Bitcoin, the flagship cryptocurrency, has captivated the crypto market recently due to its volatile performance. After noticing a rally over the past few weeks, BTC has witnessed a slump after the robust U.S. job data.

Meanwhile, amid these fluctuations, a new analysis by 10X Research suggests that Bitcoin might be on the cusp of a significant rally. This prediction has caught the attention of both traders and long-term investors, hinting at a potential upward trajectory for the digital asset.

On-Chain Activity Signals A Big Week

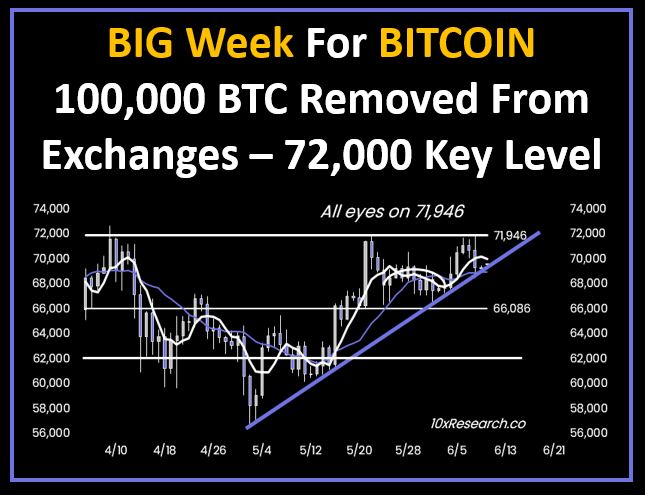

Bitcoin’s recent movements have been closely scrutinized by market analysts. According to 10X Research, nearly 100,000 Bitcoins were withdrawn from exchanges in the past month, valued at approximately $6.75 billion.

Notably, this outflux from crypto exchanges was largely led by two major U.S. platforms: Kraken and Coinbase. Kraken saw a withdrawal of 55,000 Bitcoins, worth around $3.8 billion, while Coinbase experienced a withdrawal of 24,000 Bitcoins, valued at $1.7 billion.

Meanwhile, these massive withdrawals indicate a potential bullish sentiment among investors. When large amounts of Bitcoin are moved off exchanges, it typically signifies that holders intend to keep their assets rather than sell them in the near future. This trend could tighten the available supply on exchanges, driving up the price if demand remains steady or increases.

Notably, the firm’s analysis, shared on the social media platform X, highlights the unprecedented nature of these withdrawals and the implications for Bitcoin’s price action.

Also Read: How Bitcoin Will Benefit From End Of US-Saudi Petrodollar Deal

Bitcoin Price & Performance

The current market dynamics suggest that Bitcoin might be preparing for a significant breakout. The combination of reduced exchange supply and the lingering effects of the Bitcoin halving could create conditions ripe for a price surge. Notably, investors and analysts alike will be keenly watching the market for signs of a breakout, potentially making this a critical week for Bitcoin.

However, the recent volatile performance in the market, especially after the robust job data has sparked concerns over a hawkish stance by the Federal Reserve. Now, the market will keep a close watch on this week’s U.S. Consumer Price Index (CPI), and PPI data to track the inflation level in the nation. Besides, the FOMC interest-rate decision will also play a crucial role in shaping the market sentiment.

As of writing, Bitcoin price was up 0.23% and exchanged hands at $69,432.50, with its trading volume soaring 19% to $15.27 billion. The crypto has touched a high of $69,817.52 in the last 24 hours, after hitting a 30-day high of $71,946.46.

Also Read:

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.