The Bitcoin price has surged more than 3% today, soaring to the $63,000 mark, after a volatile trading recently. Notably, the recent BTC rally, after volatile trading in recent days has sparked discussions in the cryptocurrency market over the potential reasons behind the rally in its price. Meanwhile, a flurry of analysts has provided key insights on the recent BTC price movements and some key levels to watch.

Why Is BTC Price Rising Today?

The crypto market, along with the BTC price, has witnessed heightened volatility over the past few days. However, the flagship crypto has surged today, indicating the growing confidence of the investors towards the crypto. So, here we take a look at the potential reasons and some key analysis for cues on the potential reasons behind the rally.

Increased Bitcoin Accumulation Signals Bullish Sentiment

A recent post by IntoTheBlock on the X platform has stirred optimism within the investor community, potentially fueling the recent rally in the Bitcoin price. According to the analytics firm, approximately 5.1 million Bitcoin addresses, equivalent to around 10% of the total BTC holding addresses, have accumulated BTC between the current price and the all-time high (ATH) of $72,500.

Meanwhile, this revelation suggests a significant influx of new buyers into the market, indicating growing confidence and bullish sentiment toward Bitcoin. Notably, the substantial increase in Bitcoin accumulation underscores investors’ belief in the long-term potential and value proposition of the cryptocurrency.

Several analysts see this report as a potential reason that is driving the BTC price higher as demand outpaces supply. With a sizable portion of addresses purchasing Bitcoin at current levels, the market sentiment appears buoyant, contributing to the recent upward momentum in the Bitcoin price.

Also Read: Cardano’s Charles Hoskinson Explains Why Trump Is Better Than Biden For Crypto

Analysts’ Remarks Fuels Optimism

A flurry of analysts have shared key insights on the current BTC price movements. In addition, some have also shed light on the key levels to watch for the flagship crypto’s price.

