- Dogecoin price develops a trifecta of bullish entry conditions.

- Short-sellers fail to capitalize on setting off a capitulation move.

- Downsides risks, while limited, do remain.

Dogecoin price action has certainly been a disappointment for the Dogearmy. Dogecoin lost nearly 34% of its value in November, which is likely to change very soon.

Dogecoin price action traps short-sellers, creating huge short-squeeze opportunity

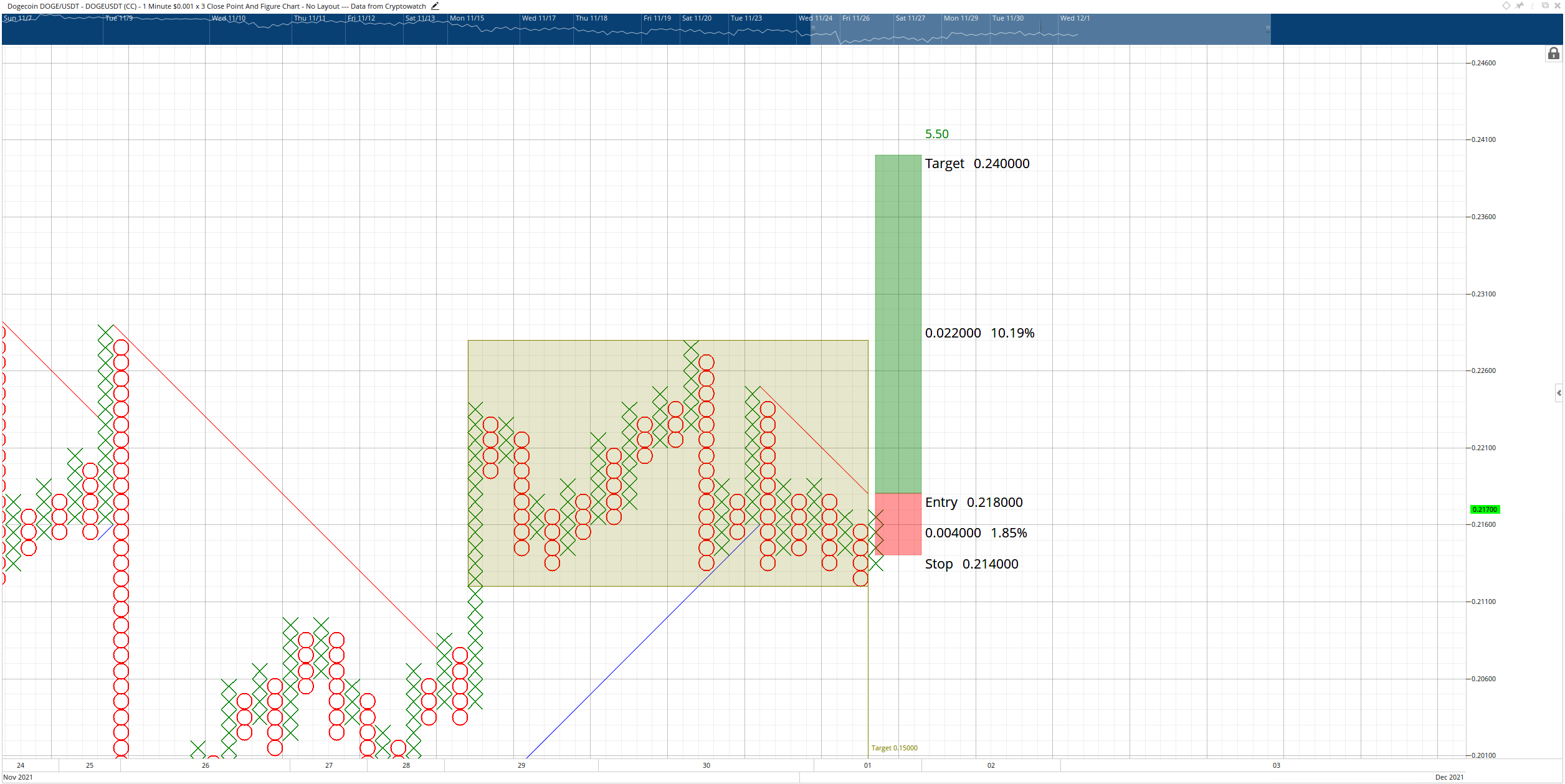

Dogecoin price has a tremendous buying opportunity setup on its $0.001/3-box Reversal Point and Figure chart. The theoretical long setup is a buy stop order at $0.218, with a stop loss at $0.214 and a profit target at $0.351. The entry, if confirmed, completes three conditions simultaneously:

- An entry at $0.218 confirms the breakout above a triple-top that formed at $0.217.

- The entry at $0.218 confirms a bullish Point and Figure pattern known as a Bear Trap.

