The founder of SkyBridge Capital, Anthony Scaramucci, believes that Bitcoin price has much potential to grow and could reach $700,000 in value. In a recent interview with David Lin on June 7th, Scaramucci spoke about Bitcoin as a technological advance compared to gold and the possible further growth of BTC as a means of payment.

Anthony Scaramucci Predicts Bitcoin Could Reach $700K

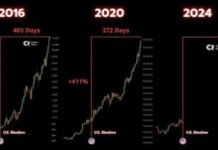

Scaramucci’s belief in Bitcoin reaching a six-figure valuation stems from its current adoption patterns and the technological underpinnings that differentiate it from other assets. He highlighted that Bitcoin’s adoption rate in the U.S. is about 5% but is increasing rapidly. According to him, if Bitcoin maintains its growth trajectory, there’s no barrier to its market cap escalating to a staggering $15 trillion in the next 15 years. This projection is based on a simple calculation: if Bitcoin’s market cap grows tenfold from its current nearly $1.5 trillion, the price per Bitcoin could skyrocket to approximately $695,000.

Furthermore, Scaramucci expounded on persistent factors that he considered to boost his prophecy. “If you look at the current market situation where the gold has a market capitalization of $16 trillion while Bitcoin is currently at $1.5 trillion, the 10 times increase doesn’t sound unrealistic at all”, he said. Here, the investor emphasized that Bitcoin has all of these qualities: scarcity and secure, decentralized transactions that Bitcoin possesses that make it equal to gold.

BTC Scarcity Key to Future Value

Scaramucci also briefly touched on the fundamentals that may help Bitcoin get there and outlined some characteristics that could allow it to achieve such a value. First, the number of bitcoins is fixed at 21 million, making it scarce, an essential factor of an integral value storage tool, such as gold. Furthermore, its decentralized nature creates a credible transaction environment, giving participants a sense of credibility.

As for the rest, Scaramucci continues to trust the fundamental value of Bitcoin and is waiting for further growth in its recognition and adoption as a payment method worldwide. “Bitcoin, as a form of digital asset, is not just a medium for store of value, especially given the ever-increasing speed of adoption of digital technology in the global market,” he said. Additionally, he believes that Bitcoins may trade at about $170,000 in the next three years, pointing to the fact that Bitcoins will experience tremendous short-term fluctuation.

Although its value has recently dropped, BTC price dropped by 2.50%, trading at $69,352, oscillating between $68,507 and $71,157. There were 31 recorded infections in the last 24 hours, and the medium—to long-term prospects remain bright. Scaramucci’s speculation stems from a market outlook that considers cryptocurrencies a necessity for the financial sector’s evolution.

Also Read: VanEck Exec Reveals Next Move In Spot Ethereum ETF S-1 Approval By SEC

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.