Dog-themed “meme” cryptos Dogecoin (DOGE) and Shiba Inu (SHIB) have gained notoriety over the past year after their values skyrocketed. That made many of their early investors rich overnight.

Dogecoin is a cryptocurrency that exists on its own blockchain like Bitcoin (BTC). On the other hand, Shiba Inu is a token that runs on the Ethereum (ETH) blockchain. But these cryptos are often compared thanks to their meme appeal.

The valuations of both coins are based more on that appeal than on their fundamentals.

However, just a few portfolios hold the majority of Dogecoin and Shiba Inu coins. In the cryptocurrency market, these big investors are known as “whales.” And if the whales hold Dogecoin and Shiba Inu hostage, it could pose a concern for retail investors.

(Read also from Wall Street Memes: Tesla Stock Earnings: Here’s What Wall Street Expects)

DOGE and SHIB: Swallowed by Whales?

Recently, concerns that a large whale has gulped down nearly 40% of DOGE’s $21.8 billion market cap circulated on Reddit’s main crypto-related threads. This would represent a holding of about $5 billion in Dogecoin.

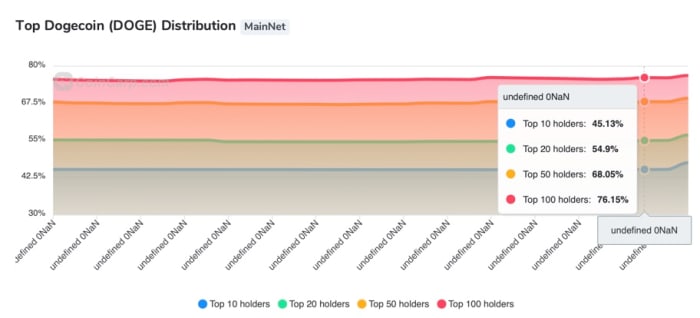

According to the most recent data, DOGE’s distributionl today stands at 44.22% in the top 10 Dogecoin holders worldwide, 63.92% in the top 100, and 79.73% in the top 1,000. See below:

The identity of the large whale who owns such a significant amount of DOGE is still a mystery. While many speculate that it may be well-known DOGE suporter Elon Musk, some Redditors pointed out that the DOGE whale may be the commission-free brokerage firm Robinhood (HOOD) – Get Robinhood Markets, Inc. Class A Report.

However, Robinhood has denied the rumor, making it clear that the company itself doesn’t trade any cryptocurrencies.

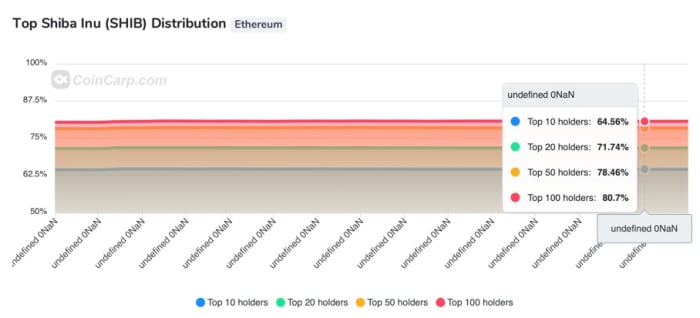

As for Shiba Inu, data indicates that the token is even more concentrated in a minority of portfolios. About 64% of SHIB’s wealth distribution is concentrated in its top 10 holders, while 71.72% is in the portfolios of its top 20 holders and 80.74% belongs to the top 100 holders. See below:

However, the largest holder of Shiba Inu is Ethereum co-founder Vitalik Buterin, who received 50% of the total SHIB circulation when it was launched in May last year. He sent the equivalent of 410,241,996,771,871 SHIB, valued at $7.3 billion, to a dead address, removing nearly 41% of the coin’s total circulation. Buterin also donated $1 billion in Shiba Inu tokens to India COVID-19 relief.

A Rug-Pull Situation?

There’s no rule about specific limits on the concentration of cryptocurrencies by a particular address. But more than 20% of the entire supply of a given currency concentrated in one portfolio is a red flag that it may be a “rug pull” — a crypto community term for a scam.

As in the case of Shiba Inu, the main holder is often the developer of the currency itself. But that’s not the case with Dogecoin. The mysterious holder of more than 40% of DOGE,had 28% fewer Dogecoin tokens in their portfolio back in May.

However, even with the largest holder of Shiba Inu being a dead address, about 23% of the crypto is concentrated among its top 10 holders. This still indicates a potential risk that shouldn’t be ignored.

The Bottom Line

It’s evident that investments in meme cryptocurrencies such as Shiba Inu and Dogecoin are based primarily on buying-and-selling speculation unrelated to the coins’ fundamentals.

Therefore, the extreme risk that exposure to these coins carries should not be ignored by crypto investors. That’s especially the case because a large concentration of these coins is allocated to only a few portfolios. Their value could easily collapse when a whale sells their holdings.

The old concept of “higher risk, higher return” still applies. With meme coins, you never know what may happen. They may skyrocket to the moon or cause irreparable damage to small investors.

(Read more from Wall Street Memes: SOFI Stock To The Moon? How The Tides Could Turn)

(Disclaimers: this is not investment advice. The author may be long one or more stocks mentioned in this report. Also, the article may contain affiliate links. These partnerships do not influence editorial content. Thanks for supporting the Wall Street Memes)