- The entry moves Dogecoin price above the current dominant downtrend angle and converts the $0.001/3-box Reversal Point and Figure chart into a bull market.

DOGE/USDT $0.001/3-box Reversal Point and Figure Chart

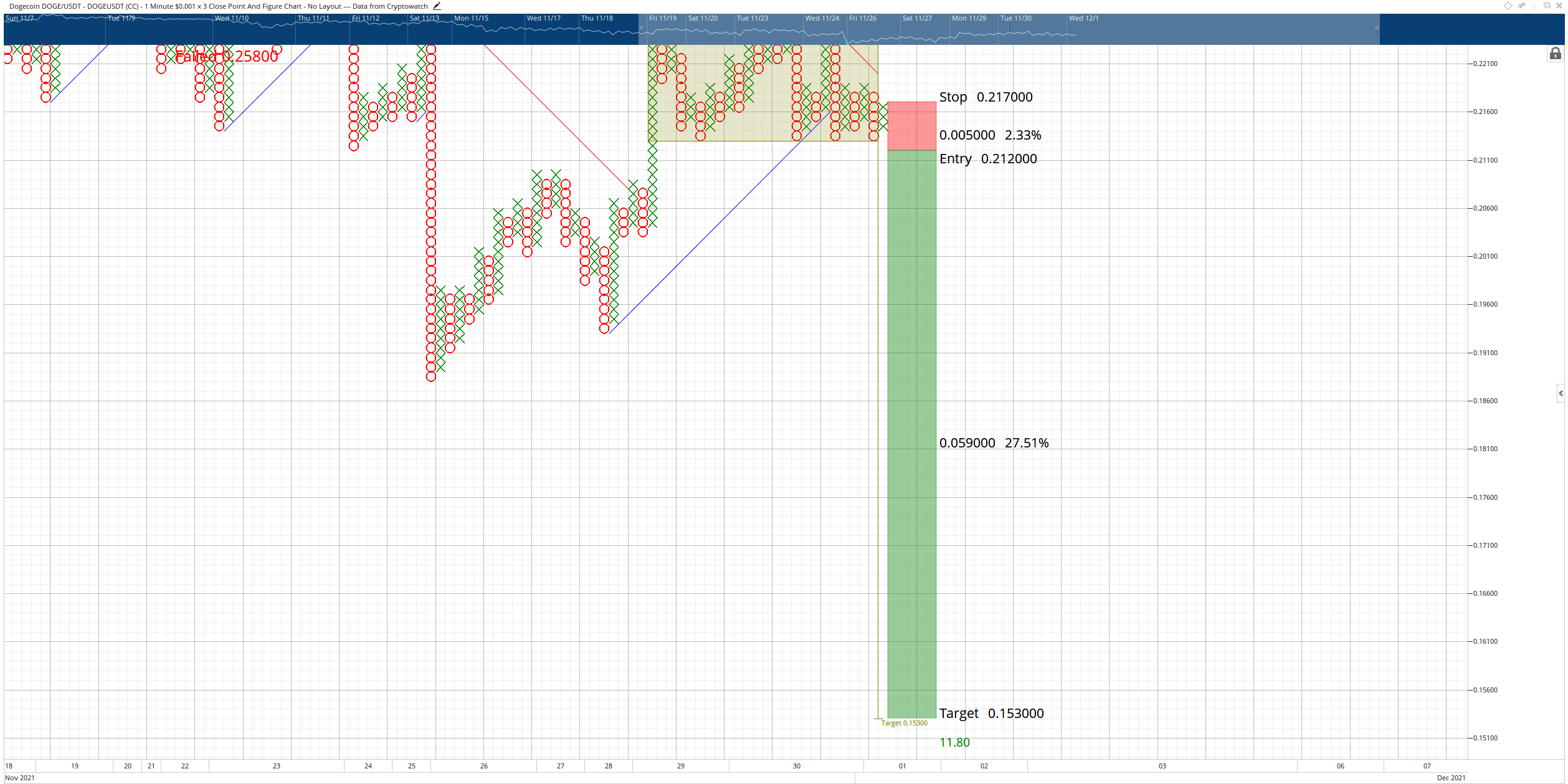

Despite the bullish positioning for Dogecoin, there is a possibility of a powerful short setup that would invalidate the above theoretical long entry. Dogecoin does have a split-triple bottom pattern on its chart. The hypothetical short entry is a sell stop order at $0.212, a stop loss at $0.217 and a profit target at $0.153. The profit target is derived from the Horizontal Profit Target Method in Point and Figure Analysis.

DOGE/USDT $0.001/3-box Reversal Point and Figure Chart

However, the probability of the profit target on the hypothetical short trade idea is low. Bears have had a myriad of opportunities to generate substantial sell-offs of Dogecoin over the past sixty days but have been unable or unwilling to do so. Additionally, downside risks are probably limited to the prior support lows near $0.185.