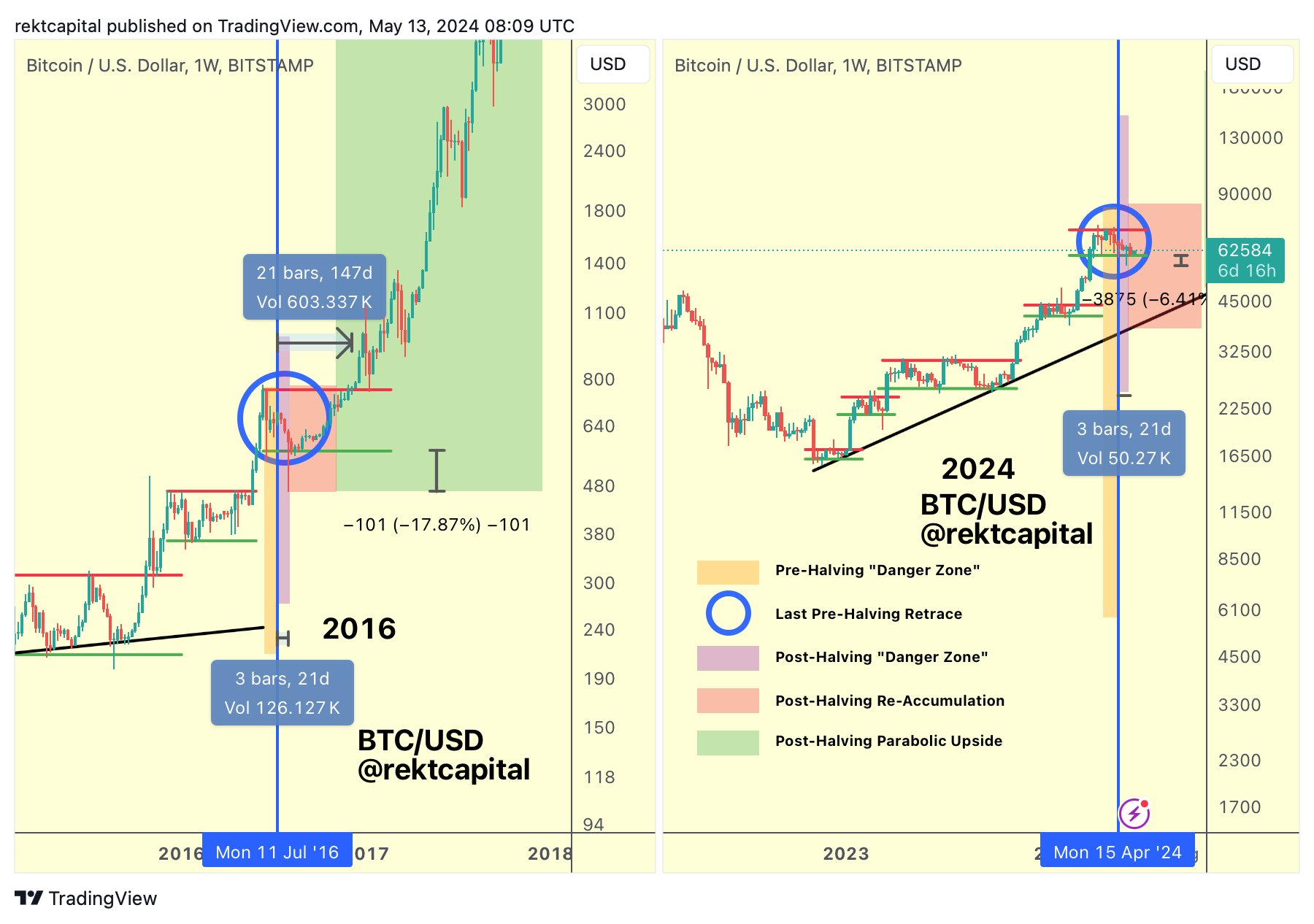

For context, renowned crypto market analyst Rekt Capital provided insight into Bitcoin’s recent price surge. Rekt Capital declared the end of the Post-Halving Bitcoin “Danger Zone,” signaling a positive turn for the cryptocurrency.

Meanwhile, according to the analyst, Bitcoin’s bounce from the Re-Accumulation Range Low support marks a celebratory moment, indicating renewed investor confidence. Notably, this announcement comes amid a backdrop of growing optimism in the crypto market, with Bitcoin rallying from recent lows.

In addition, Rekt Capital’s assessment suggests that the halving-induced uncertainties surrounding Bitcoin’s price trajectory have dissipated, paving the way for more bullish sentiment.

