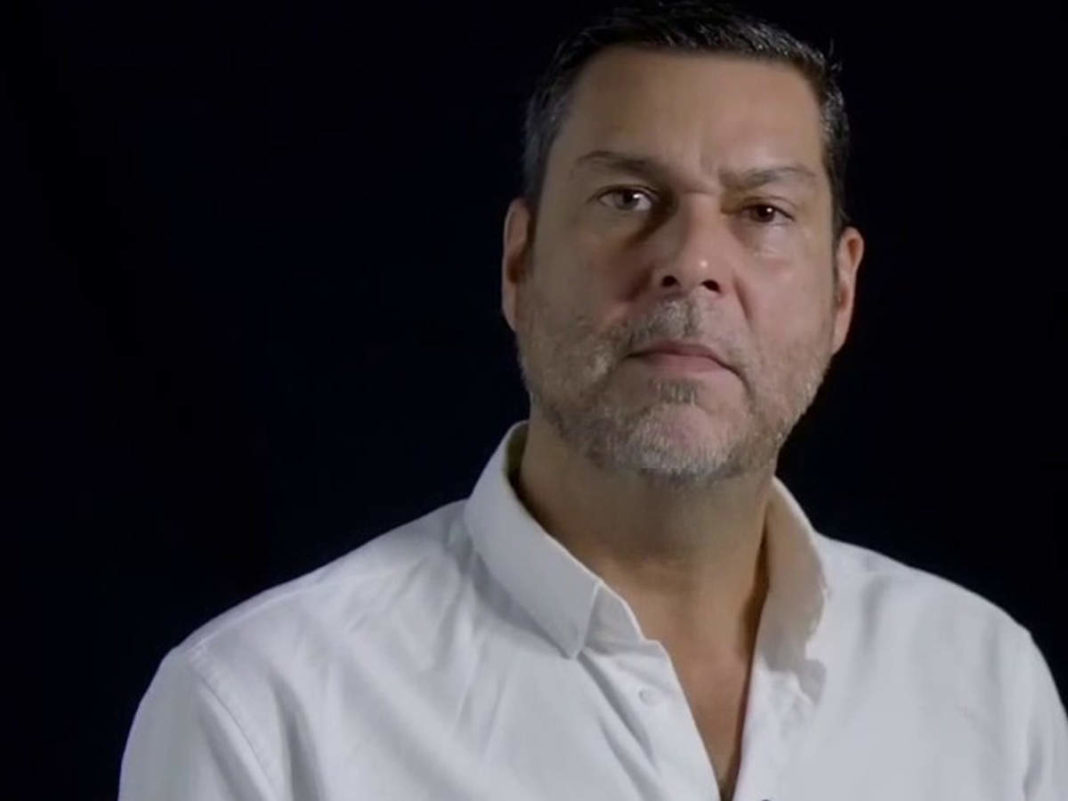

Raoul Pal, CEO, and co-founder of Real Vision has taken a bullish stance on Ethereum. Staying true to past statements, Pal reiterated support for Ethereum, which he sees growing exponentially in the coming years. For Pal, the growth of Ethereum in comparison to Bitcoin is the greatest argument for its long-term success. This has led the CEO to stand behind the leading smart contracts platform in the crypto space.

Ethereum Vs. Bitcoin

Anyone in the crypto space now knows that there is a clear line when it comes to outperformance between the two top cryptocurrencies. Although bitcoin has brought massive returns for its investors, it has not done nearly as well as Ethereum in the same time frame. This has largely driven the argument of Ethereum “flipping” bitcoin.

Related Reading | New York Mayor Says Cryptocurrencies Should Be Taught In Schools

Pal does not seem to subscribe to the school of thought that is Ethereum flipping bitcoin but is bullish on the latter’s long-term potential over the former. He argued the value of Ethereum against bitcoin when the digital asset had first launched five years ago, showing that the altcoin has performed 100x against bitcoin over its five-year lifespan.

For the Bitcoin Maxi’s: when ETH launched it was at 0.0007BTC. 6 years later, it is at 0.07. That is 100x vs BTC over the period you called it a shit coin.

The whole Pfeffer argument of utility value goes to zero has been proven wrong due to network effects

Facts matter. 1/

— Raoul Pal (@RaoulGMI) November 14, 2021

ETH price trading above $4,600 | Source: ETHUSD on TradingView.com

However, just because Ethereum has performed remarkably well compared to Bitcoin does not mean that there isn’t any potential for bitcoin. But Pal expects the altcoin to keep outperforming bitcoin in the coming years.

ETH and BTC aren’t the same thing and that is fine.

Some other token will outperform ETH probably over time too. That is cool too.

The entire space is going up 100x from here. You can choose where you want to be on the risk curve but it’s not even clear ETH is more risky now.

— Raoul Pal (@RaoulGMI) November 14, 2021

Bullish On ETH

Pal’s stance on Ethereum has not changed since he had first declared investments in the digital asset. In August, Pal had placed the value of Ethereum at $20,000 by the second quarter of 2022. This prediction was mostly predicated on its growing use cases as the leading smart contracts platform for decentralized finance and NFT activities in the crypto industry, thus giving it an edge over bitcoin which did not have much going for it besides its monetary policy.

Related Reading | Confirmed: AMC Now Accepts Bitcoin, Ethereum, Two Other Cryptos, Dogecoin To Follow

In the same vein, Pal had placed the price of bitcoin at $250,000 in the same time period, proving that his bullish sentiment went above just ETH’s potential. Pal had also moved his entire investment portfolio into cryptocurrencies in 2020, the majority of which was in Bitcoin.

In October, Pal updated his followers on Twitter that he had made the biggest personal position of his life in ETH. In the tweet, Pal said, “Just so we are clear – I am more than irresponsibly long ETH right now. I now have leverage but via calls. This is by far and away the biggest personal position of my entire life by a factor of 10 (or more). My view horizon for this part of the trade is 6 to 9 months.”

Featured image from The Economic Times, chart from TradingView.com