The crypto market swings to upside momentum in this bull market as market participants await Bitcoin halving after the approval of spot Bitcoin exchange-traded funds (ETF) by the U.S. SEC. With the prices rallying and closing high in March, here are the top cryptocurrencies to invest in April as per a popular analyst.

Top Crypto Confirms Bullish Breakout

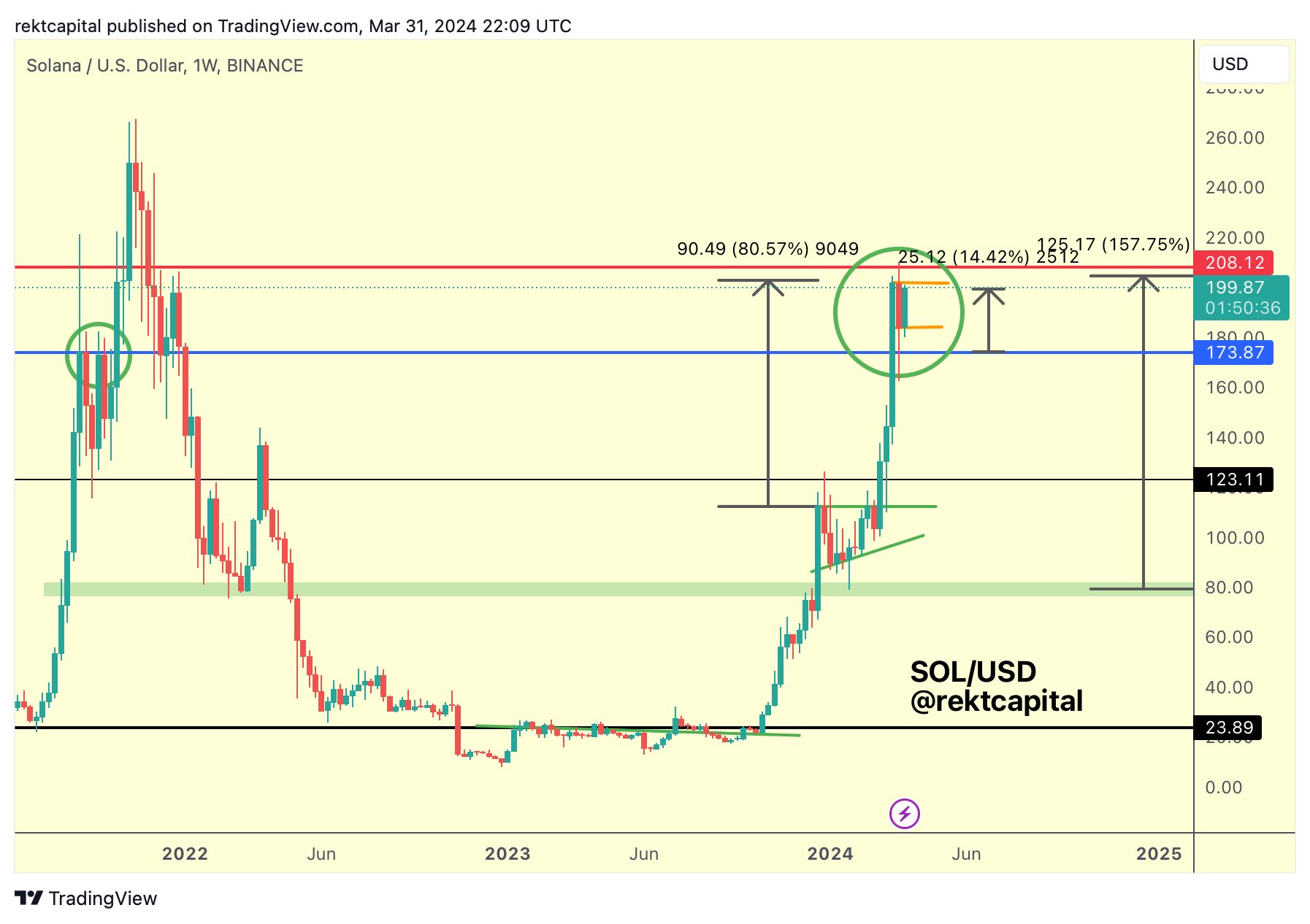

1. Solana (SOL)

Analyst Rekt Capital pointed out that Solana is showing initial signs of formation of a ‘Bull Flag’ pattern in the weekly timeframe. After this bull pattern formation, SOL price can hit a new all-time high and the odds of it happening this month are extremely high.

SOL price successfully retested the range low of $173-$175 and rebounded to trade higher above the $200 level. The $173 level is now a key support for Solana.

SOL price jumped 7% in a week and over 45% in a month. The price is currently trading at $197, with a 24-hour low and high of $194.29 and $204.18, respectively. Furthermore, the trading volume continues to remain high amid meme coins frenzy and rise in interest among traders.

2. Dogecoin (DOGE)

Analysts were closing watching Dogecoin price rally for a bullish monthly candle close in March. Dogecoin managed to close above the $0.20 level as new support confirmed further upside toward the $0.30 psychological level.

Rekt Capital also noted a bullish monthly candle close by Dogecoin in the monthly timeframe. DOGE price has seen massive rallies in February and March, he expects April to end bullish for the largest meme coin too.

DOGE price jumped 1% in the past 24 hours backed by a significant increase in trading volume. Dogecoin price rallied over 20% in a week and 70% in a month, with the price currently trading at $0.207.

