This post was adapted from a thread originally posted by @Flantoshi on Twitter

Now, this is a bizarre issue I find myself in. If you’re an avid Cardano enthusiast, just by the title and thumbnail alone you’re either already frothing at the mouth, or in absolute agreement and anything else I’ve got to say is gravy.

On the other hand, if you’re just a casual observer of the space looking in, and someone were to explain to you the elevator pitch of the situation, you’d be positively confused. The short version is that one group of nerds is annoyed with another, smaller, group of dorks for running a bunch of computers.

Of course, the matter is not that simple, the decision of whether or not to allow stakepool operators (SPO) to run multiple pools is worth billions of dollars and the livelihood of thousands of people. More importantly, if it isn’t addressed, it has the potential to destroy the Cardano blockchain’s ability to live up to its potential and ultimately just devolve into a very expensive and inefficient Excel spreadsheet.

Needless to say, tempers can run very high surrounding this issue. So before we fully tackle the matter, I beg you to please keep things civil. This article is not about pointing fingers at any specific person, but more so to show the effects that these decisions can have if left unchecked.

The premise is simple: Cardano’s main selling point is that it’s a decentralized, tamper-proof system, if it loses this aspect through negligence or greed, then it has no real competitive advantage and it’s a worthless investment.

In this article, we will be exploring just to what extent multipool operators damage the network.

The Basics

It’s easy to just take for granted that everyone knows how Cardano works when you’re on Twitter so much that you can only communicate in pithy statements and overused memes. Nevertheless, for thoroughness sake, let’s quickly go over the basics (if you’re an ADA expert, perhaps consider skipping this section).

Either way, Cardano is a decentralized computational network, where individuals can choose to become stakepool operators (SPO) and thereby help the system process transaction blocks.

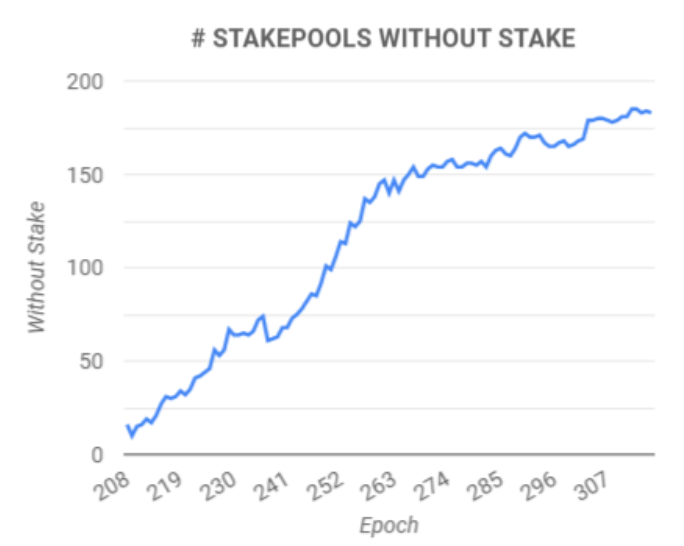

In exchange for processing transactions, they receive a reward which is paid out from treasury funds and accumulated fees on the network. At the time of writing, there are 3,147 active stakepools.

This diversity of different stakepool operators, in theory, means that it’s very difficult, if not practically impossible, to control the network. As each of the unique characteristics of the SPO (their hardware setup, physical location, financial situation and the people managing them) change what attack vectors are necessary to compromise them.

The issue though is that processing blocks is not a purely random operation, it’s a probabilistic function. In other words, there’s a formula that determines how often a given stakepool gets assigned a block to process.

One of the key elements under consideration in this formula is the amount of ADA that is tied to any given pool. This comes in two forms:

- Pledge — the amount of ADA individual SPO gave as collateral to show they’re serious about running their stakepool.

- Stake — ADA that normal users (delegators) assign to the pool, the SPO have no control over this, but it effectively works as a vote of trust that the system takes under consideration. Delegators get a portion of any pool rewards as compensation for their trust, and this is divvied out proportional to how much they gave to the pool.

Not to get too technical, as there are horrible looking formulas underpinning all this, but at its core what Cardano wants to do is to assign blocks to entities proportional to how much “skin in the game” they have, and what their standing in the community is.

