Institutional investors are grabbing every dip in Bitcoin while retail investors panic amid BTC selloffs by the German Government. Investment adviser firm Fiduciary Alliance has bagged one of the largest holdings in BlackRock iShares Bitcoin ETF (IBIT), Grayscale Bitcoin Trust (GBTC), and several crypto shares last quarter.

Fiduciary Alliance Bags BlackRock Bitcoin ETF

Investment advisory firm Fiduciary Alliance LLC becomes one of the largest buyers of BlackRock iShares Bitcoin ETF (IBIT) in Q2 2024, as per a 13-F filing with the U.S. SEC on July 10. The company added 188,668 units of IBIT valued at $6.64 million.

In addition, Fiduciary Alliance purchased Grayscale Bitcoin Trust (GBTC) units worth $3.48 million. Grayscale recently saw $25 million in inflow as a result of 13-F filings by several institutional investors. CoinGape recently reported that City State Bank revealed its exposure to Bitcoin (BTC) through IBIT and GBTC ETFs.

The company also acquired shares in crypto-related companies including Coinbase, MicroStrategy, and Tesla. It added 8,332 COIN shares valued at $1.89 million, $1.70 million of MicroStrategy (MSTR) shares, and invested $744,426 in Tesla (TSLA).

$5 billion AUM Northwest Capital Management also disclosed its entry into the Bitcoin market through BlackRock’s iShares Bitcoin Trust (IBIT).

Also Read: Binance Vs SEC — Judge Sets Deadline For Discovery Phase Post Major Ruling

Bitcoin Bulls Becoming Strong Amid Selloff

Bitcoin bulls are gradually gaining dominance as institutional investors are buying the dip. With Mt. Gox repayment and German Government selloff pulling Bitcoin lower.

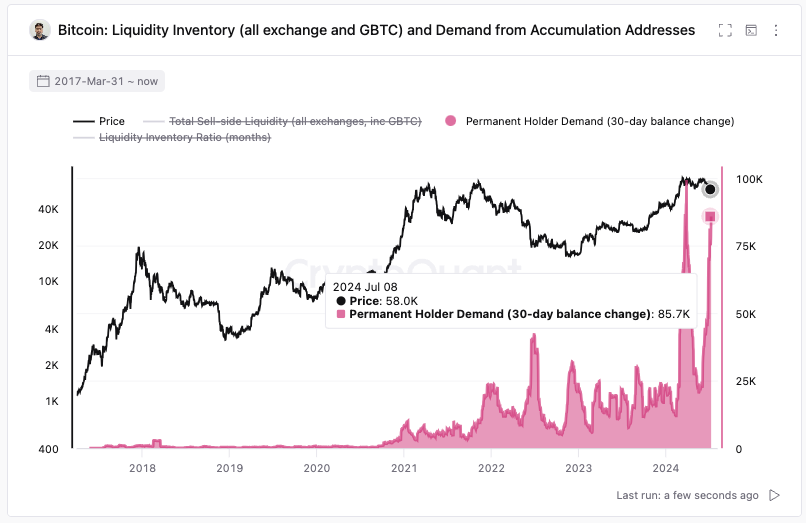

According to CryptoQuant CEO Ki Young Ju, permanent holders that are mostly custodial wallets accumulated 85K BTC in a month. “These wallets are neither ETFs, exchanges, nor miners. During the same period, 16K BTC flowed out of ETF holdings,” he said.

BTC price jumped 0.50% in the past 24 hours, with the price currently trading at $57,748. The 24-hour low and high are $57,014 and $59,416, respectively. Furthermore, the trading volume has decreased by 7% in the last 24 hours. The weakness is a result of CPI inflation data due Thursday.

Meanwhile, derivatives traders are buying as total futures open interest surged 2% to surpass $28 billion. CME BTC futures open interest rose to $8.27, up more than 2.50% in the last 24 hours. Also, total BTC options open interest continues to rebound, with currently valued at $16.5 billion.

Also Read: Elon Musk’s X Payments Gets Money Transmitter License In Washington DC

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.