Cryptocurrency is a dynamic industry changing at the speed of light, with new layers, projects and aims cropping up every day. Within crypto, DeFi is one of the most intriguing sectors in the space.

With the term itself – “DeFi”- coined only three years ago, it is very much in its infantile stage; it only broke into the crypto “mainstream” in summer 2020. But with change at this speed, friction is inevitable too. We saw that over the weekend when Andre Cronje, known by some as the Godfather of DeFi, downed tools and quit the space at large.

Resumé

Cronje is an impressive operator, his talents apparent by the disappointed reaction of crypto enthusiasts. His longtime partner-in-crime Anton Nell is also leaving the crypto space. Between the duo, they will be leaving around 25 DApps and services that they have been working on.

Perhaps the most prominent of these are Fantom and Yearn Finance, which plunged 15% and 13% respectively on the news. There were other coins which wobbled more (Solidly, which only launched last week, shed nearly two thirds of its value), showing the respect and importance the community placed on Cronje and his colleague.

Why Leave?

There are two possible reasons here. The first, and the most is likely, is that Cronje is a human being. And the thing about humans is that we are all different. Cronje is by all accounts an introvert, an incredibly talented coder who likes to build things. Of course, crypto operates on the Internet, and people on the Internet can be … not so friendly (to put it politely). The anonymous nature of a lot of Telegram, Twitter and Discord accounts means there is free reign for people to get aggressive, and when money is on the line that attitude is unfortunately exacerbated. One of crypto’s black marks is that it is so tribal and discussions can often get heated. Cronje was, by all accounts, simply fed up at being a scapegoat and a target of disgruntled investors.

It’s by far the most likely reason that Cronje defected. Indeed, he has quite before – in October 2020 he told CoinDesk, “I’m not building anything anymore. I do it because I’m passionate, but if people are going to use my test environments, then lose money, and then hold me liable, it means there is 0 upside and only risk for me”.

Heavy is the head that wears that crown.

Alternate Theories

Of course, there could be other reasons, but they amount to nothing but speculation. There is a chance that Cronje fears regulation or legal constraints, as the DeFi space becomes more mature and regulatory bodies continue to keep a closer eye on crypto. Theories abound that he will continue to operate in an anonymous capacity. He certainly loves to build things, and he has a gift. People like this generally can’t simply “retire” and do nothing, but then again – we are all different. Who am I to speculate what is going on in his mind? It could be a million different things. Maybe he will return, maybe he won’t, but for now I’m going to take him at his word and assume he has left the space.

Consequences?

I don’t think this is the apocalypse that a lot of knee-jerk reactions propose it to be. Let’s take Yearn Finance for example after the 13% fall. Cronje has not worked on Yearn for over a year, while there are 50 full-time employees and 140 part time contributors still very much on board. At a market cap of $700 million at time of writing, it’s a big project. The red candle this reads like an overreaction to me. Let us not forget that Satoshi left Bitcoin behind, and that did just fine. Ditto for Fantom, which has a market cap of $3.6 billion currently.

After all, the space is called decentralised finance, meaning we should not be dependent on any one person or agency. Of course, that’s well and good in theory, but faces behind the applications which investors are trusting with their money do help provide a degree of confidence. But I don’t think this will be a big issue for the larger projects of Cronje’s. Sure, the smaller coins (such as Solidly above) will have a tougher time recovering, but in terms of the overall impact on the DeFi space, it should not be a hammer blow.

Where Now For DeFi?

Following the explosive growth of “DeFi Summer”, growth in the space has slowed with many investors growing angsty. Most of these projects have not yet gone through a prolonged bear market, with DappRadar reporting earlier this year that should a bear market last at least a year, 80% of DeFi apps would cease to exist.

“As far as crypto winter, DeFi DApps have never gone through it”, the report states. “They have experienced crashes, but this feels like a prolonged one. Probably 20% of the apps that hold 80% of the industry value will survive. And we could see protocols that are not widely used fade away.”

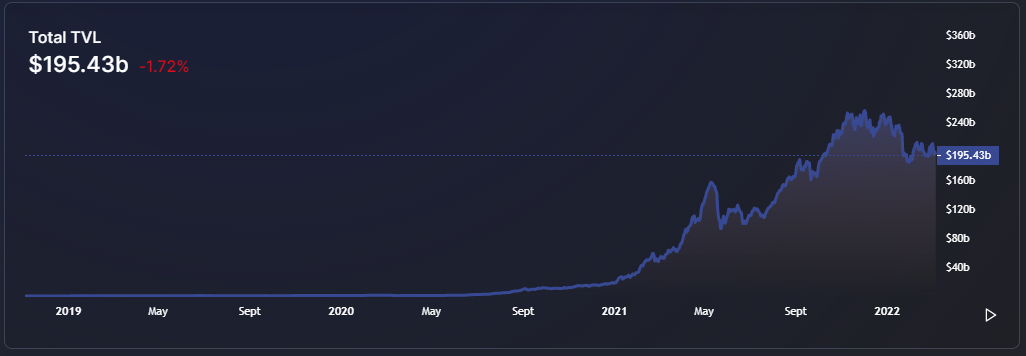

TVL in DeFi currently sits at $195 billion, down 24% from the highs of $255 billion at the start of December.

TVL in the DeFi space over the last few years, via DefiLlama

TVL in the DeFi space over the last few years, via DefiLlama

Solving the very real wider issues in the space, rather than worrying about one developer, should be the priority. The real question we need to ask following Cronje’s “resignation”, is not what that means for certain DeFi apps, but rather does it signal something more problematic about the wider DeFi space in general. I tend to think it will be just fine.