The US Federal Reserve Chair Jerome Powell has maintained a dovish stance on being able to bring inflation down to their target of 2%. While speaking at the 66th NABE annual meeting, Powell also hinted that any more potential rate cuts this year would be based on the incoming inflation data. This development is significant considering how much the Fed’s quantitative easing (QE) measures will affect the Bitcoin price.

Jerome Powell Is Confident That They Can Bring Inflation To 2%

Powell stated at the 66th NABE annual meeting that they are confident that inflation is on a sustainable path to dropping to their target of 2%. He further mentioned that they are confident that the US economy is strong overall.

The labor market is an area that has drawn concerns that the US economy might not be as healthy as it seems. However, the Fed chair stated that the labor market is solid, having cooled off from its volatile state two years ago. He added that they do not believe they need to see more cooling in the labor market to be confident that they are on track to achieving the 2% inflation target.

Meanwhile, Jerome Powell also suggested that the Fed is in no hurry to cut interest rates any further this year. At the September FOMC meeting, the Fed Chair had stated that there would be two more 25 basis points (bps) rate cuts this year.

However, in his latest speech, he warned that further rate cuts this year will depend on the incoming inflation data. He said that they would continue to assess the US economy meeting-by-meeting. The positive is that Jerome Powell is confident that the economy is heading in the right direction. He also assured that they won’t hesitate to cut rates if the inflation data is favorable.

Powell said there could be another 50 bps rate cut this year if these inflation data are favorable. This aligns with Federal Reserve’s Raphael Bostic, who hinted that he might favor another 50 bps cut this year.

Will The Bitcoin Price Continue To Rally

Despite Jerome Powell not asserting that there could be more rate cuts this year, the Bitcoin price still boasts a bullish outlook and could continue its rally. The trading firm QCP Capital recently alluded to global monetary easing policies from countries like China while stating that they expect BTC to benefit from such measures, given its status as a risk-on asset. Moreover, Bitcoin is entering the fourth quarter, when it records its most returns in the year.

It is worth mentioning that BTC is heading for a positive monthly close in September. Historically, whenever that happens, the flagship crypto also closes in October, November, and December in the green. Therefore, the Bitcoin price is expected to extend its rally in October. Moreover, the crypto has only recorded negative returns in October twice.

QCP Capital suggested that Bitcoin needs to break above $70,000 to reach new highs. 10x Research founder Markus Thielen predicted that BTC could reclaim $70,000 in the next two weeks. Thielen also predicted that the flagship crypto will reach a new all-time high (ATH) by late October.

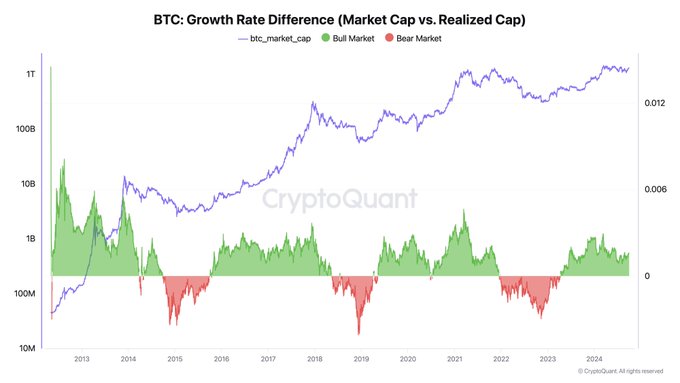

Whatever happens in October, the BTC price price still boasts a bullish outlook in the long term. Cryptoquant’s CEO Ki Young Ju recently stated that the crypto is still in the middle of a bull cycle. He accompanying chart showed that the Bitcoin still has some room to move to the upside before its price peaks in this bull run.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.