.png)

The Maladex Initial Stake Pool Offering (ISPO) will end after epoch 327. From epoch 328 (March 22nd), MAL tokens will cease to be allocated for staking with our pools.

Thank you to all those who have delegated — no matter for how long — and to everyone engaging on Discord and Telegram or sharing your enthusiasm on Twitter. Maladex, the ISPO, and the future of decentralized finance (DeFi) wouldn’t be possible without you — the community.

As the ISPO ends, you will need to decide what to do with the ADA you’ve been using to support Maladex, and we want to help.

Full disclaimer: In this article, we will explain why we believe it is fundamental for decentralization to maximize the number of entities running a single pool, as it improves the security and trust of the network. We also concede that the Maladex ISPO is spread across multiple stake pools. We are as guilty as anybody else.

While ISPOs have their merits, we believe the model can be improved and run without sacrificing decentralization. We are working on sharing our reasoning, along with solutions and tools that can help minimize the impact of ISPOs on decentralization and help future ISPO offerings on Cardano.

The original MAL pool (ticker: MAL) will remain open and from epoch 328 operate as a 0% variable fee pool. Delegators will still receive ADA rewards, but no further MAL tokens will be received while staking to the pool.

All remaining MAL pools (tickers: MAL2, XMAL, ANMAL, and DRMAL) will be spun down once delegation reaches a low enough level. The pools will remain open for a grace period of at least five epochs to ensure ample opportunity for stakeholders to find another stake pool. From epoch 328, all variable fees will be reduced to 0%, so those late to move their stake will not miss any ADA rewards.

We recommend moving your stake in epoch 326 to avoid losses in individual ADA rewards and to ensure your ADA is not left idle on the sidelines, unable to contribute to the functioning of the network.

A reminder to redelegate will be sent out to the community via social media channels as epoch 326 approaches.

MAL token rewards, like ADA rewards, are calculated based on active staking. A snapshot taken at the beginning of each epoch determines your rewards. Remember, it takes two epochs for both your rewards to be reflected and for any redelegated stake to become ‘active’ in another pool.

Safety and convenience are our priorities for the token distribution. MAL tokens will either be available for withdrawal from a smart contract or airdropped to wallets associated with the staking addresses that delegated to the MAL pools.

Check out our distribution calculator to find out how many MAL tokens the wallet you staked with will receive (remember to use your staking address, not wallet address).

Cardano is a proof of stake (PoS) blockchain. The entire network is dependent on stake pools — reliable nodes run by a Stake Pool Operator (SPO) — to process transactions and create new blocks.

It is unrealistic to expect every ADA holder to have the technical knowledge and resources to constantly maintain and keep a node running. Cardano’s ledger protocol, Ouroboros, provides a solution called ‘stake delegation’ to ensure all ADA holders have the opportunity to participate in the protocol. ADA holders can ‘delegate’ their ADA to any public stake pool to produce blocks on their behalf.

But why run a stake pool or delegate to one?

