The Bitcoin price has gained immense traction in the crypto market lately, especially with soaring anticipations after the Bitcoin Halving event. Although some experts have warned about short-term volatility, others have been bullish over a potential rally in the Bitcoin price over the long run. In addition, several prominent market experts have also unveiled a flurry of bullish forecasts for the Bitcoin price.

Analyst Discusses Crucial Data Points For Bitcoin Price

As Bitcoin teeters near the $66,000 threshold, market analysts weigh in on pivotal indicators guiding its trajectory. Notably, Marcus Thielen’s 10X Research emphasizes two critical data points, stressing the significance of Bitcoin’s recent rally.

Besides, 10X Research also discusses the impending test of Bitcoin price at the $68,300 resistance level, a historical milestone indicative of potential parabolic moves. His insights trigger intense speculation among traders, shedding light on the delicate balance between spot market dynamics and futures trading sentiments.

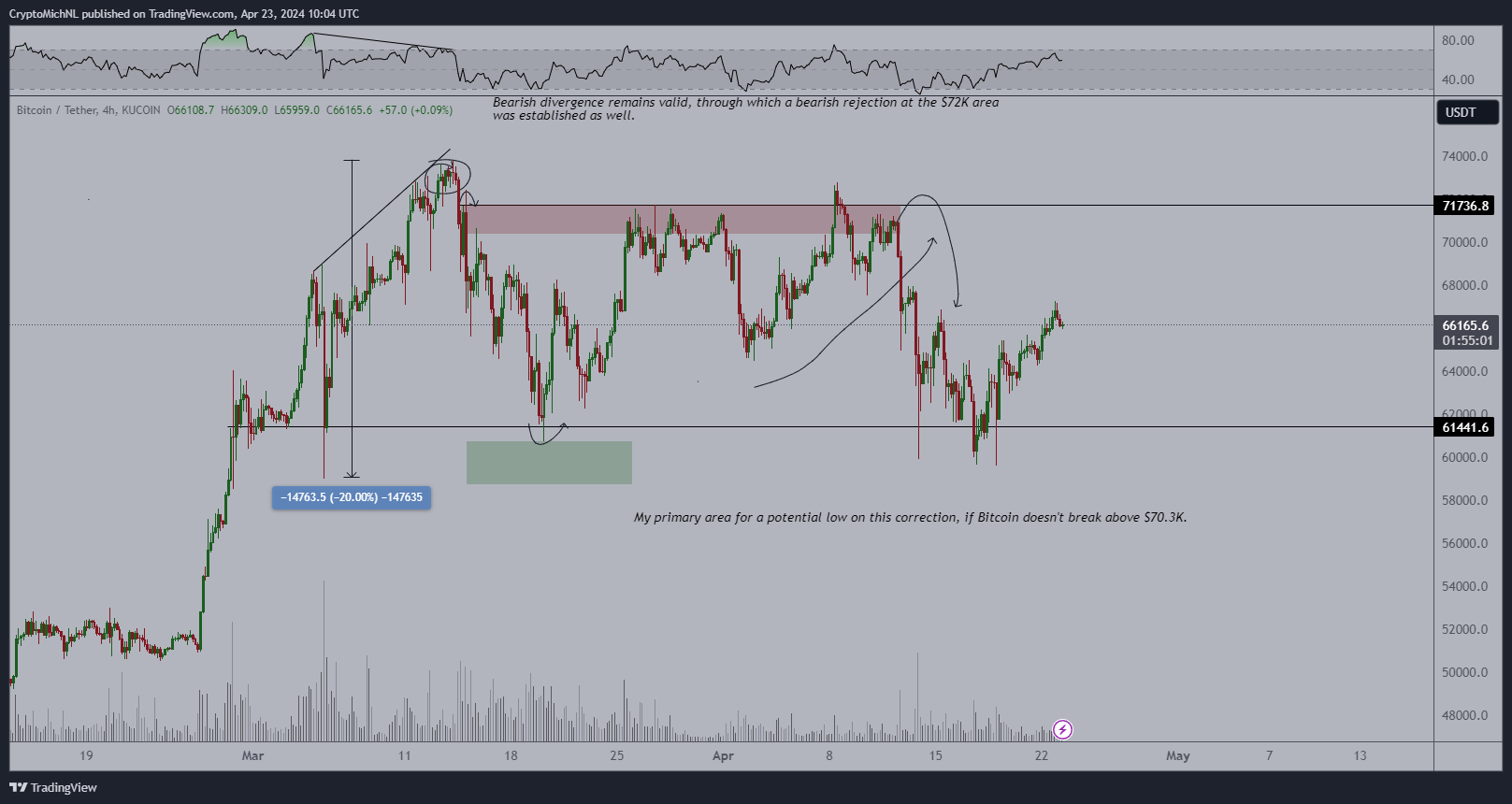

Meanwhile, Michael van de Poppe echoes the sentiment, highlighting Bitcoin’s prolonged consolidation phase while reaffirming the attractiveness of sub-$60,000 levels for strategic buying opportunities. His pragmatic outlook underscores the market’s current state of flux, characterized by boredom amid underlying bullish sentiments.

However, amid the nuanced analyses, some analysts have offered other outlooks, citing certain levels that might help the Bitcoin price to rally further in the coming days.

Also Read: Cardano Founder Charles Hoskinson Labels USDC As Early CBDC

Price Changes Amid Bullish Outlook

Analyst Captain Faibik injects optimism into the cryptocurrency market, citing bullish defenses at the $60,000 support level. In addition, he also advocates for a decisive breach of the $72,000 resistance to pave the way for a monumental rally toward the coveted $100,000 milestone.

Meanwhile, the crypto market stands at a crossroads as investors grapple with divergent viewpoints and technical indicators. 10X Research’s emphasis on Bitcoin’s response to key resistance levels underscores the market’s sensitivity to historical milestones, hinting at potential price catalysts awaiting validation.

On the other hand, Michael van de Poppe’s observation of prolonged consolidation underscores the market’s resilience amid periods of apparent stagnation, emphasizing the importance of strategic entry points for long-term investors.

However, amid the discussion, the Bitcoin price traded at $$66,146.09, up 0.30% from yesterday, while its one-day trading volume stayed near the flatline at $24.86 billion. Despite the recent volatility in the broader market, the BTC price has added over 5% in the last seven days, while noting a monthly surge of 2%.

Also Read: Binance Adds Support For OMNI, PEPE, & Others, Prices To Surge?

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.