Bitcoin and Ethereum prices take respite during volatile market conditions, with traders mostly staying away from making new trades amid uncertainty in the crypto market. Also, traders and investors are bracing for over $2 billion in Bitcoin and Ethereum options expiry on Friday.

Bitcoin and Ethereum Options Expiry

After the market saw one of the largest crypto options expiry of over $15 billion last Friday, the crypto market awaits the over $2 billion options expiry to settle some uncertainty.

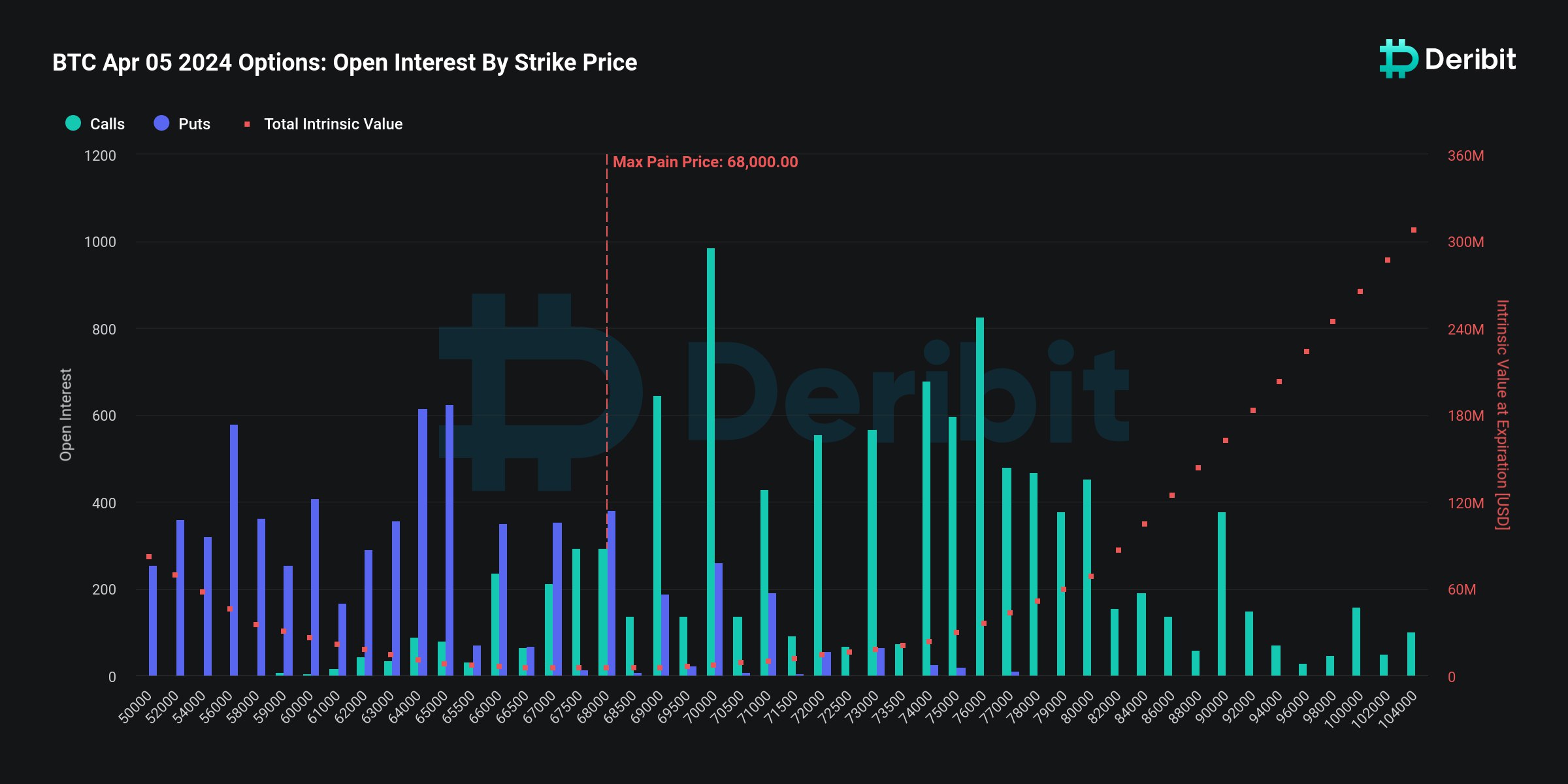

Over 18,060 BTC options of notional value $1.21 billion are set to expire, with a put-call ratio of 0.63. The max pain point is $68,000, indicating pressure on Bitcoin currently. Volatile price movements are still expected despite a release of downward pressure on implied volatility (IV). Traders remain positive about a recovery in BTC price above $70,000 this week.

In the last 24 hours, BTC call volume is higher at 10,817 than put volume of 8,076. The put-call ratio is 0.75.

