The Bitcoin price has noted a surge of around 3%, continuing its run towards the North while gaining the investors’ attention. The recent momentum indicates that despite a short-term pullback, the bulls are still dominating the market after Donald Trump’s win in the US election. Besides, it has also sparked speculations over the potential reasons that might have supported the current BTC rally.

So, let’s take a look at the potential reasons that may have helped gains in the broader digital assets space as well as in Bitcoin.

Why Is Bitcoin Price Up Today?

Donald Trump’s win in the US election has boosted the market sentiment while sending Bitcoin price to its ATH recently. However, the current market trends hint that the sentiment has faded yet, which is still supporting the BTC rally.

Here are some of the top reasons that could have contributed to the recent gains in BTC.

Donald Trump’s Election Win Boosts Bitcoin Price

Donald Trump’s victory has raised bets over potential pro-crypto policies in the US, which appears to have market optimism. Besides, the market is also anticipating a clear regulatory path ahead for the crypto market, which can help gains in the broader sector.

The buzz of the Republican victory is also evidenced by the crypto prices moving higher and making new records since last week. Additionally, Trump’s previous promises towards the crypto market, including making Bitcoin a strategic reserve for the US, have also sparked widespread discussions in the market.

This has also triggered a FOMO among other global leaders. Recently, the UK has planned to unveil crypto-friendly regulations to counter the growing US appeal among global investors. Having said that, these set of events have likely influenced the current Bitcoin price rally.

Bitcoin Options Approval Sparks Optimism

The recent green light for the US Bitcoin ETF options trading by the Commodities and Futures Trading Commission (CFTC) has further fueled market interest. This marks a major milestone for the crypto, especially as institutional interest is growing towards BTC.

Notably, the CFTC approval is also likely to provide more exposure for the investment instrument for the Wall Street players. So, looking at the BTC performance after the US Spot Bitcoin ETF approval, this development is likely to boost the Bitcoin price in the coming days significantly.

BTC Institutional Interest Soars

As already said, the Wall Street players as well as the global institutional interest have been soaring in recent days. The robust inflow into Bitcoin ETF inflow after Donald Trump’s election win indicates how investors are shifting their focus toward the digital assets space, especially Bitcoin. However, it’s worth noting that the fund flow has been muted over the last two days, as evidenced by the US Spot Bitcoin ETF outflow.

Besides, big banks are also shifting their focus towards BTC. In a recent filing, Goldman Sachs revealed that it has invested $700 million into Spot Bitcoin ETF, signaling growing market interest. Besides, Bitwise also hit $10 billion in clients’ assets under management (AUM) recently with a shifting market focus towards Bitcoin and crypto.

US SEC Chair Resignation

Donald Trump’s election win also sparked discussions over the potential resignation of the current US SEC Chair Gary Gensler. Besides, Gensler has recently shared a statement saying “proud to serve” the SEC, which has also sparked discussions over his potential resignation soon.

Notably, the anticipation in the market keeps growing over the US SEC Chair’s potential exit soon. A flurry of experts have predicted his exit as soon as this year, while many called for his resignation before Donald Trump takes office.

Meanwhile, Gensler has faced immense backlash from the crypto industry over the years for his anti-crypto stance. Now, with his possible resignation, the market anticipates a pro-crypto candidate to replace him, which might foster innovation and growth in the broader crypto market.

US Fed Rate Cut Boosts Bitcoin Price

The US Federal Reserve announced a 25 bps rate cut last week at the November FOMC. This has raised the risk-bet appetite of investors, while many have started focusing on assets like crypto. Both Bitcoin price and other top altcoins have benefited from the decision.

However, while the market was expecting another rate cut in December, the recent economic figure suggests otherwise. The recent US CPI data this week showed that the US inflation has advanced for the first time in the last eight months. Besides, the US PPI figures also came in hotter than expected, sparking concerns in the market.

Despite that, BTC remained strong and continued its rally, indicating growing investors’ confidence. It appears that the traders have shrugged off the economic concerns as Trump’s victory and anticipation over pro-crypto policies continue to dominate the market.

Will Bitcoin Price Hit $100K?

The market experts are bullish on Bitcoin price rally to $100K soon. Besides, the top altcoins like XRP, Solana, and Dogecoin are also noting strong gains, with Ripple’s native crypto soaring past the brief $1 mark. This indicates the growing market confidence in the digital assets space.