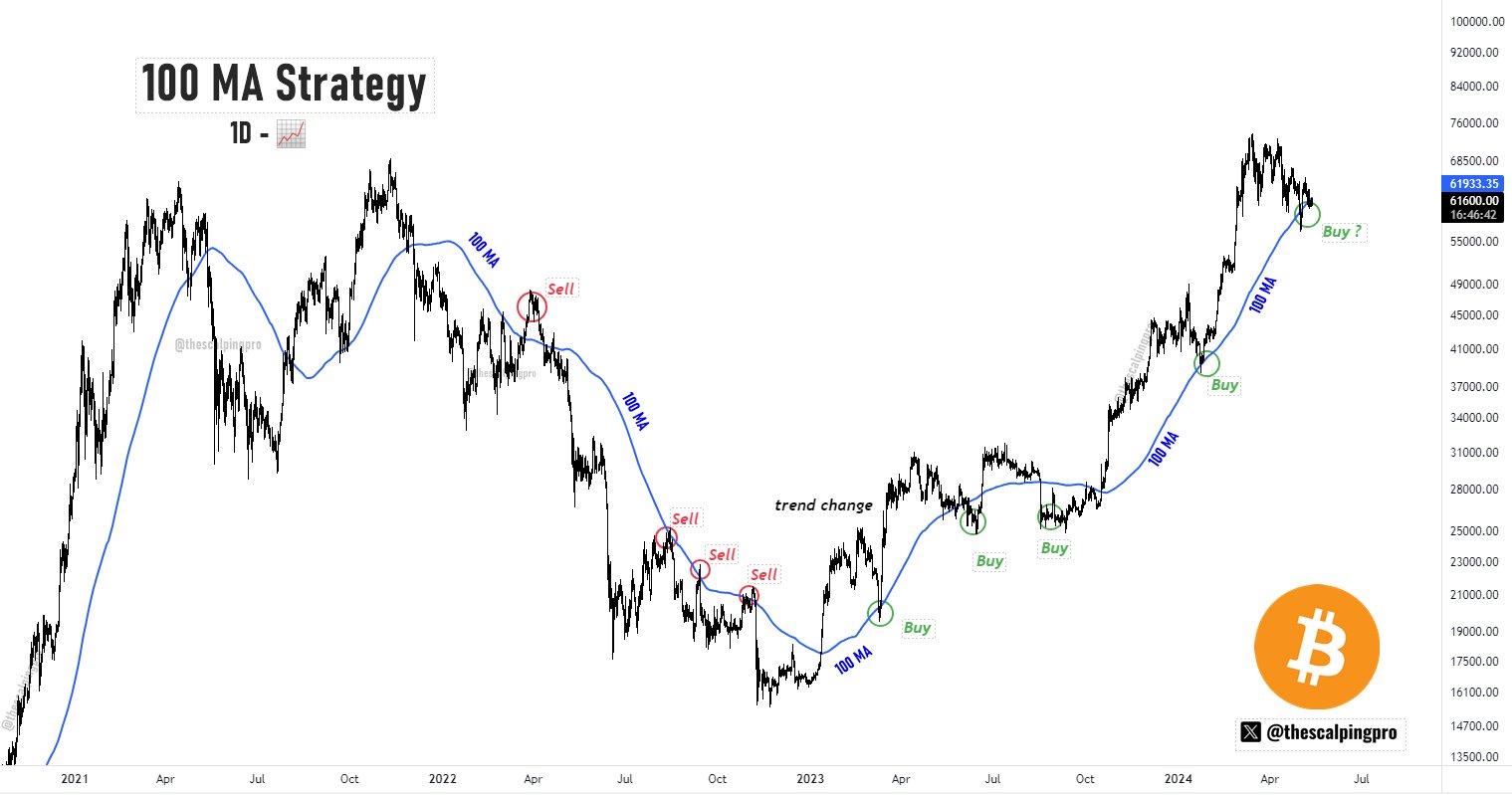

On the other hand, Mags, another popular analyst, has offered valuable insights that could be attributed to the recent BTC rally. According to Mags, Bitcoin’s current rally may be attributed to technical analysis indicators, particularly the 100-day moving average (MA) on the daily chart.

Notably, Mags highlights a historical pattern where Bitcoin tends to bottom out or experience a local bottom when it reaches or slightly dips below the 100-day MA. The analyst said that in January, the last time Bitcoin tested this MA, it marked a significant turning point, leading to an impressive 90% surge in price.

This pattern suggests that the recent rally in Bitcoin could be driven by similar technical factors, with traders interpreting the test of the 100-day MA as a bullish signal.