In this way, hopefully, only people who have a lot to lose if they were to maliciously misrepresent the transaction data get assigned the blocks to process. However, if you don’t occasionally give new people a chance to showcase their loyalty to the network, power begins to concentrate to a handful of early adopters.

To that end, stakepools reach a saturation level at around 67m ADA, so the expected rewards per minted block go down. This is to incentivize people to go elsewhere.

Nevertheless, as running a fully saturated stakepool can be VERY lucrative (to the tune of hundreds of thousands of dollars per year), there’s naturally the incentive to open more than one. But the problem is that this becomes a positive feedback loop:

You’re able to afford more marketing because you have millions of dollars at your disposal, and you’re able to fill more pools to saturation, which gets you even more resources and thus you can expand your operations.

Meanwhile, single pool operators can barely keep the lights on and decentralization is lost, which slowly erodes the value of the network as a whole.

Muh Free Market

In an ideal world, I would like everyone to rise and fall based on their merit and grit. It’s a lovely idea, and back in the day I was a hardcore libertarian — I mean raging ‘will quote Ayn Rand at you if you look at me funny’ kinda guy.

I still broadly sympathize with the idea, though I’ve gotten a better taste in literature since, and now I have to caveat everything with a big “BUT”: I like the idea of free markets BUT I’m wary of just setting them loose without some safety rails, as early advantages compound to become insurmountable fortresses.

Just to make a point, an SPO is expected to pledge X amount of ADA for their pool. This is true whether they started today, or four years ago.

The issue though, is that the amount of money this represents is wildly different depending on when it happens. Someone four years ago might have bought in at $0.15, while if someone was unfortunate to recently buy at all-time highs, they might have bought ADA at around $3.

Meaning that the startup cost of the business is 20x steeper for starting recently. Of course, this is not a fair competition! It’d be like wanting to start a sandwich shop and your competitor is somehow able to have 2,000% lower costs.

The pledge requirement is a necessary evil, so I’m not going to suggest altering it at all. This example is more to show how stacked the deck can be for new entrants to the marketplace; as there are far more difficult to tabulate competitive advantages in favour of the old powers, such as larger audiences, established connections, partnerships (like the recent Sundaeswap ISPO) etc.

It also bears saying that the success of a large multipool stakepool, necessarily means that someone is worse off. There will only ever be 45bn ADA, so this hard cap means that every time a delegator decides to go with an SPO, every other SPO on the network loses potential revenue (assuming that they don’t already have a saturated pool and don’t have any intentions of opening a new one).

In economics terms, this would be called a “Zero Sum Game”, as in a situation where the success of one person necessarily means everyone else that participates is worse off. Think of it as having a slice of cake. Every time you take a slice, that means someone else can’t have that same portion.

To add to this, it’s worth noting that stakepool operators typically run on razor-thin margins as is. Although setups vary, and some people can do it cheaper, typically you’re looking at a few hundred dollars per month of operating costs, plus considerable man-hours in maintaining the network and doing marketing.

If you don’t have sufficient delegators to regularly mint blocks, then you’re expected to eat the costs for months on end. Then, when we consider that most people even in ostensibly rich countries like the US don’t even have $1,000 stashed away for emergencies, it’s becoming a very big ask.

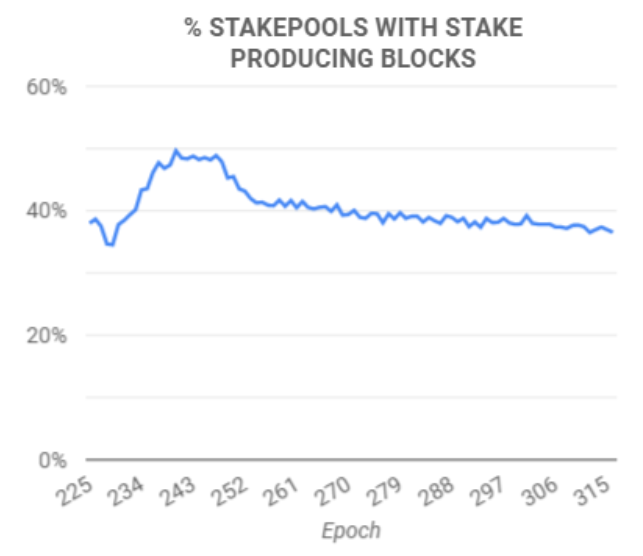

Meanwhile, there’s also a negative feedback loop happening for single pool SPO with insufficient delegators. If you don’t happen to win a block early on, your Return on Assets (ROA) declines over time. So, while on paper you should be getting a c.4.5% ROA a year regardless of pool size, the reality is that you might just be unlucky and not mint a block for years.

