The U.S. Spot Bitcoin ETF experienced a turbulent week, resulting in a significant outflow of nearly $200 million on June 14. Fidelity’s FBTC led the exodus with an $80.1 million outflow, followed by Grayscale’s GBTC at $52.3 million.

Notably, as Bitcoin’s price shows signs of volatility amid the gloomy U.S. Spot Bitcoin ETF trading, experts weigh in on the potential implications for the cryptocurrency market.

Bitcoin ETF Records $200M Outflow

The U.S. Spot Bitcoin ETF faced a challenging week, with persistent outflows totaling $581.4 million over the past five days. On Friday alone, outflows reached $189.9 million, with Fidelity’s FBTC and Grayscale’s GBTC being the main contributors.

Notably, Fidelity’s ETF saw the largest single outflow, amounting to $80.1 million. Grayscale’s ETF followed closely, losing $52.3 million in assets.

Meanwhile, this week’s trend shows Bitcoin ETFs struggling to maintain investor interest. Outflows occurred on four of the past five trading days, suggesting a shift in market sentiment. However, it’s worth noting that these withdrawals come after a period of robust inflows, marking a sudden reversal in investor behavior.

In addition, the rapid outflows reflect broader market concerns and increased volatility in Bitcoin price. This sentiment shift has led to increased caution among investors, weighing on the risk-bet appetite of the investors. However, the question now is whether these trends will continue or stabilize as the market adjusts to recent price fluctuations.

Also Read: Bitcoin Price Bull Run Is Intact As Per These Five On-chain Metrics

What’s Next For Bitcoin Price?

Despite the recent positive signs in the market, Bitcoin continued to record a significant decline over the last few days. In other words, the significant ETF outflows have coincided with notable volatility in Bitcoin’s price. BTC has struggled to maintain stability, fluctuating around key levels.

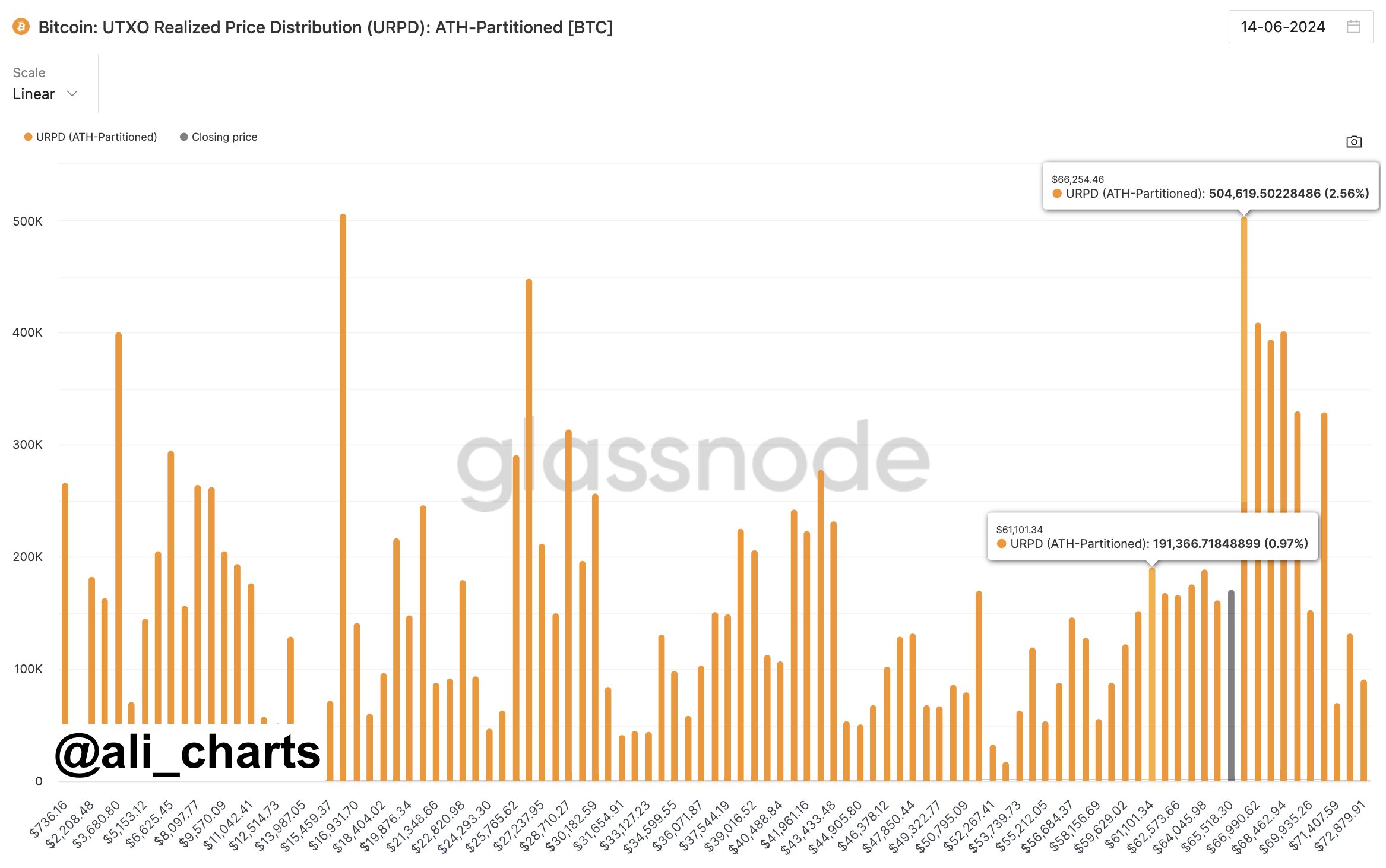

Amid this, prominent crypto market analysts highlighted a key point that Bitcoin must hold to avoid a further dip to $61,000. In a recent analysis shared on the X platform, Martinez said that Bitcoin needs to stay above the $66,254 mark, otherwise BTC price witness a potential correction down to $61,100.

As of writing, Bitcoin price exchanged hands at $66,242.59, noting a drop of 1.01% over the last 24 hours. Besides, the trading volume also dropped slightly, while its price saw a 24-hour low of $65,049.23.

Despite the recent dip, the CoinGlass data showed that Bitcoin Futures Open Interest recorded a slight recovery in the last four hours while dropping more than 2% in the 24-hour timeframe.

Also Read:

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.