monsitj/iStock via Getty Images

The world’s largest digital asset management firm has created an NFT weighted with rivals of Ethereum (ETH-USD). In this article, I will highlight the prospects for the projects seeking to be ‘Ethereum Killers.’

Grayscale Investments creates an ETF for Ethereum’s rivals

Grayscale Investments, which is best-known for its Grayscale Bitcoin Trust (OTC:GBTC), has set up a new fund for exposure to competitors of Ethereum. The fund will include names such as Cardano (ADA-USD), Solana (SOL-USD) and Avalanche (AVAX-USD).

The Grayscale Smart Contract Platform Ex-Ethereum Fund (GSCPxE) marks the 18th investment product from the world’s leading digital currency asset manager. The fund provides exposure to an assortment of what’s known as smart contract platforms, with the company stopping short of using the ‘Ethereum Killer’ tag.

The GSCPxE is a market-cap based weighted portfolio that is intended to track the CoinDesk Smart Contract Platform Select Ex ETH Index.

The fund comes has a 2.5% annual fee and is comprised of the following asset weightings: Cardano 24.63%, Solana 24.27%, Avalanche 16.96%, Polkadot (DOT-USD) 16.16%, Polygon (MATIC-USD) 9.65%, Algorand 4.27% (ALGO-USD), and Stellar (XLM-USD) weighted at 4.06%

Grayscale CEO Michael Sonnenshein said:

Smart contract technology is critical to the growth of the digital economy, but it’s still too early to know which platform will win – from attracting and retaining the most vibrant developer communities, to ensuring the platform is high-speed, flexible, and scalable. The beauty of GSCPxE is that investors do not have to choose one winner, and instead can access the development of the smart contract platform ecosystem through a singular investment vehicle.

The current outlook for Solana and Cardano

The weightings of the new fund highlight that Grayscale sees Cardano and Solana as the frontrunners to unseat Ethereum from its long-held throne as the second most-important, and valuable, blockchain project.

One of the most important points to begin with is the focus of all three projects on proof-of-stake (“PoS”) mining. Ethereum is making a long-awaited transition to the PoS model and other projects have attempted to mount a challenge before that process is complete. Solana and Cardano actually started life as PoS blockchains, but that was less of a talking point in previous years.

In February 2021, Cardano’s founder, Charles Hoskinson, estimated that the Cardano network used 6 GWh annually, less than 0.01% of the 110.53 TWh used by the Bitcoin (BTC-USD) network as estimated by the University of Cambridge. This is becoming more important in the current climate as even Greenpeace have joined the chorus of criticism towards Bitcoin’s energy-intensive mining. There were also calls from policymakers in Sweden to limit PoW models, which was backed up by German politicians. PoS requires not mining and it is said it could reduce the network energy consumption of Ethereum by 99%.

Smart contracts, which are the underlying driver of the new ETF fund, are pieces of code on a blockchain that trigger actions upon the fulfillment of certain conditions. Ethereum uses the smart contract feature to deploy decentralized applications (dApps). However, the sheer volume of those self-executing contracts clogged the network.

This was the key problem that incumbents looked to solve. Ethereum’s comparatively low transactions per second and larger number of smart contracts butted created a slow network with high transaction fees.

The main advantage for Solana is that the platform can process up to 50,000 TPS, while Ethereum’s transfer rate is between 15 and 45 TPS. That is set to be another feature of the Ether upgrade with a faster and more scalable platform. In my in-depth article of Ethereum I noted that the platform could be set to be faster than Solana at 100k tps.

Solana has also started to gain traction in the market for non-fungible tokens (NFTs) after launching on OpenSea, the leading marketplace for digital art. The rival platform Rarible has also announced an integration of Solana NFTs which is now live.

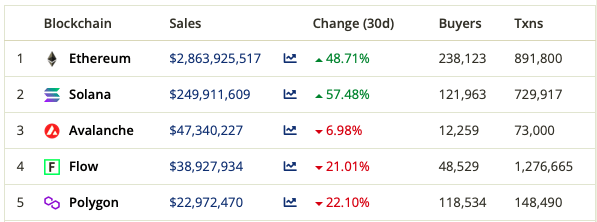

NFT Sales Volumes (Bitrates)

Ethereum has long been the leader in NFT sales and currently has over 10x the sales volumes of Solana. The latter will likely gain some ground with its inclusion on the new platforms, but a recent drop in NFT demand is a worry for its goals.