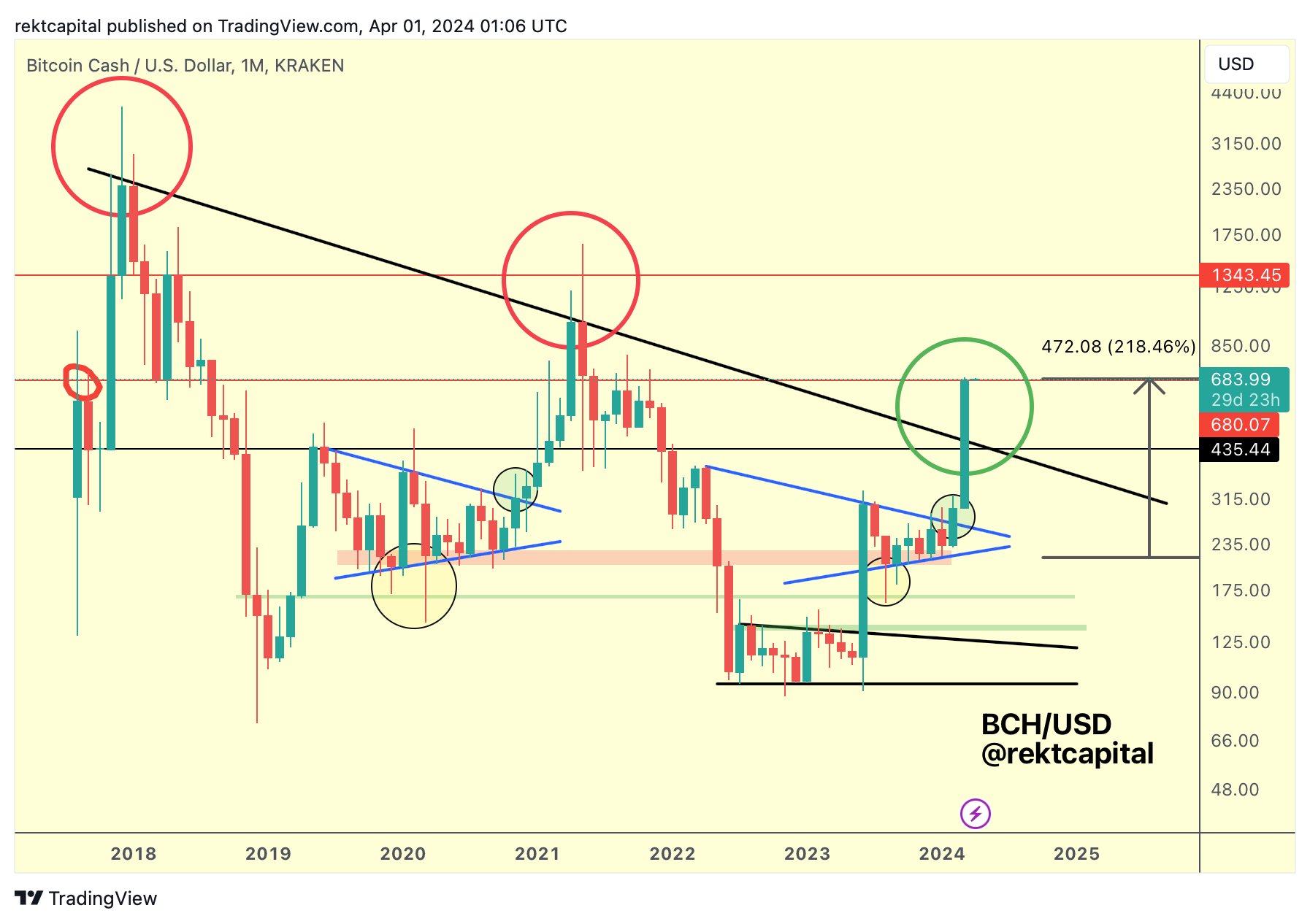

3. Bitcoin Cash (BCH)

Rekt Capital said “Bitcoin Cash has made history.” The statement came after BCH price closed the month above a multi-year downtrend for the first time since late 2017. He confirmed the end of macro downtrend for Bitcoin Cash.

The excitement surrounding Bitcoin halving has shadowed Bitcoin Cash halving event. BCH halving will happen at block height 840,000 on April 3 at approx 1:00 UTC. The current block reward is 6.25 BCH, the next block reward will be 3.125 BCH.

BCH price rose 12% in the past 24 hours, with the price currently trading at $664.62. The 24-hour low and high are $594.89 and $700.30, respectively. Moreover, the trading volume has increased by more than 280% in the last 24 hours. Bitcoin Cash has rallied over 40% in a week.