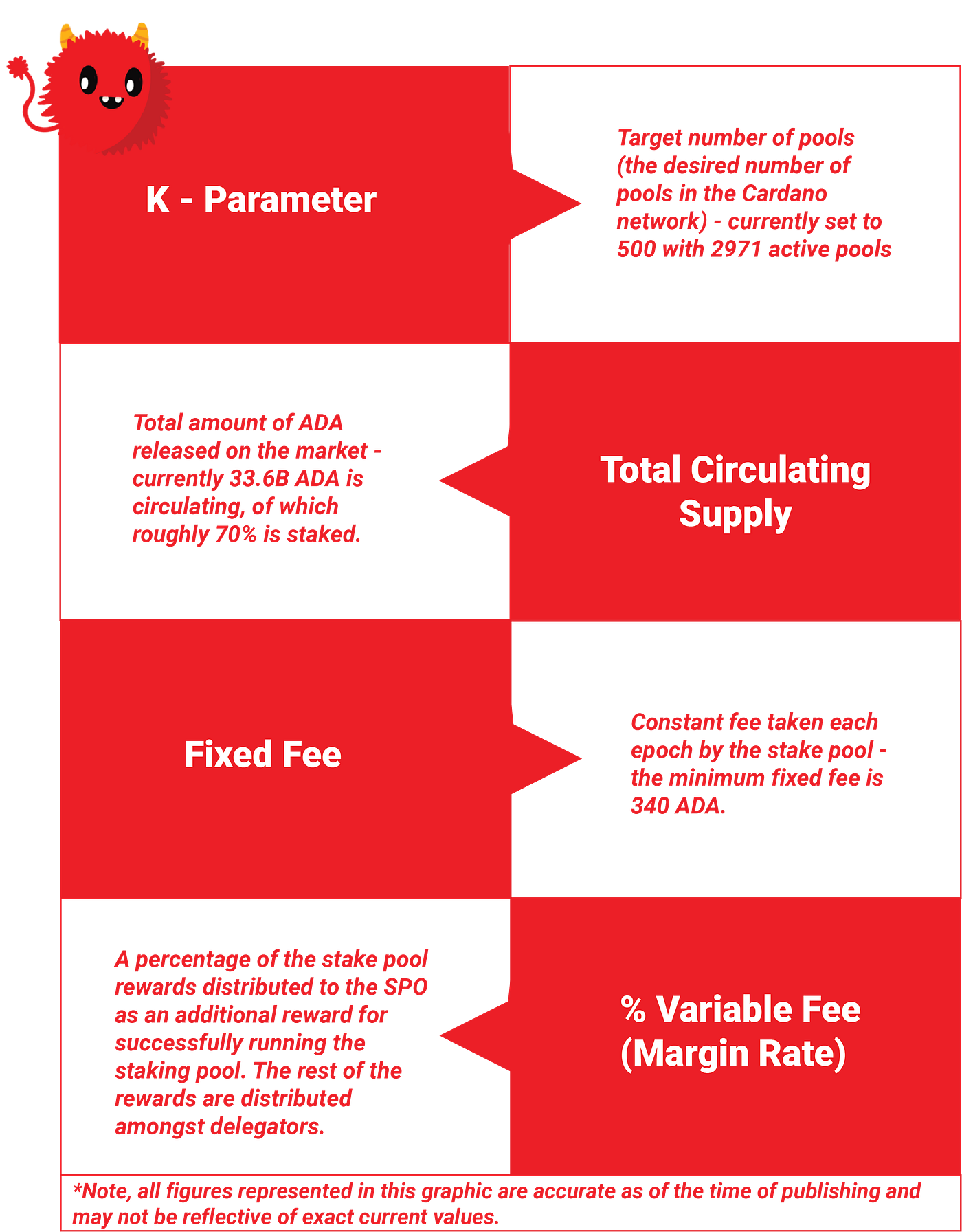

Participation in the network is incentivized through rewards distributed by the protocol. Below are the four main parameters that dictate rewards:

Pool reward parameters

Block production translates to rewards distributed to the pool operator (according to the fixed and variable fees) and delegators who receive a share proportional to the size of their delegation in the pool (minus operator fees).

To decide which pool gets to produce a block, the Ouroboros protocol elects (at random) a ‘slot leader’ using ledger data from two epochs ago as the source of randomness. All slot leaders for an epoch are known 1.5 days (1/3 of epoch length) before that epoch starts — this schedule is known only to SPOs.

The more ADA staked with an SPO, the higher the chances that SPO has of being elected the slot leader in any given slot (there are 432,000 slots each epoch). You can conceptualize this process by imagining each ADA token as a ‘lottery ticket’; the more lottery tickets, the higher the chances of ‘winning’ a slot leader position. When an ADA holder delegates to an SPO, they are delegating their chances — ‘lottery tickets’ — of becoming a slot leader for that epoch. Delegators are not spending or locking in their ADA as it can be withdrawn, transferred, or spent at any time.

To avoid ADA centralizing to any single SPO and unfairly increasing its chances of becoming a slot leader, Ouroboros sets a saturation point (stake cap) for all pools, which is calculated by dividing the total circulating supply (33.6B ADA) by k (500) — at the time of writing the stake cap is equal to around 67.2M ADA. A pool that goes over the stake cap no longer receives any further increase in rewards. As more delegators stake to an oversaturated pool, the rewards per delegator decrease, incentivizing delegators to seek unsaturated pools and spread ADA across many pools.

A solution for SPOs approaching or exceeding saturation, as hinted by the Ouroboros protocol design, is to keep increasing the variable fee until the pool falls back under the saturation value. This allows SPOs to capitalize on their popularity by collecting a larger share of rewards but without hurting the network.

The best way individuals can support decentralization on Cardano is to use their ADA.