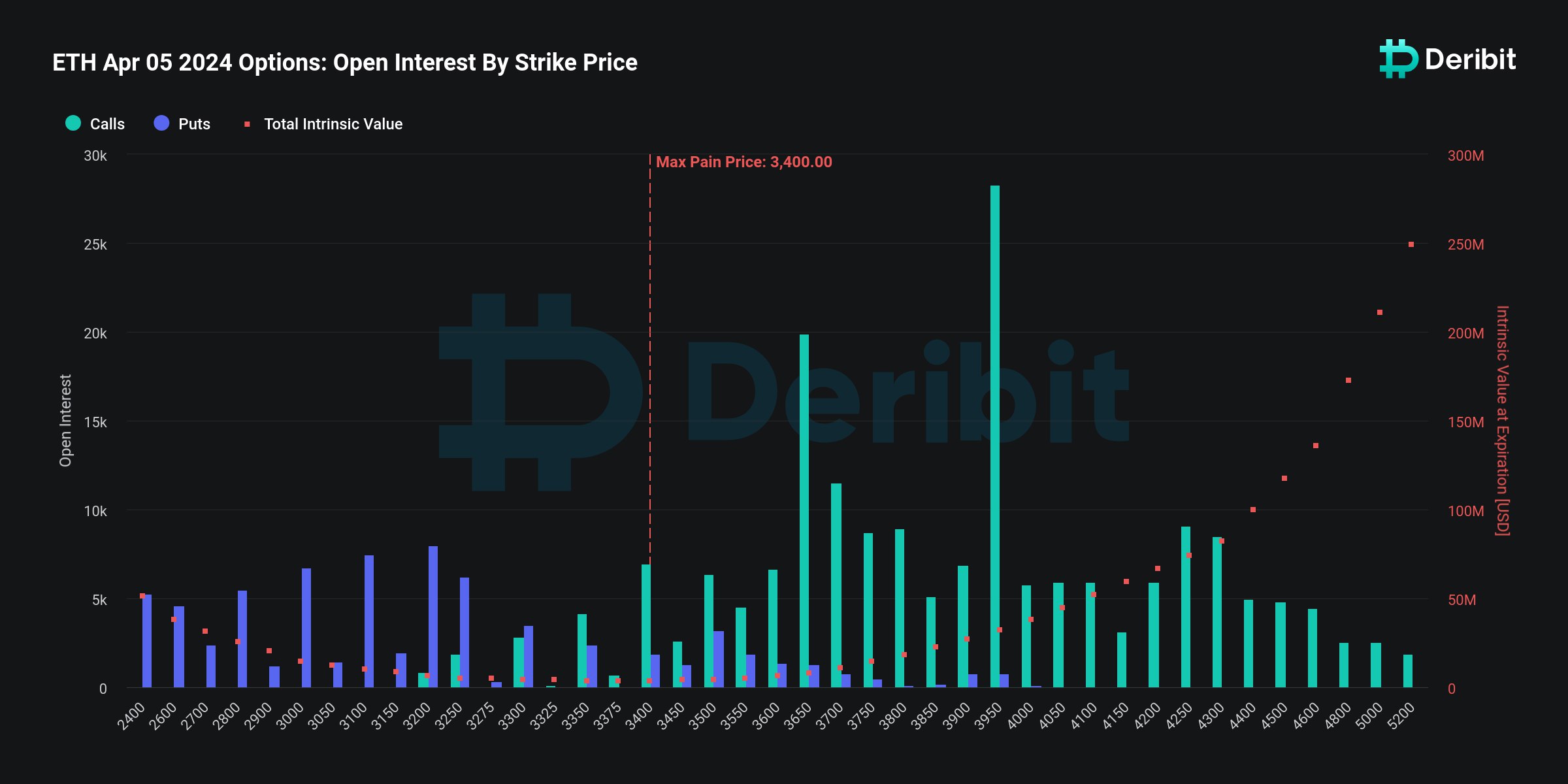

Meanwhile, 270,441 ETH options of notional value of almost $0.89 billion are set to expire, with a put-call ratio of just 0.38. The max pain point is $3,400, which is also higher than the current price of $3,287. This indicates ETH price could fall lower if it fails to rise above max pain point. Keeping an eye on trading volumes is required for further guidance on directions in ETH price.

In the last 24 hours, ETH call volume is 155,690 and the put volume is 49,100. The call open interest are higher than put open interest, with a put-call ratio of 0.31.

Also Read: Bitcoin Options Market — Volatility Declines Amidst BTC Price Pullback

Bitcoin Rise to $70,000 to Trigger Broader Market Recovery

QCP Capital analysts said BTC price is stuck in tight rage after falling below $70K and there is not enough Bitcoin ETF flow to catalyze price action in either direction. However, the demand for BTC long positions continues.

This BTC topside demand along with some upward momentum in spot Bitcoin ETF inflows should “support BTC price and perhaps, even take BTC above 70k by the end of the week.”

ETHBTC tested a critical support level after breaking below 0.05. There has been ongoing large selling of ETH calls that have crushed volumes and also put some downside pressure on ETH price.

ETHBTC is now at a 2-year low as Bitcoin halving approaches, analysts still expects a bounce from these levels but asked to hedge gains for possible further downfall.

BTC price currently trades at $67,105, with a 24-high of $69,291. Whereas, ETH price is trading at $3,285, dropping from $3,443 after Fed official hawkish comments.

Also Read: Bitcoin Cash (BCH) Price Hits 3-Year High Above $700, More Steam Left?

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.