Bitcoin price has been on the investors’ radar lately, with BTC just topping the $65,000 mark. Notably, the robust rally over the past few days has sparked discussions in the crypto community if the rally would be sustained or would be short-lived.

Meanwhile, a flurry of short-term concerns has further fueled speculations over the longevity of the rally. Despite that, the market pundits remain optimistic over the continuation of this bullish sentiment.

Why Bitcoin Price Is Poised For A Rally?

The questions about whether the rally is to be short-lived or to continue forward stems from the recent short-term challenges. For context, the recent Mt. Gox repayment concerns have further fueled discussions over a pull-back in the prices.

However, the recent market trends and positive comments from industry experts have raised bets over the continuation of the rally. Here we explore some of the potential reasons that could further bolster the rally.

Fed’s Interest Rate Cut To Fuel Crypto Market Rally

A recent report from CNBC highlighted the potential Fed rate cut as soon as in September. Citing the CME FedWatch Tool prediction of 93.3% odds over a 25 basis rate cut has fueled optimism in the market.

Notably, this comes after the latest U.S. CPI data, a favorite metric of the central bank to gauge inflation, shows a cooling figure. In addition, the recent comments from Fed Chair Jerome Powell also raised bets over a dovish stance in the policy rate plans.

Jerome Powell on Monday gave some relief to the investors saying that the central bank wouldn’t wait for the inflation to come down the 2% target range to start trimming rates. Besides, he also expressed “greater confidence” that the inflation will come down to the 2% range, given the recent set of data.

Also Read: Samson Mow Predicts Immediate Bitcoin Cash (BCH) Sale From Mt.Gox

Bitcoin ETF Hitting New Milestone

The robust inflow into the U.S. Spot Bitcoin ETF has bolstered market confidence recently. It reflects the growing institutional interest in the flagship crypto, further cementing bets over the rally to continue.

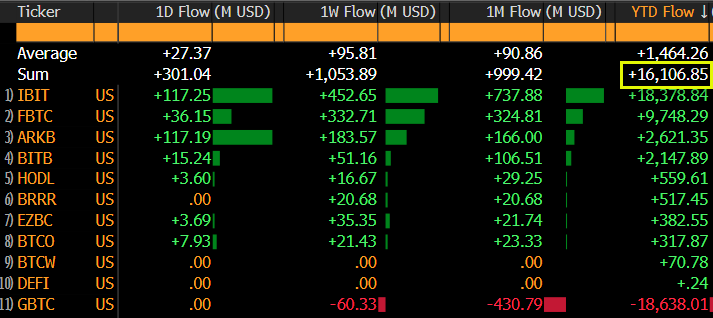

Senior Bloomberg analyst Eric Balchunas highlighted the robust influx in a recent X post. According to Balchunas, Bitcoin ETF has taken “two steps forward” after one step back in June, citing yesterday’s influx of $300 million and weekly inflow of over $1 billion.

In addition, he also highlighted the YTD influx already crossing $16 billion for the first time with recent influxes. Notably, the analysts have predicted an inflow of just $12 billion to $15 billion for the first 12 months, which the investment instrument has already surpassed.

Mt. Gox Repayment Doesn’t Imply A Selloff

Bitcoin bulls can breathe a sigh of relief. Fears surrounding a potential selloff due to Mt. Gox repaying creditors in BTC have been downplayed by CryptoQuant CEO Ki Yong Ju. Ju assures investors that the outflow currently observed isn’t retail dumping, but rather Mt. Gox preparing for payouts.

Unlike the forced sale by the German government, Mt. Gox creditors have the freedom to hold or sell their recovered BTC, he affirmed. Besides, analyst Alex Kruger even estimates a maximum 10% price dip in the worst-case scenario of an immediate sell-off.

Furthermore, Ju believes these long-held coins will likely react similarly to existing BTC in the market, potentially dampening any significant price drops. This news adds to the positive sentiment surrounding the BTC price rally.

Will The BTC Rally Continue?

The crypto market is buzzing with anticipation, as evidenced by the recent performances of digital assets. In addition, the speculations over U.S. Spot Ethereum ETF trading to start on July 23 have further fueled sentiment. Besides, this could also boost the altcoin market.

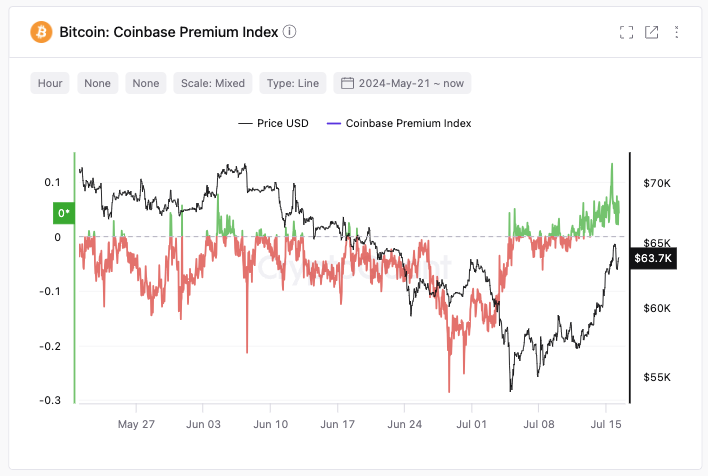

In addition, a flurry of on-chain data indicates BTC price rally is to continue. For instance, Ki Young Ju has recently highlighted that the Bitcoin Coinbase Premium Gap has hit a 3-month high, indicating a shift in the crypto market sentiment.

