Global financial services firm Cantor Fitzgerald has launched a Bitcoin (BTC) financing division to give leverage to investors who hold the asset. The company also revealed that it holds large amounts of Bitcoin sparking a frenzy in the crypto community. This year, institutions have increased their Bitcoin holdings following widespread market adoption.

Cantor Fitzgerald Reveals Large Bitcoin Holdings

The firm disclosed that it holds a large amount of Bitcoin as well as stating the case for Bitcoin freedom in the United States. Speaking at the 2024 Bitcoin Conference, Howard Lutnick the Chairman of Cantor Fitzgerald noted that the firm owns a “shit load” of BTC.

Furthermore, he stressed that Bitcoin should be free to trade just like gold globally pledging to improve the status quo. “Bitcoin is the same as gold, and Bitcoin should trade the same as gold everywhere in the world without exception and without limitations.”

In a recent press release, the company unveiled plans to launch a Bitcoin financing business with $2 billion initial capital which will grow alongside the operation. The funds will be provided to investors who hold Bitcoin marking another step in institutional Bitcoin adoption. Per the release, Lutnick highlighted the motive for the move stating that it bridges the gap between traditional finance and digital assets.

“Cantor Fitzgerald arranges and finances vast amounts of securities and commodities and, as strong supporters of Bitcoin, will now build an incredible platform to support Bitcoin investors’ financing needs. We are excited to help unlock Bitcoin’s full potential and continue bridging the gap between traditional finance and digital assets.”

Also Read: Ripple Vs SEC: Judge Torres Delibrates on Ruling, Alderoty Weighs On Regulation

Market Marks More Traditional Investments

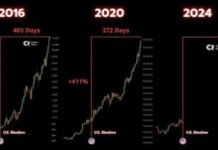

This development by Cantor Fitzgerald underscores the growing institutional appetite in the crypto market. The launch of spot Bitcoin ETFs in the United States opened up a new chapter of institutional flows with billions in assets. The status quo led to asset managers extending their reach to spot Ethereum ETFs which are also projected for inflows. Global adoption has pushed the price of Bitcoin to new highs.

Also Read: Elon Musk Lauded As X Faces Unofficial Community Review

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.