In a massive boost for Cardano, data unveiled by multi-asset broker eToro shows ADA has taken BTC’s place as the most held crypto token on the trading platform.

Due to its limited store of value use case, some believe it’s only a matter of time before Bitcoin loses its crown. Are we about to witness the fall of BTC?

Cardano tops eToro rankings

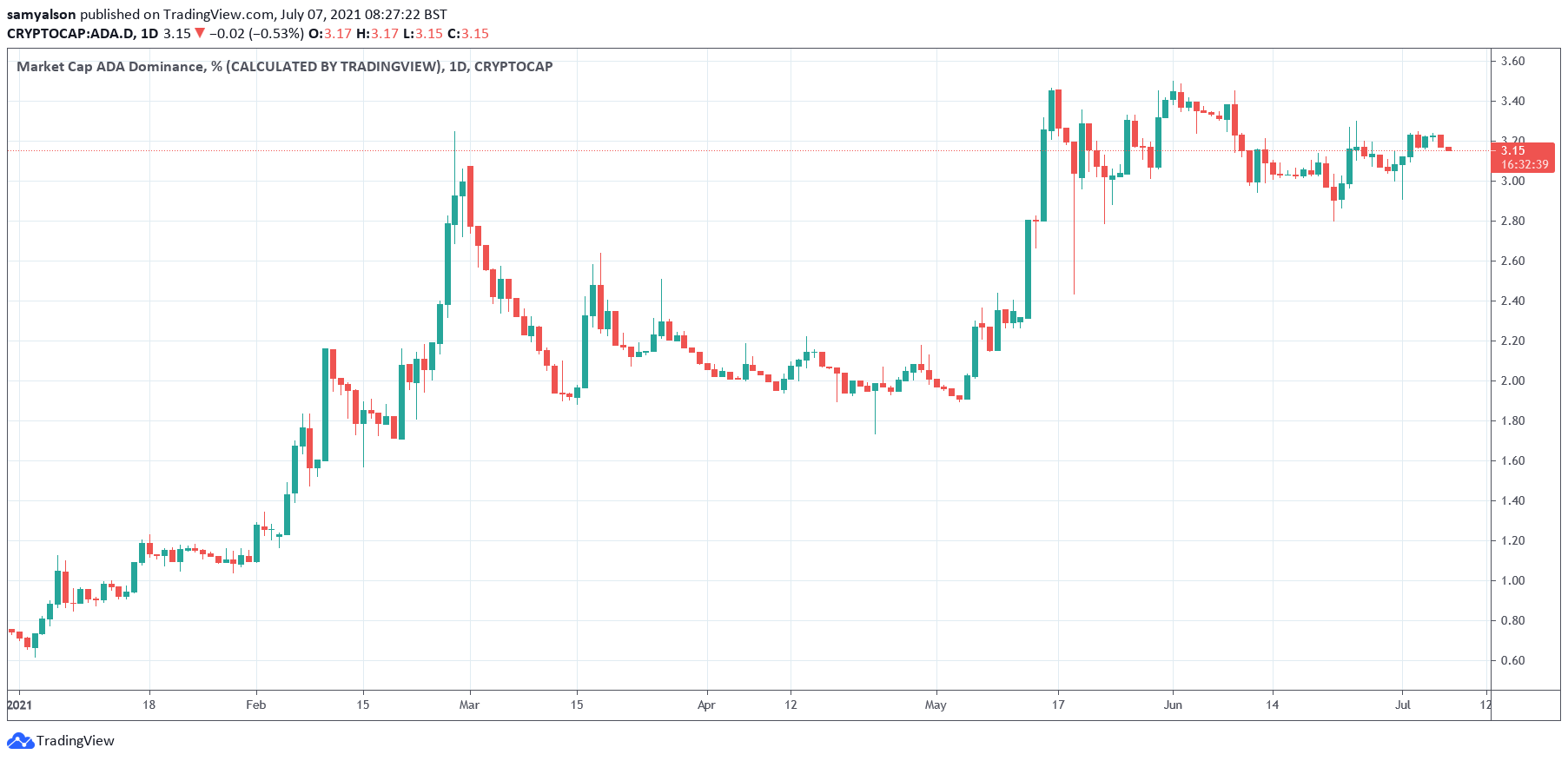

As far as market cap dominance is concerned, Cardano currently holds just 3.2% of the market. In comparison, Bitcoin accounts for 44.2% of the market – which is over 13 times greater.

However, despite Cardano’s relatively minor dominance, it has shown increasing strength over the course of this year. On January 1st, 2021, Cardano held 0.7% of the total market cap.

In the second quarter of this year, eToro customers increased their ADA holds by 51% on the previous quarter. This was enough to usurp Bitcoin and take the top spot as the most held crypto asset on the platform.

Commenting on this, Simon Peters, Analyst at eToro, said Cardano’s potential use case is the driving factor here. He referred to the coming Alonzo hard fork, which is scheduled for a mid-August/early September release, as the reason why investors are flocking to Cardano.

“If successful, it will bring smart contract functionality by allowing the writing and deployment of smart contracts for the first time on the Cardano blockchain.

This upgrade will be significant as it will enable developers to build projects on the network, helping Cardano to position itself as a real ‘competitor’ to the likes of Ethereum.”

Some expect Alonzo to catalyze the ADA price skywards. Analyst Kim Chua also plays into the “Ethereum killer” narrative, saying Cardano’s ability to compete with Ethereum could see ADA hitting $3 in the near term.

Bitcoin no longer king on Celsius either

In a further blow to Bitcoin’s dominance, the CEO of Celsius, Alex Mashinsky, said Ethereum had already flipped Bitcoin, on his platform at least.

Speaking to Kitco News, Mashinsky revealed that Celsius users now hold more Ethereum, in dollar terms, than they do Bitcoin. He added that he sees Celsius as a crypto-microcosm, in that, what happens there will later happen in the macrocosm.

Mashinsky pointed to Bitcoin’s limited store of value use case versus Ethereum’s yield use case in explaining this phenomenon. He said more people want yield than they do wealth preservation.

“There’s more people in the world who are vying for yield than people in the world saying, “I’m afraid of my fiat current, I’m just going to park some value..”

With both Celsius and eToro experiencing a drop in Bitcoin popularity, it’s clear that the demand for programmable money is beginning to make its presence felt.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Like what you see? Subscribe for updates.