Cardano has also dabbled in the NFT space with newcomer exchanges like Arcadex looking to setup on the project. A new project named Hoskinsea, with an obvious nod to the platform’s founder, is taking a novel approach to digital art, with plans to revolutionize music sales through NFT listings on the Cardano blockchain.

For Cardano, the project is gaining ground in the decentralized finance world. The Vice President of IOHK published a LinkedIn Post on Tuesday saying that around 900 projects were under development in the network, while 100,000 new wallets have been created in the last month alone. A development update will also facilitate the bridging of ERC-20 tokens to Cardano blockchain. This is important for DeFi progress as the majority of project’s were built with Ethereum’s ERC-20 technology.

Cardano’s founder has said that the project will have the same performance as Solana by the end of this year.

The outlook for Solana and Cardano will hinge on two key areas: Will NFT sales continue to power Solana, or will Cardano’s DeFi focus be the winner? We also have to consider the re-emergence of Ethereum when its upgrade is complete to a leaner and meaner blockchain.

One issue that could level the playing field in NFT sales is that Ethereum’s network update should lower listing fees and, ultimately, its cut of NFT sales.

A quick analysis for the rest of the chasing pack

Amongst the rest of the chasing pack, Avalanche, Polygon, and Polkadot were given the next largest weightings in the ETF.

Avalanche and Polygon also feature in the market for NFT sales but they are small compared to the two market leaders. Polygon’s emergence on OpenSea allows artists to list their artwork for free, which is why the project trails in sales fees.

Polygon has grasped the market’s desire for energy-friendly projects with the launch of its Green Manifesto – a commitment to become carbon-negative in 2022. The platform hosts more than 3,000 decentralized apps and has helped process billion of transactions. Polygon has a host of products that include stock and forex price APIs which can be rented for up to $3,000. The problem is the lack of market size for those feeds.

Polygon was created as a project to combat the high gas fees in Ethereum and I personally feel that the latter’s re-emergence as a leaner and greener blockchain will see Polygon lose ground.

Avalanche was also a project touted for its speed, where Bitcoin can handle 5 transactions per second, Ethereum can handle 15 and Avalanche handles 4500. That still falls short of Solana’s impressive speed of around 50,000 tps and Avalanche may also lose ground when Ethereum’s upgrade is complete.

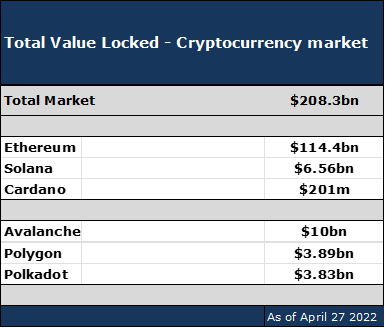

The Total Value Locked on each chain is also striking on this front as Ethereum has captured $114bn of the total deposits staked in the cryptocurrency ecosystem. This is over ten times the size of Avalanche’s, while the rest of the competitors lag further. The only outlier is Cardano, which has only $201 million. That is due to the fact that the newer projects were able to pick up a chunk of the DeFi market while Cardano was going through its upgrade.

TVL Crypto (DeFi Llama, Author)

Polkadot focuses its attention more on interoperability between blockchain networks, which is the foundation of Web 3 or a decentralized internet. I see this as more of a supporting project for others and it is not trying to target DeFi or NFT markets specifically.

Conclusion

Personally, I feel the projects that were seeking to unseat Ethereum have had their day in the sun. Ethereum dominated the DeFi industry and still hosts the majority of projects on its blockchain. High gas fees and a clogged system forced some new coins to look for cheaper and faster alternatives in the nascent days of decentralized finance. Solana and Cardano have a chance to grab some market share from Ethereum and their success will depend on the outcome for things such as NFTs. Solana is gaining breakthroughs in that area just as sales have cratered. Despite being slow and costly, Ethereum still holds the lion’s share of TVL and I believe that when its upgrade is complete, the project will grow further, while the DeFi projects that it hosts on its blockchain can also attract more capital. I would avoid a collective investment in all projects and would focus on Ethereum, with a smaller bet on Solana or Cardano. Ethereum’s upgrade to a leaner and greener blockchain is not only a threat to its challengers, but to the dominance of Bitcoin itself.