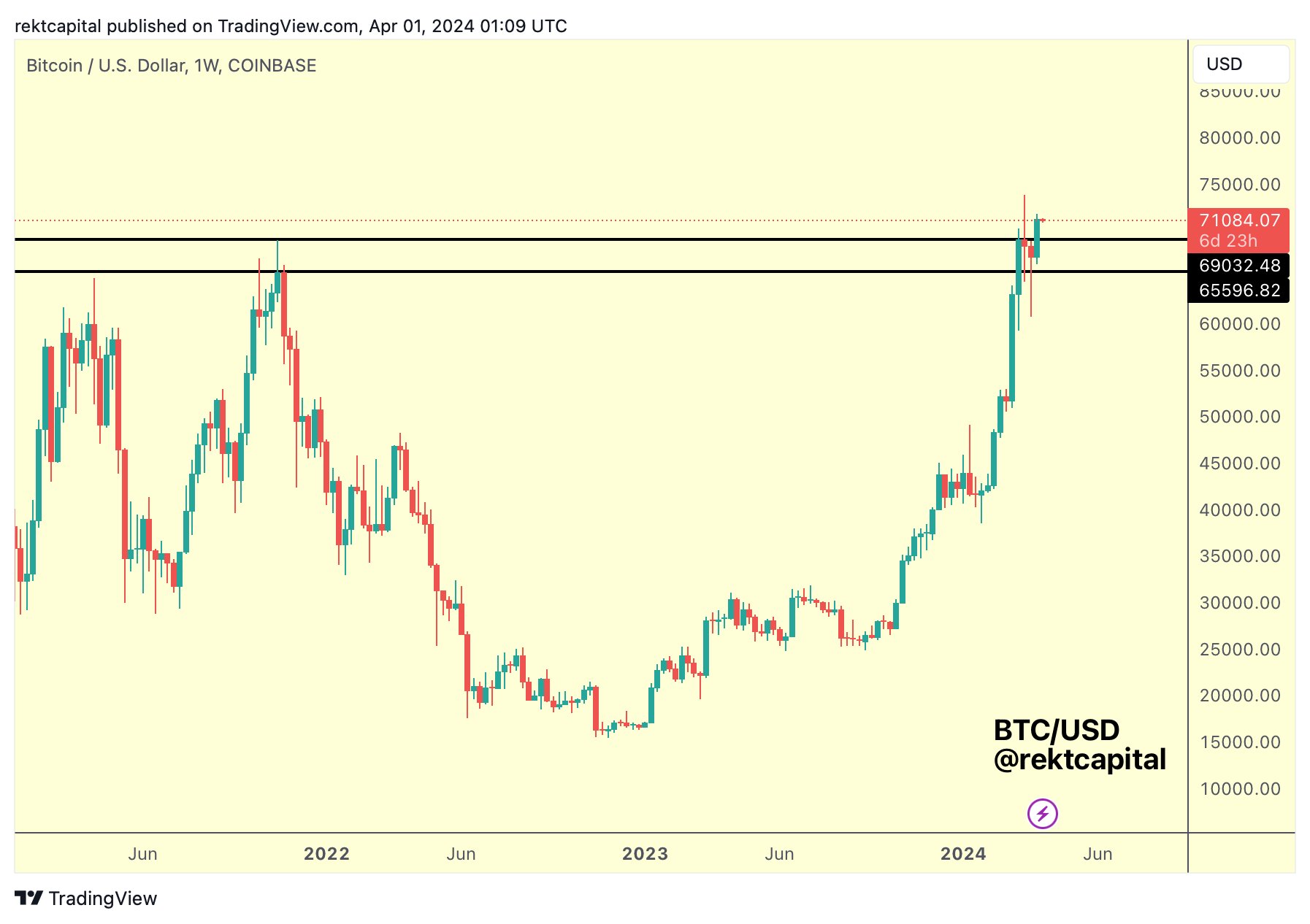

4. Bitcoin

Experts have given a target price of at least $80K after Bitcoin halving and $120K until the end of the year. Bitcoin block halving event to happen at block height 840,000 on April 20 at approx 07:30 UTC. The block reward will reduce from 6.25 BTC to 3.125 BTC, giving a push to BTC price due to supply-demand dynamics.

Bitcoin also had first monthly candle close above old all-time highs of $69,000, which is historic. Furthermore, Bitcoin has confirmed a breakout above the weekly range, with continued inflows into spot Bitcoin ETFs.

Rekt Capital predicted that BTC price needs to dip into the range of $69,032 to successfully retest it as new support before continuing higher towards new ATH.

BTC price jumped 4% in a week and over 12% in a month, with the price currently trading at $69,535. The 24-hour low and high are $68,986 and $71,377, respectively.

