A recent development highlights the ongoing interagency drama between the US Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC): the classification of major cryptocurrencies has become a focal point of contention.

Once again, the CFTC has affirmed its position that Ethereum (ETH) and several other cryptocurrencies should be classified as commodities, intensifying the battle for regulatory oversight in the expansive digital assets industry.

Regulatory Rift With SEC Over Bitcoin, Ethereum, And Litecoin Classification

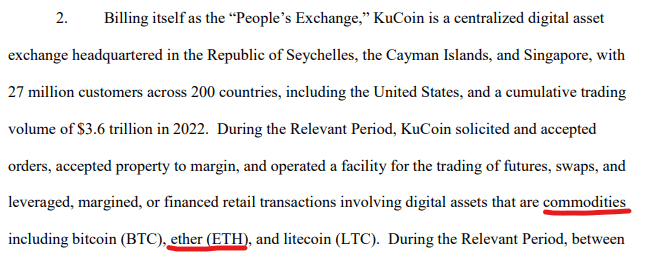

The latest episode in this regulatory feud unfolded with the CFTC filing a complaint against the crypto exchange KuCoin, coinciding with the unsealing of an indictment by the US Department of Justice (DOJ) against KuCoin and its founders, Chun Gan and Ke Tang.

The CFTC’s complaint alleged that KuCoin engaged in illegal off-exchange commodity futures transactions and leveraged, margined, or financed retail commodity transactions.

Furthermore, the exchange was accused of operating without the necessary registrations, failing to supervise its activities diligently, and neglecting to implement an effective customer identification program.

However, the most striking aspect of the complaint lies in the CFTC’s assertion that KuCoin facilitated trading involving digital assets such as Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC), recognizing them as commodities.

This starkly contrasts with the SEC’s current stance, championed by Chair Gary Gensler, which suggests that only Bitcoin holds the commodity classification, leaving other cryptocurrencies outside this designation, including Ethereum.

This ongoing turf war over cryptocurrency classification has a history, as evidenced by the CFTC’s previous lawsuit against Binance last year, where Ethereum and Litecoin were also deemed commodities.

Legal Experts Suggest Turf War Over Crypto Jurisdiction

The discrepancies between the two regulatory bodies have sparked debate within the industry, with legal experts such as Jake Chervinsky, Chief Legal Officer at venture capital firm Variant, interpreting the CFTC’s position as a challenge to the SEC’s authority.

Chervinsky suggests that the CFTC’s message to the SEC is that numerous digital assets should be regarded as commodities, indicating that the cryptocurrency space is within the jurisdiction of both agencies, even if the CFTC’s approach is less vocal. Chervinsky’s statement further reads:

Usually, the SEC and CFTC pretend they aren’t in a turf war over crypto. Today the CFTC is openly attacking the SEC’s supposed investigation of ETH. This may seem minor, but is actually pretty savage interagency drama by DC standards… I read it as CFTC saying to SEC ~ a ton of other digital assets are commodities too and you’re not the only one who gets to judge them; this space belongs to us just as much as you, even if we aren’t as loud about it.

As the CFTC and SEC clash intensifies, the industry awaits further developments and official rulings that will shape the regulatory landscape for cryptocurrencies and their respective classifications.

At the time of writing, the price of ETH stands at $3,543, experiencing a slight 0.6% decline in the past 24 hours. This follows a notable 5% rebound over the past seven days.

Featured image from Shutterstock, chart from TradingView.com