Bitcoin Analysis

Bitcoin’s price rebounded nicely from incessant selling pressure on Monday and when the day’s candle was painted, BTC’s price was +$461.5.

The boost in Bitcoin’s price was also felt across the aggregate market as the Total Market Cap bullishly engulfed back above a critical level on Tuesday [$761 billion].

The BTC/USD 1D chart below from AlanSantana is where we’re leading off with Wednesday’s price analyses. At the time of writing, BTC’s price is trading between just below the 0.148 fibonacci level [$16,904.0].

Bullish BTC market participants are hoping to put an end to 2022’s bear market and reverse course to the upside to start 2023. Firstly, they must regain the 0.148 with targets above that level of 0.236 [$17,758.7], 0.382 [$19,176.6], 0.5 [$20,322.6], 0.618 [$21,468.6], and 0.786 fib level [$23,100.2].

Conversely, bearish traders want to reject the attempt of bulls to retake the 0.148 fib level and then again go down and retest BTC’s multi-year low of $15,501.

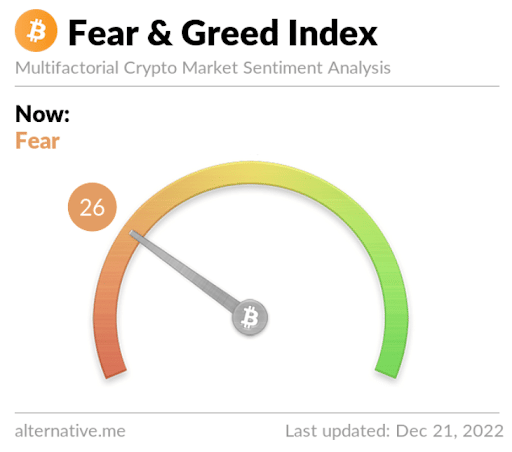

The Fear and Greed Index is 26 Fear and is -3 from Tuesday’s reading of 29 Fear.

Bitcoin’s Moving Averages: 5-Day [$17,092.04], 20-Day [$16,936.11], 50-Day [$18,023.38], 100-Day [$19,436.89], 200-Day [$25,332.7], Year to Date [$28,519.7].

BTC’s 24 hour price range is $16,373.1-$17,061.3 and its 7 day price range is $16,373.1-$17,061.3. Bitcoin’s 52 week price range is $15,501-$52,027.

The price of Bitcoin on this date last year was $48,923.

The average price of BTC for the last 30 days is $16,835.3 and its +1.2% over the same period.

Bitcoin’s price [+2.81%] closed its daily candle worth $16,902.7 and in green figures for the first time in three days on Tuesday.

Ethereum Analysis

Ether’s price marked up more than 4% during its trading session on Tuesday and concluded the day +$49.36.

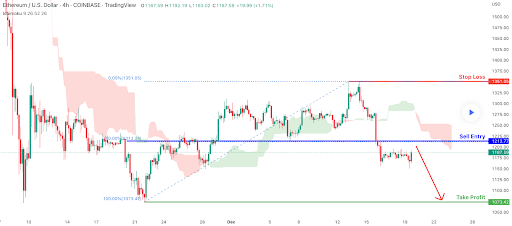

The second chart we’re analyzing this Wednesday is the ETH/USD 4HR chart by desmondlzw. ETH’s price is trading between the 100.00% fibonacci level [$1,073.42] and the 50.00% fib level [$1,212.24], at the time of writing.

The primary target to the upside of the 4HR time frame for bullish traders is the 50.00% fib level followed by a full retracement at 0.00% [$1,351.05].

Bearish traders have another vision and that’s to go back down and retest the 100.00% fib level [$1,073.42] before another potential retest at the $1k level. The third target to the downside is ETH’s 2022 low of $883.62.

Ether’s Moving Averages: 5-Day [$1,231.76], 20-Day [$1,242.96], 50-Day [$1,310.20], 100-Day [$1,434.92], 200-Day [$1,777.51], Year to Date [$2,0009.39].

ETH’s 24 hour price range is $1,163.12-$1,230.47 and its 7 day price range is $1,163.12-$1,230.47. Ether’s 52 week price range is $883.62-$4,148.85.

The price of ETH on this date in 2021 was $4,016.27.

The average price of ETH for the last 30 days is $1,227.66 and its +0.41% over the same span.

Ether’s price [+4.23%] closed its daily candle on Tuesday worth $1,217.18 and in positive figures for the first time since last Saturday.

Cardano Analysis

Cardano’s price was the worst performer of the lot of projects covered today but also marked up during its daily candle and ADA concluded Tuesday’s session +$0.0059.

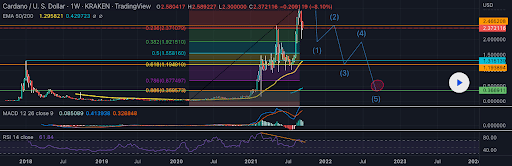

The final chart this Tuesday for analysis is the ADA/USD 1W chart via YouKnowTheVibes. ADA’s price is trading between the 1 fib level [$0.018] and 0.886 [$0.369], at the time of writing.

Bullish ADA traders have targets of 0.886, 0.786 [$0.677], 0.618 [$1.19], and the 0.5 fib level [$1.55].

From the bearish perspective, they’re aiming at a retest of the 1 fib level and below that level the next target is $0.01.

Cardano’s 24 hour price range is $0.251-$0.262 and its 7 day price range is $0.251-$0.262. ADA’s 52 week price range is $0.25-$1.63.

Cardano’s price on this date last year was $1.27.

The average price of ADA over the last 30 days is $0.3 and its -20.25% for the same interval.

Cardano’s price [+2.33%] closed Tuesday’s daily session worth $0.258 and also in green figures for the first time since last Saturday.