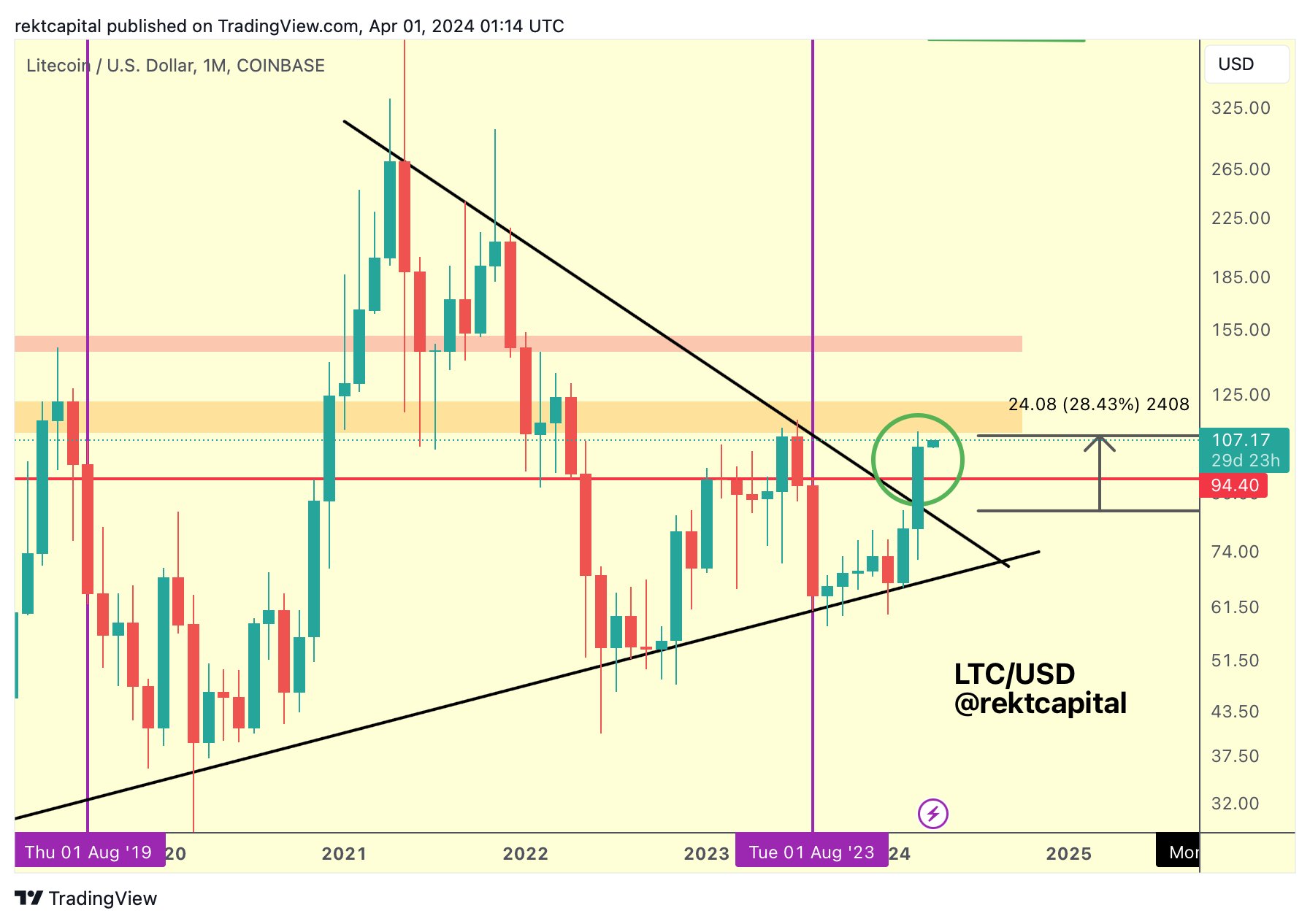

5. Litecoin (LTC)

Litecoin also had a monthly close above the long-running downtrend. The ‘macro downtrend’ has been broken for the first time since April 2021, revealed Rekt Capital.

With the macro downtrend now officially over, we will be looking at LTC price above $150 in April. LTC price rallied over 22% since successfully retesting its multi-year Macro Downtrend as new support.

LTC price jumped 17% in a week and over 24% in a month, with the price currently trading at $104.73. The 24-hour low and high are $101.73 and $112.32, respectively. Furthermore, the trading volume has increased by 132% in the last 24 hours.

Also Read:

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.