Bitcoin bulls took the price to rally over the $71,500 level after sentiment improved due to cooling inflation and bullish technical chart patterns. Bitcoin price eyes breaking above $72,000, with $1.5 billion in shorts facing liquidation at the level for a move to a new all-time high of $75,000.

Traders say Bitcoin is at a major inflection point as indicated by a decline in trading volumes before a $2.2 billion in Bitcoin and Ethereum options expiry and US nonfarm payrolls and unemployment rate data today.

$2.2 Billion in Bitcoin and Ethereum Options Expiry

The crypto market remains calm as a result of $2.2 billion Bitcoin and Ethereum options expiry, experts point to a possible selloff or gleam outlook for weeks.

Over 17,493 BTC options of notional value $1.24 billion are set to expire, with a put-call ratio of 0.69. The max pain point is $70,000, indicating Bitcoin traders have room to liquidate positions as selling pressure remain. Implied volatility (IV) witnessing declines across all major terms to 50%, which means volatility would drag price down.

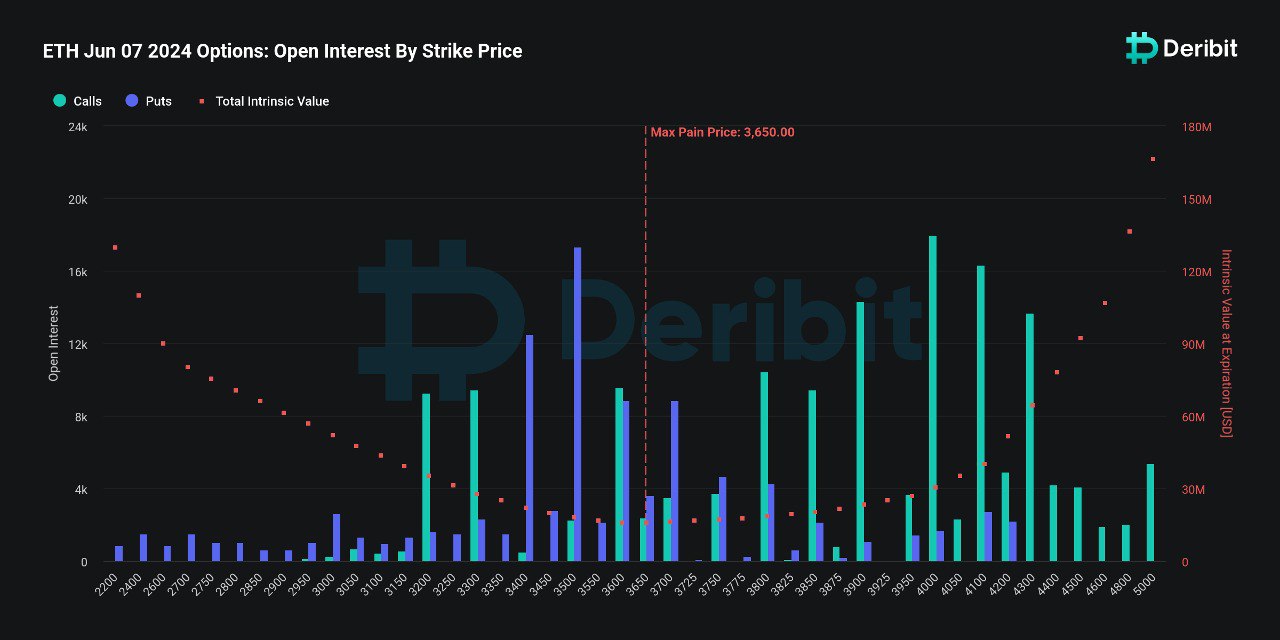

Meanwhile, 260,000 ETH options of notional value of almost $1 billion are set to expire, with a put-call ratio of 0.65. The max pain point is $3,650, which is also lower than the current price of $3,813. This indicates traders still have room to liquidate and lower the price. Keeping an eye on trading volumes is required for further guidance on ETH price directions.

Also Read: Whales Shuffle 318M XRP as Price Holds $0.52 Support

Nonfarm Payrolls and Unemployment Rate

The US Bureau of Labor Statistics to release nonfarm payrolls and unemployment data today. The US economy is set to add 185K jobs in May 2024, slightly higher than 175K in April.

The unemployment rate is expected to remain steady at 3.9%, holding at two-year highs. Also, wages likely rose 0.3% month over month, a small uptick from 0.2% seen in April, but the yearly gain is seen unchanged at 3.9%.

May jobs data are expected to come in strong, despite cooling labor market. An increase in unemployment rate above 3.9% will bring a positive move in the market.

Bitcoin Price to Rally to $83,000

BTC price has been moving sideways for the last 2 days near $71K as traders awaited key economic data. The price currently trades at $71,047, with a 24-hour low and high of $70,119 and $71,625, respectively. Furthermore, the trading volume continues to stay low, indicating a decline in interest among traders.

According to 10x Research, the head and shoulders pattern formation indicates that Bitcoin will soon rise to $83,000, and the resistance line may be broken in the next few days. “The ideal time for this resistance to break is either today, Friday, June 7, or next week, Wednesday, June 12.”

Meanwhile, Bitcoin futures open interest has started to fall ahead of CME Bitcoin futures market trading close today. The total BTC futures OI rises to $38.04 billion.

Also Read: Bitcoin Whales Buying $1 Billion Worth BTC on Daily Basis, $80,000 Coming Soon

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.