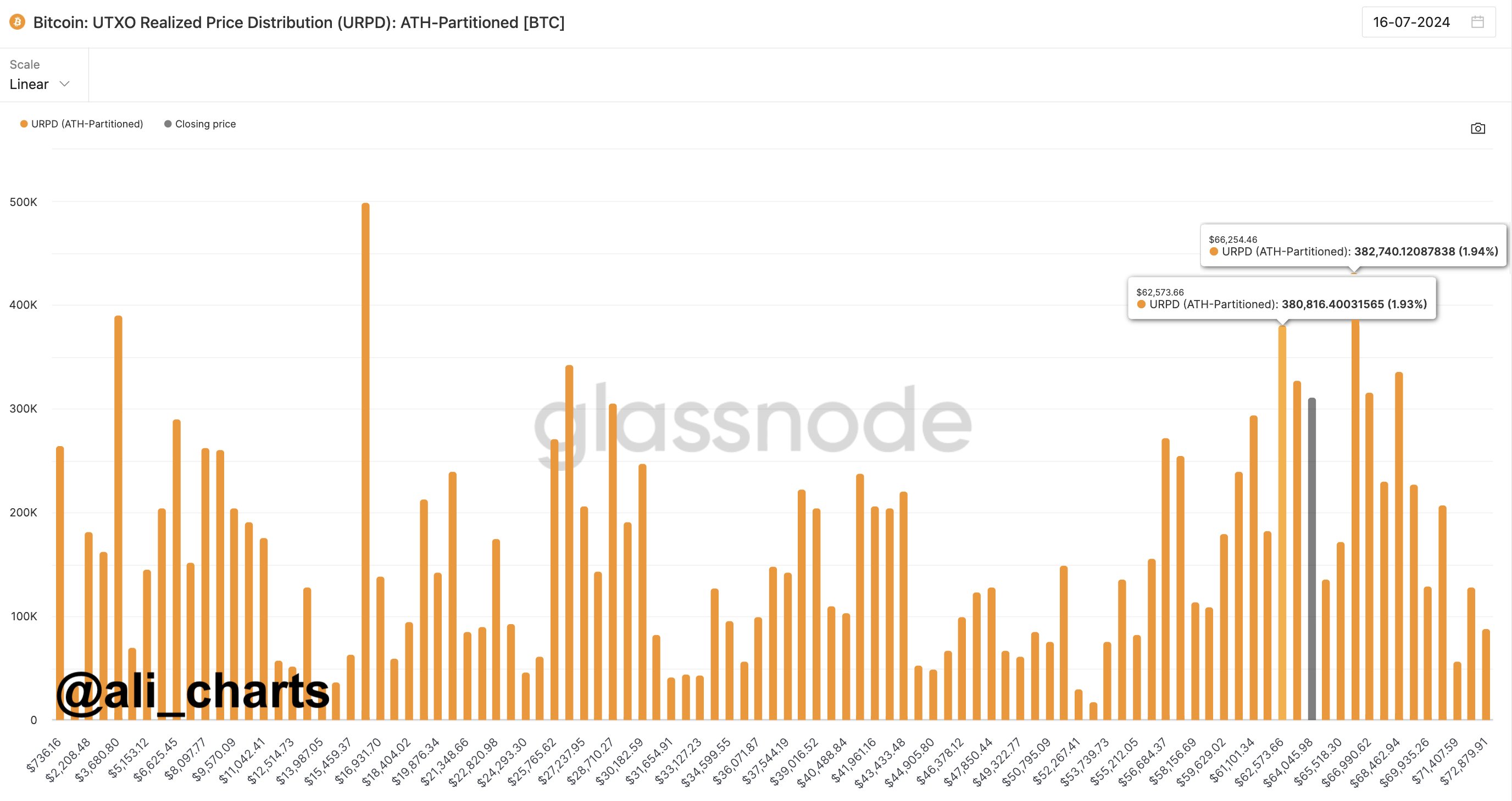

On the other hand, renowned crypto market expert Ali Martinez said that if BTC can stay above the $62,500 mark, the next target level would be $66,250. Furthermore, he also emphasized the $66k mark to propel another rally to a new ATH for BTC.

As of writing, Bitcoin price erased some of its major gains and traded near the $64,500 mark, after crossing the brief $65K mark recently. However, BTC Futures Open Interest (OI) was up nearly 3%, according to CoinGlass data, indicating the market confidence in the crypto.

Also Read: SEC’s Hester Pierce Breaks Silence On Replacing Gary Gensler

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.