On-chain data shows the Ethereum transaction fee has remained low despite the recent price rise. Here’s what this may mean for the market.

Ethereum Fees Saw Huge Spike During The Local Bottom

As per data from the on-chain analytics firm Santiment, the ETH transaction fee has fallen below $2 per transfer now. The relevant indicator here is the “average fees,” which measures the total amount of fees (in USD) that investors have to attach to their Ethereum transaction in order for it to go through on the blockchain.

The value of this metric can fluctuate depending on the traffic that the network is receiving. Generally, when there are a large number of transfers happening at once, transactions may take more time to be executed. So, those that want their transfers to go through quickly during such times of congestion simply attach a higher fee with their transactions to make sure that they are prioritized by the network.

On the other hand, when there aren’t many users making moves on the chain, the average fees can plummet since there aren’t many investors competing against each other to get their transactions done quicker anymore.

Because of this relationship, the average fees indicator can provide insight into whether the Ethereum network is seeing a high amount of activity or not at the moment.

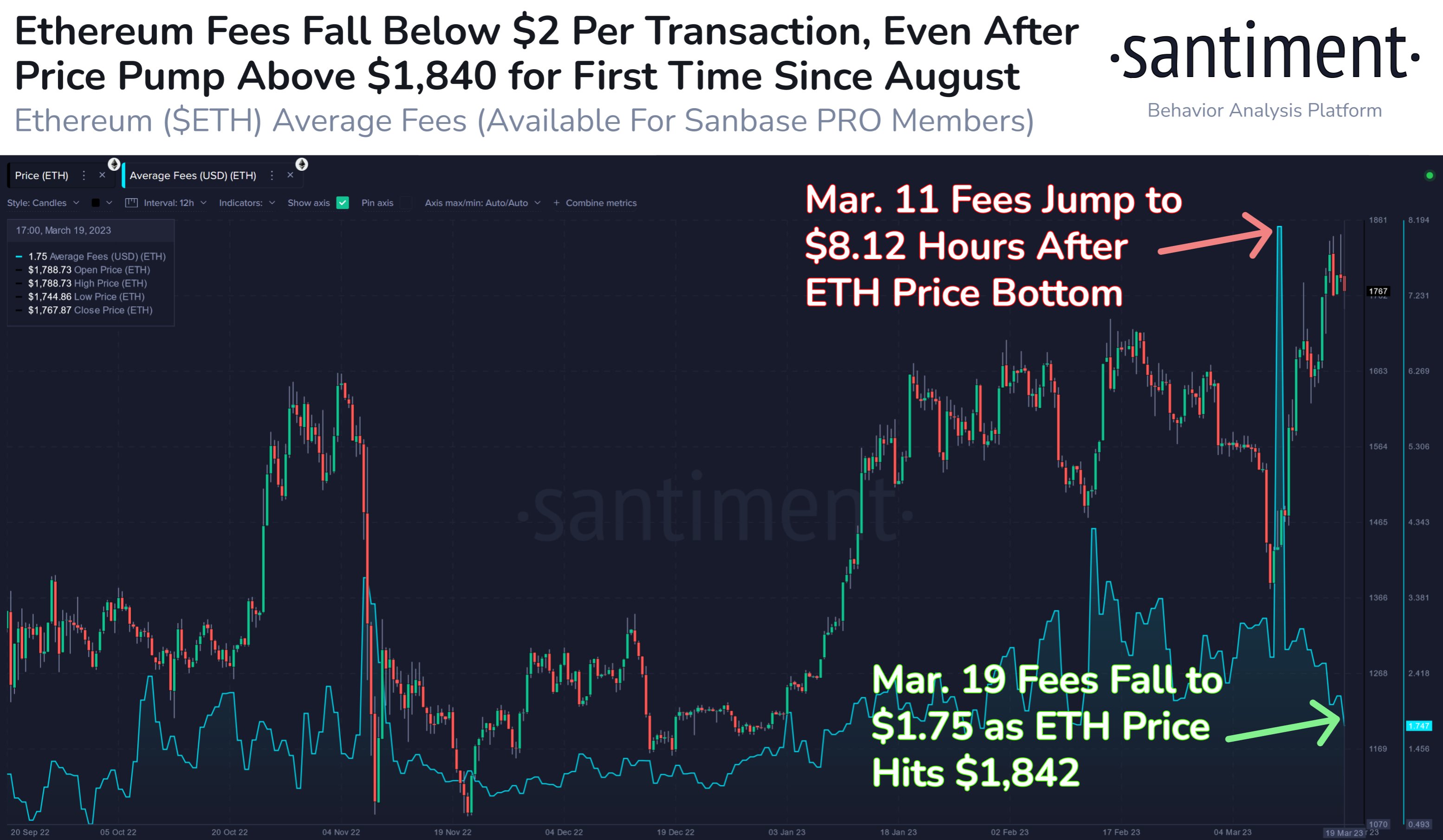

Now, here is a chart that shows the trend in the ETH average fees over the last few months:

Looks like the value of the metric has observed some decline in recent days | Source: CryptoQuant

As displayed in the above graph, the Ethereum average fees had seen some pretty high values earlier in the month when the ETH price had plunged and hit a local bottom.

During this spike, the indicator had reached a peak of about $8.12, suggesting that holders were active back then. This high network traffic naturally came in part from those who were applying selling pressure on the coin, thus the decline in the price.

However, that wasn’t all. The high fees would have also been a result of the buyers rushing in to buy the cryptocurrency at the low prices, hence why the asset’s value sharply shot up not too long after.

Ethereum has continued this fresh price surge recently, with the asset even managing to break above $1,800 briefly during the weekend, a level that the coin hadn’t previously reached since August 2022.

As this rise in the value of Ethereum has occurred, however, the average fees have only trended down. Now, the indicator’s value has dropped to just $1.75, implying that the network isn’t too hot right now despite the rally.

Santiment thinks that this could be a good sign for ETH as it means the price wouldn’t encounter any notable transaction barriers currently, something that could help open the door to $2,000 for the asset.

ETH Price

At the time of writing, Ethereum is trading around $1,780, up 12% in the last week.

ETH seems to have shot up recently | Source: ETHUSD on TradingView

Featured image from DrawKit Illustrations on Unsplash.com, charts from TradingView.com, Santiment.net