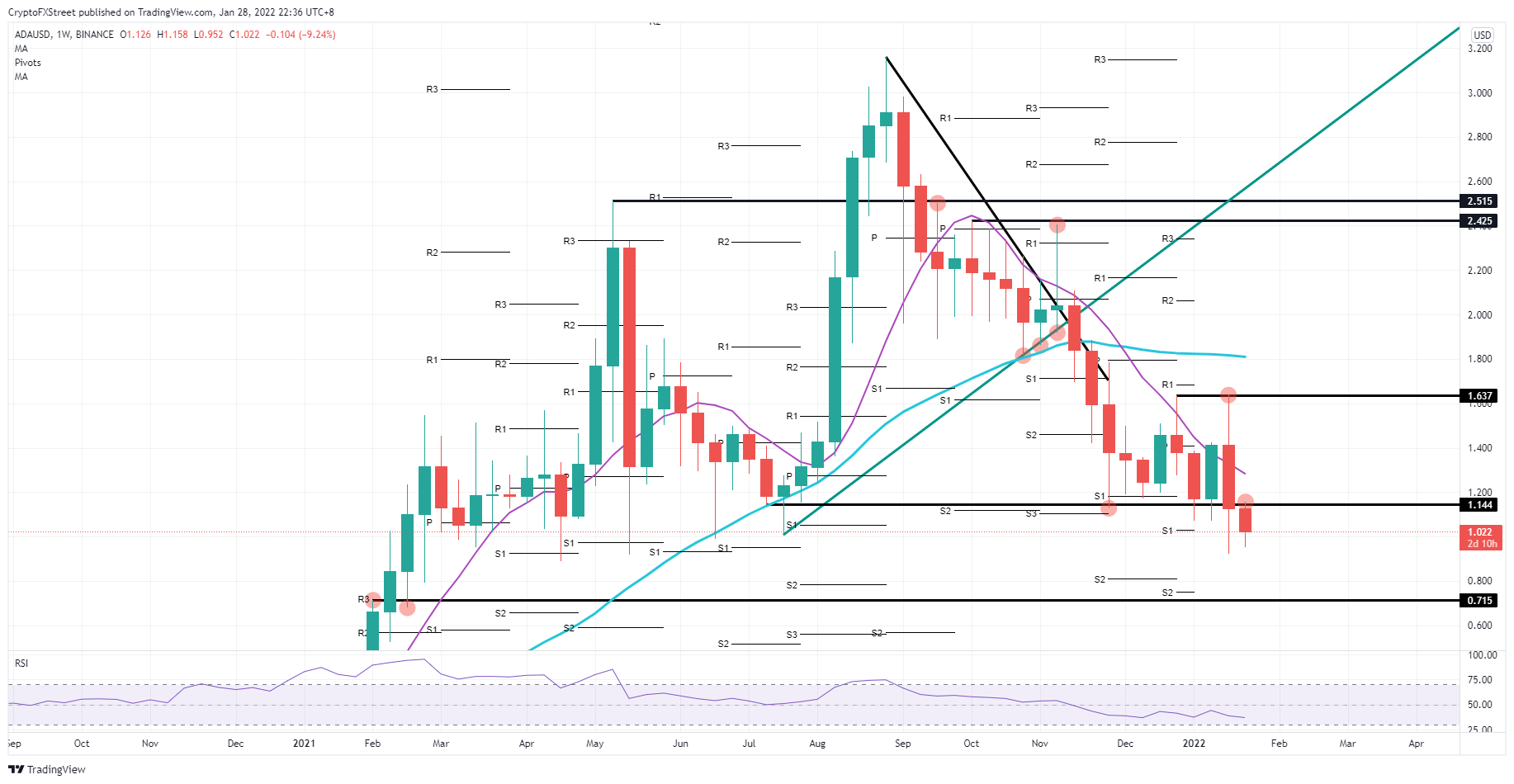

- The Cardano price saw a brutal bull trap and rejection against $1.64.

- ADA price now slides further away as bulls were unable this week to break above $1.44.

- The stage is set for ADA price to dip below $1.00 and look for support at $0.71.

Cardano (ADA) bulls have tried their utmost best to get ADA price to outperform. But the global market risks were just too heavy to bear, and bulls received a firm rejection against $1.14. Together with the death cross formation, it does not look like Cardano is in for an uptrend anytime soon as losses are set to deepen out even more next week.

Cardano bulls should hibernate and come back end of next week

Cardano price is set to add another losing week to the records as bulls were unable and just not up for the task of going against the tide of global financial markets. The message Powell and the Fed delivered on Wednesday was just too significant a headwind for Cardano price action and set the scene for a 10% loss for the week. Although minor, the fact that price action is drifting away from $1.14, and is testing the waters around $1.00, sets the stage for further continuing into next week.

ADA price could go into next week by testing and sliding below $1.00 for the remainder of that week as long as current headwinds keep persisting and shake financial markets to their core. With mild risk-off, cryptocurrencies are not the suitable asset class to excel at their best. So expect bulls to stay sidelined for brighter market conditions and clearer risk-on, but until then, expect ADA price to dip towards $0.71, the low from mid-February.

ADA/USD weekly chart

Beneficial for asset classes like cryptocurrencies is that sentiment can fade in the matter of just a single trading session. Should sentiment next week shift to full risk-on as traders shrug off the Fed comments and worries on stagflation, expect a quick reversal with bears being pushed against $1.14. At that point, the Relative Strength Index (RSI) should start to trade near mid 50. As bulls have more room to go, a run towards $1.63 might be too far fetched for next week, but at least a break above the 55-day Simple Moving average at $1.29 could be in the cards.