Then people see the low ROA for your pool and are scared off, as they don’t understand that over a long enough timeframe it doesn’t matter.

At this point, you have to be very confident in your abilities and a little bit insane to attempt to run a stakepool.

It’s why while I do want to eventually open a stakepool, I’m not confident in opening one until the @Flantoshi community is large enough for it to make economic sense. As much as I like Cardano, I have to put my finances first. So I’m treating the stakepool as what it ultimately is: a business.

And much as we already saw in the real world where entities like Walmart crushed Mom & Pop stores, the same is bound to happen in Cardano if we don’t do something now while we still can.

Even though it is still within the bounds of an intelligent, capable, driven and middle-class person (in a first-world country) to successfully compete against multipool operators, the window is closing as the entry barriers rise.

Cardano ought to remember its own mission of driving power to the edges, and giving a voice to the voiceless. If we simply recreate the tyrannies of the past but ON THE BLOCKCHAIN, what’s really the point?

It is with this backdrop that it becomes particularly heinous when stakepool operators just keep opening multiple pools. They’re essentially robbing opportunity from new entrants, thereby centralizing the system and making everyone worse off in the long term, because they are trying to extract as much value as they can for themselves.

If the main value proposition of the network is decentralization, more ought to be done to defend the crown jewel through parameter changes that make monopolies less likely, otherwise, we will inevitably lose it.

The Inevitability of Complex Systems

Do you know why we have stars in the universe? (I promise it’s relevant)

Well, to summarize a very complex subject, shortly after the Big Bang, as matter was dispersed throughout the universe, some hydrogen atoms just happened to be closer to each other. These hydrogen gas particles then clumped together due to gravity, and suddenly they had more gravitational attraction due to their mass, so more and more hydrogen atoms were drawn by this increasing gravitational pull.

Eventually, these got so big, and there was so much gravitational force that stars formed.

In other words, early microscopic advantages in distance allowed for certain hydrogen atoms to come together. These were then bigger than any particle in its vicinity, so they gobbled everything up due to natural forces; there came a point where small particles simply had no chance to ever become that big and had no other choice but to succumb and be absorbed. So, from the tiniest atomic unit possible we got gigantic stars through small (but persistent) early advantages that kept building on top of each other.

It’s a well-studied phenomenon that in complex systems through random chance there is usually one victor that takes most of the benefits, as early advantages compound on each other until there are insurmountable barriers.

The same happens with language use. For instance, about 6% of the words you use in English are “the”, followed by “of”, and then “and”. The interesting thing though is that each successive word of the list is used 1/n as frequently as its place on the list (since “of” is the second most frequent it’s used ½ as much as the first tank, while “and” is used ⅓ of the time since it’s third, etc).

The spooky thing is that this applies to ALL languages, every language features this frequency formula if you rank the words, it’s such a consistent observation that it has a name “Zipf’s Law”.

I could go on providing examples of complex processes having disproportionally influential elements within the system, even if said power was supposedly randomly allocated. But I’ll spare you the details, just know it’s a whole field of study.

In other words, complex systems, despite seeming arbitrary and random, have patterns that keep repeating. In the case of free markets, we know what happens if left unchecked — through sheer random chance and early advantages, some players within the system start being able to buy out the competition.

Eventually, this leads to the formation of monopolies and cartels where the few remaining players in the late-stage game come together and work their differences in such a way as to be mutually beneficial while leaving the consumer to be a distant secondary consideration (if they’re even considered at all).

When people unironically say that mom & pop stores should’ve just been more creative to defeat Walmart, it’s missing the point. If it hadn’t been Walmart, it would’ve been another mart — same store and business model, different brand.

