Samson Mow, a prominent Bitcoin (BTC) advocate and maximalist, has proposed a bold buyback strategy. It is aimed at reintegrating 50,000 Bitcoin into Germany’s national reserves. This proposition comes in response to the recent selloff of the same amount of Bitcoin with the government wallet left with zero BTC now.

Samson Mow Extends Bitcoin Buyback Proposal

The German government has successfully disposed of the Bitcoin reserve seized from the now-defunct Movie2k website. Joana Cotar, an independent member of the German Bundestag, took to social media platform X to express her frustration. “0,” Cotar wrote, referencing the zero balance of Bitcoin now held by the government. “Congratulations, you have to be that stupid first,” she continued.

The statement emphasizes her dissatisfaction with the government’s handling of the cryptocurrency assets. Moreover, Samson Mow’s proposal comes in timely, as it coincides with mounting criticisms and calls for a more strategic approach to crypto management. In a post on X, Mow argued that while the German government had no choice but to offload the seized BTC. Hence, he suggested that a robust plan to re-acquire at least 50,000 BTC should be established.

He wrote, “The German government had no choice but to dispose of the 50,000 BTC seized from Movie2k. However, this October we should put together a concrete plan for Germany to re-acquire at least 50,000 BTC in a proper nation-state #Bitcoin adoption strategy.” Moreover, he tagged both Joana Cotar and Bitcoin im Bundestag, an organization dedicated to improving Bitcoin education in politics.

The controversy was further fueled by a user query about the legal obligations surrounding the sale of seized BTC. Mow clarified that in many jurisdictions, including Germany, governments are indeed obligated to liquidate seized assets. This point likely explains the recent selloff.

Also Read: Breaking: Germany Runs Of Bitcoin With 3846 BTC Moved To Flow Traders

Germany’s Massive BTC Liquidation

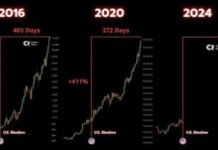

The recent liquidation of the German government’s Bitcoin holdings, led to dump of over 50,000 BTC since mid-June. Moreover, it had a noticeable impact on the crypto market. The relentless selloff contributed to a downtrend, keeping Bitcoin price below the $60,000 mark.

However, with the selloff now concluded, market analysts are optimistic about a potential recovery phase. Michaël van de Poppe, a renowned crypto analyst, highlighted that the market has now absorbed the $3.5 billion BTC sell pressure. He lauded Bitcoin’s resilience at $58,000. Hence, he believes that a recovery is incoming.

Michael Saylor, founder of MicroStrategy and a well-known Bitcoin proponent, also weighed in on the situation. On X, Saylor wrote, “You don’t sell your #Bitcoin.” The message was written in German, aiming to make it clear to the German government that HODLing BTC is better.

Meanwhile, Cotar has been particularly outspoken about the government’s Bitcoin strategy. Cotar described the selloff as “counterproductive,” arguing that Bitcoin presents a unique opportunity for asset diversification and risk mitigation.

Moreover, the German lawmaker invited key officials to her upcoming lecture on October 17. Samson Mow is also expected to attend this event. This lecture could serve as a platform to discuss and potentially formalize Mow’s Bitcoin buyback proposal.

Also Read: Bitcoin Selloff Intensifies As German Govt. Offloads 3450 BTC To Exchanges

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.