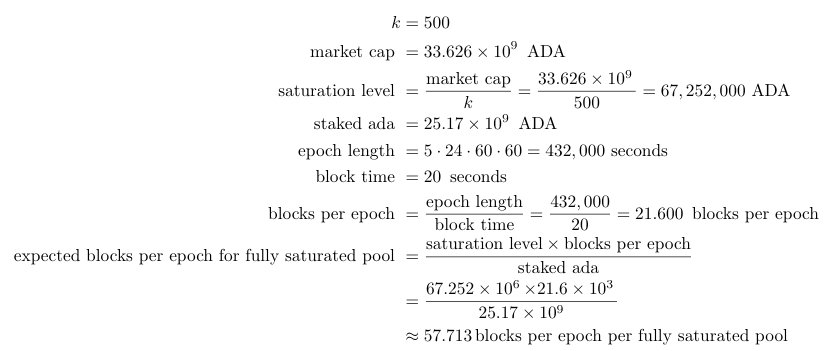

The saturation point caps the number of chances to become a slot leader and, in theory, the amount of ADA any single SPO controls. With k = 500, a fully saturated pool (67.2M ADA) can expect to produce, on average, 57.7 blocks per epoch — that’s 0.27% of all transactions in the epoch processed by a single pool if they reach full saturation.

Formula to determine expected block production of fully saturated pool

If an SPO opens multiple pools, the potential ADA they control without being penalized by the protocol is multiplied by the number of pools they operate. If the Multiple Stake Pool Operator (MSPO) can saturate a second pool, that’s an average of 115 blocks per epoch (twice the amount as for a single pool), and so on.

Bear in mind that saturating even one Stake Pool takes a lot of ADA, but every time a single entity opens multiple pools, the potential for network centralization increases.

One entity controlling more ADA than the 67.2 million stake cap, means there’s less ADA available to fund single SPOs. This increases the barrier of entry, resulting in fewer SPOs and less decentralization.

Higher centralization presents an operational risk to the network. If an MSPO makes a mistake or is the target of an attack, it usually applies across all of their pools, magnifying the potential damage.

However, the centralization of ADA presents a more existential threat to the Cardano network in the form of counterparty risk.

When the system is working fairly, slot leaders process network transactions on a first-in, first-out basis, but a slot leader can manipulate their node to prioritize (ensure a transaction is included) or even exclude transactions if it benefits them. For instance, because the slot leader schedule is known to SPOs, an SPO in collusion with a decentralized application (DApp) may prioritize transactions associated with that DApp that gives them higher transaction fee rewards. The more ADA that a malicious actor controls, the greater the percentage of network transactions they can manipulate.

If, for example, an MSPO controlled 33% of the system’s delegated ADA, they would, on average, be the slot leader once every three blocks — that could have a significant impact on what transactions do and do not go through if the MSPO were to act in bad faith.

More worrying still, if a single entity or group of entities controls over 50% of the systems delegated ADA they could launch what is known as a ‘51% attack’ and take control of the network.

The accumulation of such a large portion of ADA — as of the time of writing >12.58B ADA — may seem unlikely, but it would only take the top 27 pool groups, with the highest delegation, working together to take control of over 50% of the ADA on the network. If centralization increases, the number of pool groups required for an attack decreases.

Top 27 Pool groups (Courtesy of adapools.org)

Trusting the system to operate fairly is far easier when hundreds or thousands of SPOs have an equal chance of becoming slot leaders.

Delegators need to be wary when choosing a staking pool. If they decide to delegate to an undersaturated pool in a multiple pool operation, they are contributing to centralizing the distributed ledger and risk hurting the security and fairness of the system. It might also be an inefficient use of a delegator’s capital (read more on capital efficiency).

SPOs can pledge their own ADA to the stake pool. This is different from a stake as the ADA is locked into the pool and takes two epochs to withdraw. The protocol rewards the stake pools with a higher pledge, with higher rewards up until the pool becomes saturated. If an SPO splits their pool, they may also split their pledge, which reduces the rewards for delegators in both pools.

In an ideal world, the most successful Cardano node operators would increase the variable fee to capitalize on their success without sacrificing decentralization — we are yet to reach this ideal. If the blockchain’s commodity is trust, which is directly derived from its decentralization, then the number of independent entities running pools is its measure.

An ISPO is a novel way to bootstrap and provide capital for the marketing and development of projects on Cardano (or any PoS blockchain). Delegators use their ADA as a vote of confidence in a new project without the risk of purchase — staked ADA can be withdrawn in full at any time. Delegators to an ISPO accept a higher variable fee, forgoing portions of their ADA rewards to receive project tokens. Variable fees can be set anywhere from 0–100%, but if a pool’s variable fee is set to 100%, it is automatically made private and is hidden from some pool sites and excluded from wallet delegation functionalities. For this reason, while some of the Maladex pools are listed as 100%, they are technically 99% pools.