It’s simply the consolidation of power in free markets, and so every so often the system has to be reset, via antitrust regulation, or revolution, as the situation might become intolerable.

Now, as we’re in the blockchain space, there is a layer of complexity to consider. There’s a maxim that people repeat here “Code is law”, in reference to the fact that if the protocol allows something to happen it ought to be permissible.

So, if we are seeing that disaster is imminent as the accelerating system is heading to a brick wall, is it not our duty to slam the brakes? We need to change things at a protocol level, social pressure is just not gonna cut it, as the system is built in such a way as to make consolidation somewhat inevitable.

Who cares about decentralization anyway?

Did you know that about 1/16 websites run on AWS servers? Do most people care about what AWS even is? (It’s Amazon Web Services, the eponymous company’s cloud computing arm, in case you’re curious)

Put bluntly, if a system works, if it performs as expected, people don’t care about what’s under the hood. To quote science fiction author Arthur C. Clarke “Any sufficiently advanced technology is indistinguishable from magic.”

We live in a world of wonders that, for all intents and purposes, is magical, though our daily exposure has blinded us to this fact through its mundanity. But because of this, we don’t care how a sausage is made, we only care that it tastes good.

In much the same way, people in the Cardano community like to yammer on about decentralization but to the end consumer, it’s an airy-fairy concept that is utterly meaningless. If it works well, and it’s responsive, it’s no better or worse as an experience than a centralized system.

Nevertheless, there is one type of user that very much cares about decentralization (or at least the fact that it means that their data is secure and tamper-proof regardless of what their enemies might want to do) — large organizations.

As luck would have it, large organizations, irrespective of whether they come as governments or corporations, are also capable of directing billions of people to wherever they choose, ergo that’s the likeliest source of meaningful mass adoption.

In other words, if we want crypto to be anything other than the playtoy of degens in their mother’s basement, we must focus on decentralization. If we can’t decentralize and guarantee that this will remain so in perpetuity, then our main value proposal is nonexistent.

Multiple stakepool operators say that this type of salty rhetoric is just repeated ad nauseam by single pool SPOs because they’re jealous, and it’s effectively a marketing tactic. I don’t discount the fact that it probably is a marketing tactic, but are single stakepool operators necessarily wrong though?

Toothpaste companies run marketing campaigns where they tell me that brushing my teeth is good for my oral health and that dentists recommend doing so. As far as I can tell, this is correct, and the fact that they get paid if this is true is irrelevant. Just because you saw something in an ad doesn’t mean it’s not true!

Cards on the table, I have a dog in this fight, if the decentralization of Cardano falls past a certain threshold I’ll just sell, as I’d have been better off just buying Amazon stock, as their cloud computing is cheaper and far more efficient.

Devil’s Advocate

Now, it must be said that I have painted a very unflattering picture of multiple stakepool operators as if they’re greedy ghouls sucking the lifeblood out of Cardano. I stand by my broad caricature, though I’d argue that there is some nuance to be had.

Firstly, it isn’t so much about our current crop of multipool operators. They just get a bit of flak as they’re the most obvious targets. But let’s imagine these current multipool operators are saints. Every ADA that they receive is either put back into the business or donated to charity, they have nothing but goodness in their hearts.

Well, great! But what about the next generation, and the generation after that? Can you vouch for their moral fortitude hundreds of years down the line?

Because that’s what Cardano is ultimately trying to create, a system that will last generations. And the system quirks and lack of limiters now can create oligarchies later.

Secondly, the enemies of decentralization aren’t necessarily your current Youtubers that just so happen to command a high level of influence enough to fill many pools. No, the big enemies are megalithic, profit-driven, amoral corporations who cannot be reasoned with, and don’t care about anything except what impacts their bottom line.

Indeed, to a certain extent, they’re already here, after all, the Centralized Exchanges also offer staking services to their customers. Not only that, but they can also vote with those funds, so they can even impact Cardano governance to be in their favour.

This problem will only get worse as time goes by if we don’t put a stop to it now while we can. What if Google comes in tomorrow and opens 500 pools to saturation? They’re perfectly capable of doing this, and as Cardano gains importance it might even gain the attention of nation-states.

Are we prepared for the eventuality of a well-funded and dishonest player?

