Metaplanet, a japanese investment company has unveiled plans for a substantial $68 million stock rights offering to fund Bitcoin acquisition. This strategic initiative, announced following a recent Board of Directors meeting, marks a significant pivot for the company as it seeks to establish a foothold in the digital asset space.

Metaplanet’s Stock Rights Offering

Metaplanet announced a significant move with a $67.5 million stock rights offering aimed at funding Bitcoin acquisition. The company’s Board of Directors has approved the gratis allotment of its 11th series of unlisted stock acquisition rights to all common shareholders.

Under this offering, shareholders of record as of September 5, 2024, will receive one stock acquisition right for each share they own. This proportional distribution ensures that current shareholders have the opportunity to maintain their ownership percentage in the company. The exercise price for each right has been set at $3.70 (555 yen), providing a clear entry point for investors interested in participating in Metaplanet’s cryptocurrency strategy.

Shareholders will have the flexibility to decide whether to exercise their rights, with no obligation to do so. The exercise period will run from the receipt of notification until October 15, 2024. During this time, shareholders wishing to participate must submit an exercise request form and remit the corresponding funds to the company.

In an interesting twist, Metaplanet has reserved the right to acquire any unexercised rights at no cost after the October 15 deadline. The company may then allocate these rights at fair value to specific investors approved by the Board of Directors, potentially bringing in new strategic partners or additional capital if the initial offering is undersubscribed.

This stock rights offering represents a significant step for Metaplanet, potentially positioning the company as a notable player in the corporate Bitcoin investment landscape. It also provides an opportunity for existing shareholders to participate in this strategic shift towards cryptocurrency assets.

Also Read: Iran-Backed Hezbollah Attacks Northern Israel, Brace For Market Impact

Metaplanet’s Broader Commitment to Bitcoin Adoption

Beyond its fundraising efforts, Metaplanet is taking a proactive role in promoting Bitcoin adoption on a global scale. The company has become a founding member of the Bitcoin for Corporations initiative, launched by MicroStrategy and Bitcoin Magazine. This initiative aims to provide comprehensive resources and educational content to corporate leaders, fostering the adoption and integration of Bitcoin worldwide.

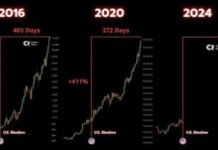

Metaplanet’s Bitcoin strategy has already shown promising results. The company recently achieved its target of acquiring 1 billion yen worth of Bitcoin assets, currently holding 20.381 BTC. This acquisition has had a positive impact on Metaplanet’s stock price.

Also Read: US Commences $50B Treasury Buyback, 50 bps Fed Rate Cut Odds Surge

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.