Even though delegators give up more of their rewards during an ISPO, if an individual staked to ISPOs over an entire year (with 99% variable fees), they’d only be forfeiting around 5% of their ADA (in sacrificed rewards), and none of their initial stake.

ISPOs are often split over multiple pools but key differences distinguish them from MSPOs.

Spreading an ISPO over multiple pools with differing variable fees gives stakeholders the choice of how much of their staking reward they want to give up. The variety of choices attracts a wider range of participants.

Multiple pools also mitigate the risk of oversaturation from high demand. An ISPO pool is unable to increase the variable fee to discourage delegation, but it can decrease token rewards per participant to encourage movement to its other pools. For this reason, the Maladex team decided to keep the number of tokens available in each pool fixed, to incentivize delegation to less saturated MAL pools. When there are fewer delegators sharing in a pool’s fixed MAL token rewards, each individual delegator receives more MAL tokens.

ISPOs present unique opportunities for the Cardano community. During an ISPO, the only way to receive a new project’s tokens is to stake the native token of the blockchain it is on — remember, an ISPO is not a sale of tokens, it is a reward for supporting a project. ISPOs create an incentive for people to move their ADA off of centralized exchanges (CEXs) and onto the Cardano mainnet to pursue an opportunity that doesn’t exist on a CEX — driving more capital to DeFi. Capital moving off of CEXs helps reduce the crypto market’s trading volume gap that currently sees 95% of the trading done outside of DeFi.

In addition, ISPOs offer the potential for much higher rewards than the standard APY from staking on Cardano. ISPO delegators are among the first to receive a new project’s tokens. Their potential alpha (ROI above standard APY) is directly correlated to the success of the project they are supporting. Not only can investing in an ISPO be a more efficient use of capital, but it incentivizes community engagement and growth while funding a new project on Cardano. New projects also mean more utility on the blockchain, which can increase the value of ADA itself.

Finally, ISPOs are temporary, but their impact on the Cardano ecosystem is not. The centralization of ADA across ISPO pools is limited by the number of tokens allocated to the ISPO. After the token supply is exhausted, all of the extra ADA, delegators, and excitement the project brought to the ecosystem remain, ready to be decentralized and distributed to other SPOs, ISPOs, or projects on the network.

ISPOs are not a perfect solution; during their limited lifetime, they create centralization of the network. However, they bring more ADA to DeFi and encourage a healthy movement of ADA between pools while providing a low-risk way for stakeholders to support (and potentially profit from) new and exciting projects on Cardano.

The Maladex team initially looked into the possibility of running our ISPO in cooperation with single SPOs. However, there were many considerations:

1. The legal status of SPOs supporting the development of projects on behalf of the project (country of incorporation, the scope of potential liabilities, etc.).

2. The technical aspects, how to safely and effectively set up such a system.

3. Community trust, most projects at the beginning of their ISPO journey do not necessarily have the deep trust of the community. This makes it difficult to pitch to SPOs.

After long consideration and consultation with lawyers, we decided to run the ISPO independently. We hope to work with the community to enable future ISPOs to overcome these obstacles.

The ADA you own gives you the power to decide the future of Cardano. We recommend doing your own research to make sure you are supporting projects and stake pools whose mission resonates with you.

Any SPO with above 1M ADA (1.079M ADA to be precise) in delegation should be able to produce, on average, one block every epoch— as long as their variable fee is <5% and the fixed fee is close to 340 ADA, they would represent a sound investment.

But, even an SPO with < 1M ADA in delegation can be a good choice and offer similar returns when delegating long term. Rewards from smaller pools may not come every epoch, and the minimum fixed fee (340ADA) will have a bigger impact, but with fewer stakeholders, the individual share of rewards is larger. Staking with a smaller pool also contributes to decentralization by encouraging more SPOs.

Someone needs to be the first to take a leap of faith and delegate to a pool for it to cross into the threshold of consistent block production. Many SPOs struggle to reach their first 1M ADA delegations, but after reaching this threshold finding new delegators becomes a bit easier, so consider helping these smaller pools out when you can.

There are currently 2971 active stake pools on the Cardano network, this list is just the tip of the iceberg of what is out there. Don’t end your journey here. Keep exploring and supporting single SPOs, and always remain open to new pools coming online and contributing to decentralization. Delegate your ADA where it is treated the best.

Twitter | Discord |Website | Telegram Group | White Paper | ISPO