Bitcoin and cryptocurrency prices have begun to bounce back following a major sell-off through January (possibly helped by some huge price predictions).

The bitcoin price is up almost 10% since this time last week while ethereum and its major rival solana are up around 12% as competition between the two rival chains heats up. The price of Binance’s BNB, Cardano, and XRP have also rebounded but not as strongly.

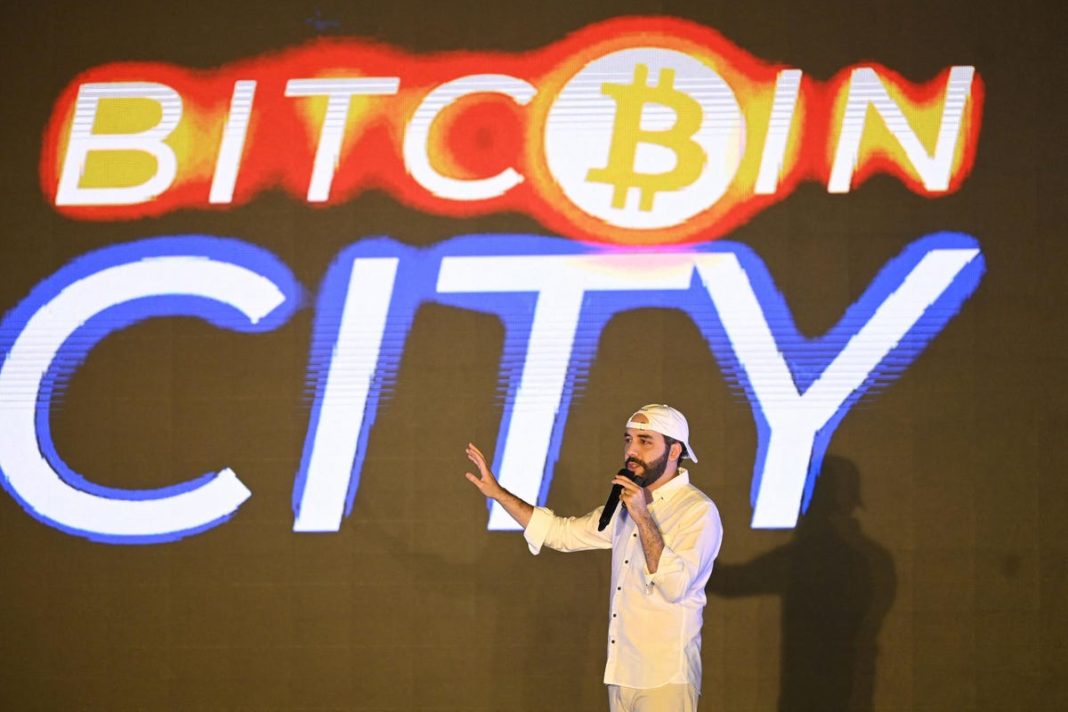

Now, El Salvador’s president Nayib Bukele, who has spearheaded the country’s radical bitcoin adoption experiment over the last year, has predicted a “gigantic” increase in the bitcoin price—calling it “just a matter of time.”

Sign up now for the free CryptoCodex—A daily newsletter for the crypto-curious. Helping you understand the world of bitcoin and crypto, every weekday

El Salvador’s president Nayib Bukele has emerged as one of bitcoin’s most bullish supporters over … [+]

“There are more than 50 million millionaires in the world,” Bukele said via Twitter, outlining the bull case for bitcoin. “Imagine when each one of them decides they should own at least one bitcoin. But there will ever be only 21 million bitcoin. [Not] enough for even half of them.”

At the turn of the year, Bukele has issued a flurry of bitcoin price predictions for 2022—including that the bitcoin price will more than double to $100,000.

Bitcoin’s scarcity, which will see the number of new bitcoins being created gradually fall until the last bitcoin is “mined” some time in a little over 100 years time, is often cited as a reason the bitcoin price will continue to climb. If demand for bitcoin outpaces supply then that would theoretically push up the price.

However, Wall Street giant Goldman Sachs last week warned increased crypto adoption may not translate into higher prices and could even damage the narrative that bitcoin, ethereum and other coins diversify a portfolio.

Bukele made his bitcoin price prediction in the wake of a fresh warning from the International Monetary Fund (IMF) over bitcoin and crypto price volatility. El Salvador has bought over 1,000 bitcoins through 2021 and formerly made bitcoin one of its official currencies along with the U.S. in September.

Extreme crypto price volatility is causing “destabilizing” capital flows in emerging markets while the replacement of traditional currencies with cryptocurrencies poses “immediate and acute risks,” a senior official at the IMF told the Financial Times.

“Crypto is being used to take money out of countries that are regarded as unstable [by some external investors],” said Tobias Adrian, the IMF’s financial counselor and head of its monetary and capital markets department. “It is a big challenge for policymakers in some countries.”

Last week, the IMF urged El Salvador, which is seeking more than $1 billion in financing from the fund, to give up its bitcoin experiment, warning of the risks of bitcoin and stressing that it would negatively affect the country’s ability to get a loan.

CryptoCodex—A free, daily newsletter for the crypto-curious

The bitcoin price has bounced from its January lows but remains severely down on its high of almost … [+]

However, El Salvador could escape reliance on the IMF. Bukele has said he plans to build a low-tax “bitcoin city” powered by a volcano in the country, partly financed by a bitcoin-backed $1 billion sovereign bond, expected to be issued in just a few weeks.

“It seems that El Salvador may not need the coercive loans from the IMF any longer by issuing the innovative the bitcoin bond, which allows them to raise funds to set up mining infrastructure,” Marcus Sotiriou, an analyst at the U.K.-based digital asset broker GlobalBlock, wrote in a note.

“The IMF may be fearful of the rise of bitcoin’s increasing global presence, as other Latin American countries are rumored to be adopting bitcoin as legal tender themselves.”