- Bitcoin price has recovered from its dip to $25,800, with price currently above $27,400.

- BTC could continue to bounce into the $28,000-$30,000 range as broader market sentiment improves.

- However, an analyst’s Bitcoin price prediction suggests bad news for BTC if $27,600 becomes new resistance level.

The price of Bitcoin as of May 15, 2023 9:50 am ET is $27,405, with BTC up 2% in the past 24 hours. 911.81. While Bitcoin could yet break above a key resistance level and target old support above $28,000, a popular crypto analyst says failing to breach the said supply wall could see the digital gold retreat to a closely watched support level.

Analyst shares Bitcoin price prediction as markets eye new bounce

The outlook for Bitcoin is however still broadly bullish long term, particularly after the crypto sector navigated the collapse of FTX. The current US regulatory environment remains a key concern for the ecosystem though and this as well as continued correlation with the stock market could prove another wobbly trajectory for crypto prices.

According to crypto analyst Rekt Capital, Bitcoin price could dip past the largely anticipated buffer zone at $25,000 if current levels don’t hold.

Although the stock market looks poised for gains as investors see a debt limit deal and inflation fears across corporate America easing, a flip in sentiment both in the equities and in crypto could send BTC below $25k.

Rekt thinks the flagship crypto’s price could fall to the $20,000 level. He tweeted early Monday as BTC/USD bounced from lows of $25,800:

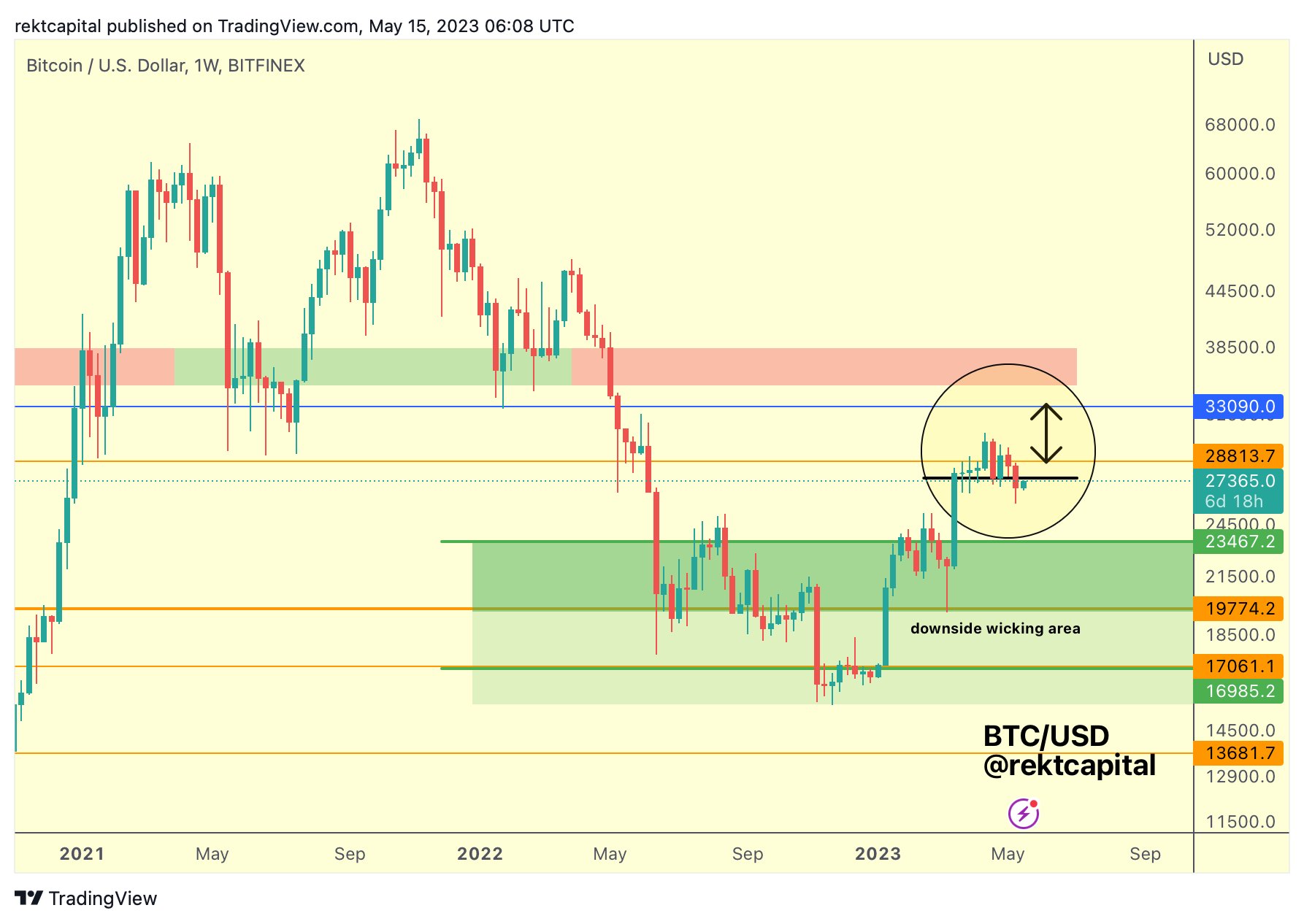

“First, #BTC failed to reclaim the $28800 level on the Weekly (orange). And then $BTC Weekly Closed below $27600, failing to hold it as support (black). Turn $27600 into resistance and this could enable further downside into the low $20,000s.”

The analyst explained his Bitcoin price prediction further in another tweet.

“The problem with this #BTC bounce is that it is occurring after a Weekly Close below black support. Such a 1W close is setting BTC up for more downside especially if this rebound is a relief rally. Reject at $27570 (black) would likely force more downside,” he noted.

Below is the analyst’s chart highlighting the price levels, with potential downside wicks beyond the multi-month support line.

Bitcoin price prediction on the weekly chart. Source: Rekt Capital on Twitter

Bitcoin price prediction on the weekly chart. Source: Rekt Capital on Twitter

On the upside, the key challenge would be around $28,800. Consolidation is likely between $28k and $30k. Above that lies the supply zone near $33,000.