Key Levels To Watch

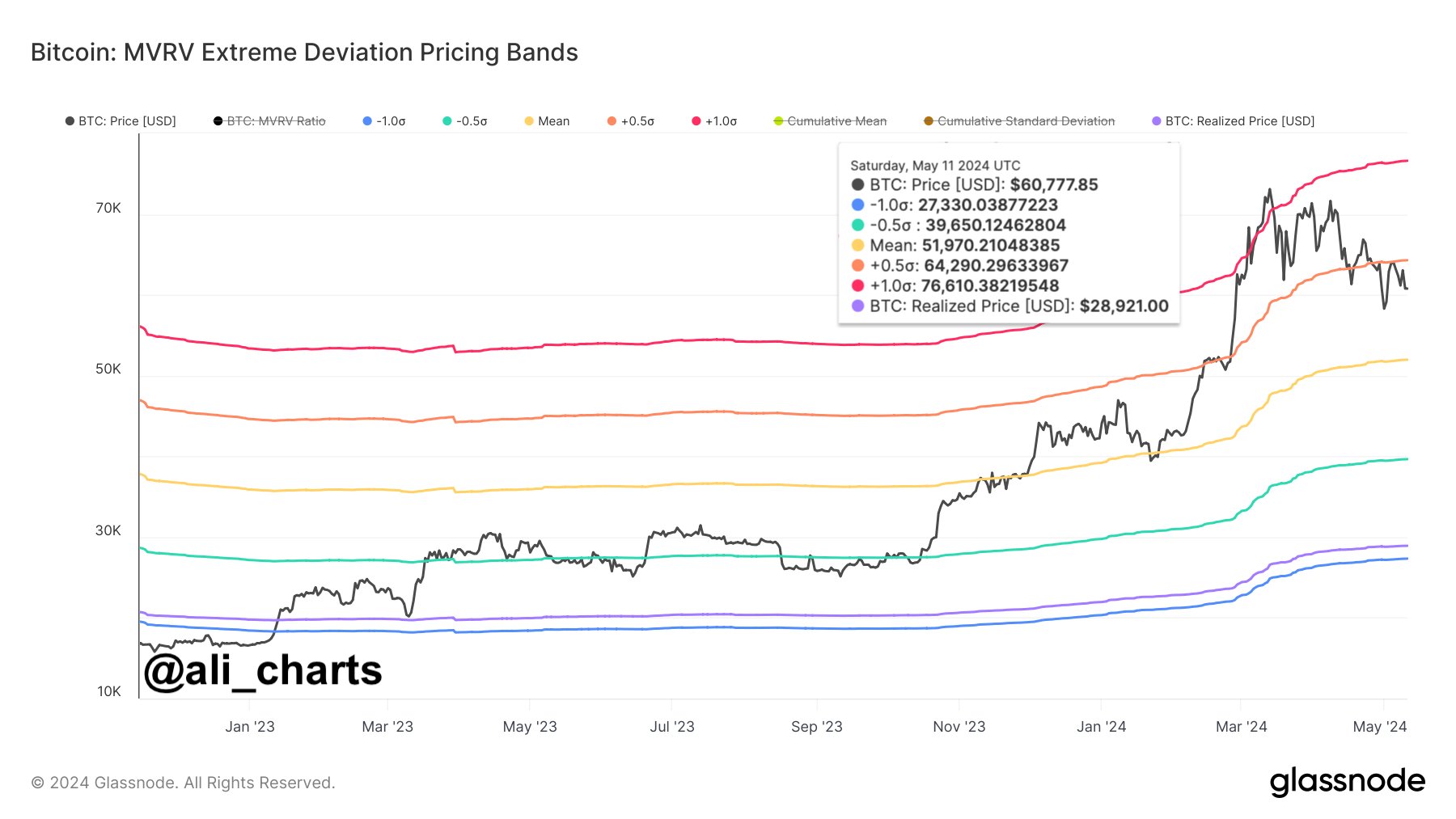

Top crypto analysts, including Ali Martinez and Michael van de Poppe, have emphasized crucial BTC price levels amidst market volatility. Notably, Martinez underscores the significance of Bitcoin reclaiming $64,290 for a potential surge towards $76,610. However, he also warned of a BTC retest towards $51,970 if this level isn’t surpassed.

On the other hand, Michael van de Poppe advocates for holding onto the current support level, suggesting that a breach of $60,000 could lead to a further dip towards $52,000-$55,000. In addition, he urged the market participants to remain patient and accumulate amid the uncertainty, as the crypto market navigates through various news-driven fluctuations.

BTC Price Rallies Amid Soaring OI

The Bitcoin price rally comes amid a soaring open interest, suggesting a bullish sentiment in the market towards the flagship crypto. According to CoinGlass data, the Bitcoin Futures Open Interest (OI) has surged 3.74% in the last 24 hours to 479.88K BTC or $30.25 billion.

The CME and Binance exchanges have topped the list in the OI chart, soaring about 3.20% and 3.57%, respectively. Notably, over the last four hours, the overall Bitcoin Futures OI soared 3.95%, reflecting a bullish sentiment in the market.

However, as of writing, the Bitcoin price was up 3.14% to $63,021,56, while its trading volume jumped over 70% in the last 24 hours to $22.47 billion. Over the last 24 hours, the crypto has touched a low of $60,769.84, indicating the still-volatile scenario hovering in the market.

Also Read: What’s Happening With Ethereum Price Today?

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.