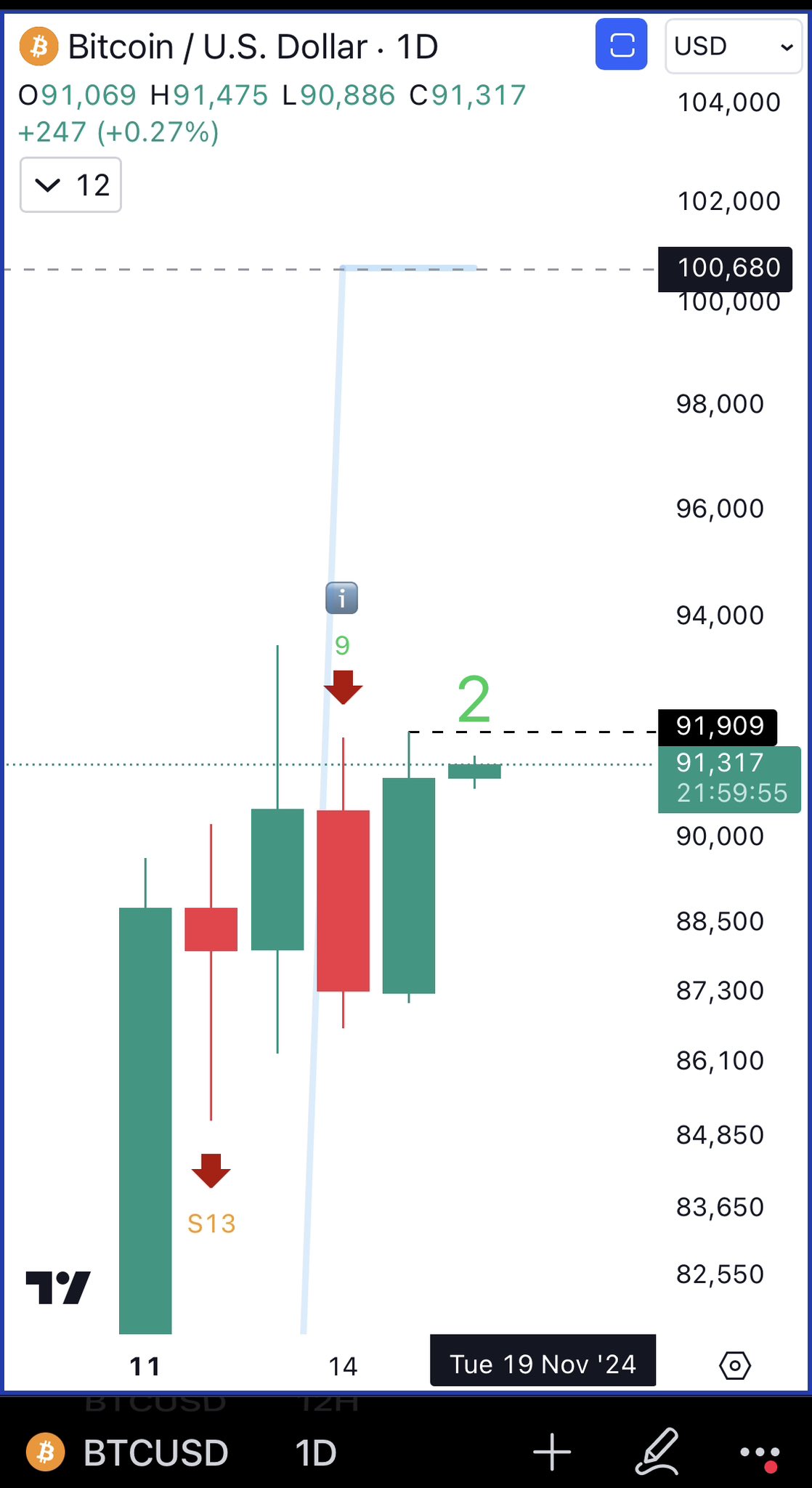

Notably, in a recent X post, prominent crypto market expert Ali Martinez remained optimistic despite risks prevailing over a short-term pullback. Martinez noted that BTC is poised to hit $100,680 next if it can witness a daily close of over $91,900.

Simultaneously, another market expert Rekt Capital said that if BTC close above $91,018, it could continue its run toward the north ahead. Notably, BTC price today was 2.85% and exchanged hands at $91,430, while its trading volume fell 19%. The crypto has touched a 24-hour high of $91,868.74, and Bitcoin Futures Open Interest rose nearly 2%, indicating space for further gains ahead.

Besides, a recent report of Matrixport also hints at a potential rally ahead. The report noted that despite the BTC RSI at 77 now hints at an overbought condition for the crypto, it remained optimistic about Bitcoin’s future trajectory.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.