Solutions?

In economics, there’s a concept called “the tragedy of the commons” where it’s highlighted that things that are part of the common good, are not often priced into the cost of transactions, and because nobody is responsible for these goods, they get overused until they’re fully depleted.

Imagine we’re farmers and there’s a field close to where we live. It’s a luscious and beautiful field and as nobody owns it, everyone’s welcome to bring their cattle to graze without limits.

The problem though is when people start realizing those two important words “without limits.” Very quickly, some asshole will realize that they can buy many, many more cows and they’ll be fed. Then everyone else realizes it as well, and the dominant strategy becomes to bring as large of a herd as you can, as everyone else will do the same.

The field then dies, same happens with decentralization (same happened with kitchen cleanliness in my student accommodation when some asshole decided he didn’t want to clean anymore, so nobody else wanted to clean his mess and we had to live in squalor for a year — FUCK YOU DAINIS!).

Anyway, what I’m trying to get to is that just because something doesn’t have a price, it doesn’t mean it’s not valuable. Often the traditional response comes in two forms:

First, there’s an outright ban. RESULT: Nobody can use the field. That’s bad for everyone.

Second is acknowledging that the field provides value, and we should start charging for the negative externalities caused by people enjoying it, at a rate that allows people to use it but at a sustainable, self-replenishing rate. These funds can then be used to help replenish and manage the common good.

In praxis, it’s a tax that makes you pay your fair share for the usage of communal property and the damage you cause in doing so.

The same mechanism is used for pollution in the form of carbon credits, where we acknowledge that pollution is bad but it is a necessary byproduct for the creature comforts of modern life. The problem lies in that these funds are more often than not misappropriated and not used for their intended purpose, but smart contracts can be utilized so that the money is guaranteed to be used responsibly.

In other words, I’m not necessarily saying that multipool operators are bad by default. Some genuinely help the community. What we can agree on is that a hundred pools is too many.

Somewhere between 1–100, there is an optimal number of pools that we should call a limit. This needs to be modelled and researched through statistical and game theory simulations, I invite IOHK & Co to figure that one out.

Once we identify that ideal number, we should create limiters built into the network parameters and penalize multipool operators to heavily disincentivize pools beyond that number.

The problem is that Cardano is blind as a network, it possesses no AI and there’s no registry. A first good step would be to identify multipool operators with a nifty little new thing called an “oracle” which are humans or machines that verify that a certain set of parameters are true. They only get paid out if there’s a consensus with multiple independent ones, and there can also be a second layer of them that checks the work of the first.

So there could be a permanent active bounty for finding multipools, which are identified by oracles, and their work is checked by another group. Then we penalize identified multipools.

What I have admittedly haven’t found a solution for is a “Sibyl Attack” where some entity pretends to be multiple different people to gain more power over the network. I invite the community to come up with a solution for that particular hurdle.

Conclusion

At its core, blockchain as an emerging technology is useless if it just ends up as a handful of computers pretending to be a thousand different other users to each other.

At that point, you’re an inefficient and expensive Excel spreadsheet with macros enabled.

Cardano is supposed to be a decentralized network, if we are to accept any element within the system which harms this core tenet, then it must be an element that is such an unequivocal boon that its benefits far outweigh the cost imposed on the system.

The wider community should not be used as a piggybank by influencers just because they happen to have gotten popular. Not only do they damage their long term interests, but also severely hurt their fans (after often already charging above-average margins for their stakepools, but that’s a story for a different day).

Nevertheless, our primary enemy is large, profit-driven entities that just want to make a quick buck off of us. We must enact network parameter changes now before it’s too late, otherwise, Cardano will die.

If you’re in the crypto or in the traditional finance industry looking for someone to ghostwrite content for you, please do not hesitate to message me. I’m a full-time ghostwriter.

Join the community over at @flantoshi on Twitter.

And if you would like to support this project and help me pay rent, I’ll pass on the tip hat and you can send ADA to:

addr1qxfgs44d763uuw4hy6qatx383v9mmrrm6qazay6eren9sp5r2usruecwv33lp2t2nqp4ss6hrc9ac8yd2klxnsfnxz2qw3su4s

Thank you for your support!