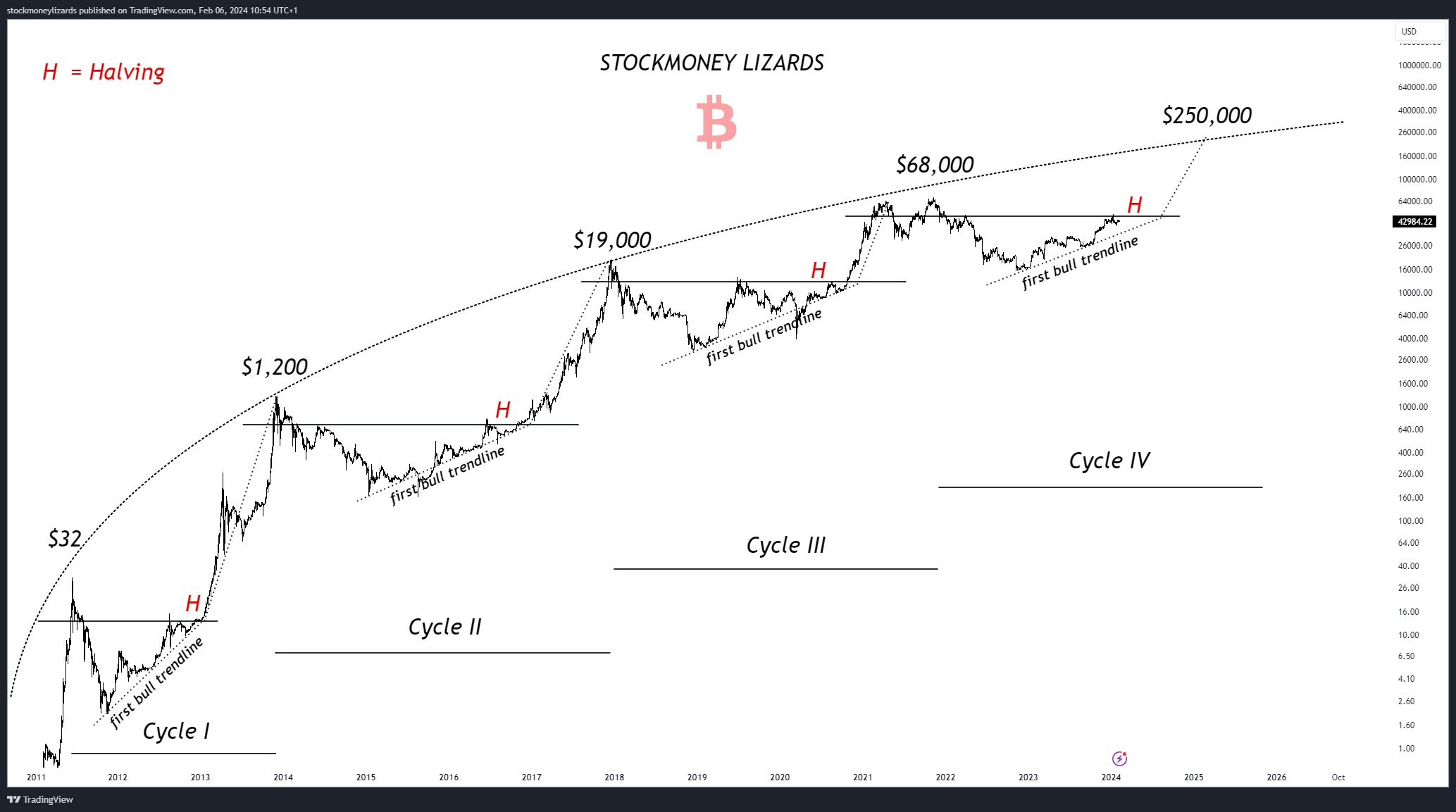

Stockmoney Lizards, a prominent figure in the crypto analysis realm, recently made a striking declaration regarding Bitcoin’s price trajectory. Emphasizing the significance of historical data, the analyst indicated that Bitcoin’s price evolution over the past 13 years aligns remarkably with a logarithmic growth curve.

Notably, this pattern, according to the analyst, is orchestrated by the phenomenon of Bitcoin Halvings, which historically precede bullish cycles. Meanwhile, highlighting the current phase as the fourth cycle, Stockmoney Lizards suggested that the prevailing price pattern mirrors previous cycles closely.

In addition, the analyst went on to assert that the likelihood of Bitcoin dipping below $40,000 again is slim, hinting at a potential new bottom. On the other hand, the analysis projected a potential peak at $250,000, instilling optimism among Bitcoin enthusiasts.

Also Read: Ripple CTO Weighs in on Ex-Employees and XRPL Developments

Market Response and Liquidation Trends

Despite the bullish sentiment echoed by Stockmoney Lizards, the market recently witnessed a muted momentum, with Bitcoin’s price crossing $48,000 in the last 24 hours. However, some market pundits attribute this current downward performance to profit-taking strategies employed by some investors.

However, concerns were raised over crypto liquidation data, indicating widespread selloffs. In the past 24 hours, CoinGlass reported 41,319 traders being liquidated, amounting to a staggering $113.01 million in total liquidations.

Meanwhile, the largest single liquidation order, valued at $1.93 million, occurred on Binance for the ETHBTC pair. Notably, Bitcoin topped the list of individual crypto liquidations, totaling $38.25 million, followed by Solana at $8.81 million.

However, the dip from the $48,000 mark could also propel a buying opportunity for some investors. As of writing, the Bitcoin price was trading at $47,204.28, down 0.20%, after reaching a 24-hour high of $48,152.49.

Meanwhile, amid market turbulence and liquidation concerns, Stockmoney Lizards’ bold prediction of Bitcoin’s $40,000 floor offers a ray of hope for investors. While recent price fluctuations may cause apprehension, the analyst’s insights provide a broader perspective on Bitcoin’s long-term trajectory. As the crypto market continues to evolve, only time will tell if Bitcoin indeed maintains its newfound bottom or embarks on a new price discovery journey.

Also Read: Analyst Remains Bullish On XRP’s Run To $1.88

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.