Despite an overall reddish day in the market and Bitcoin’s ongoing tussle to confirm a “higher low” level of support, there are bullish signs to be found, according to some analysts.

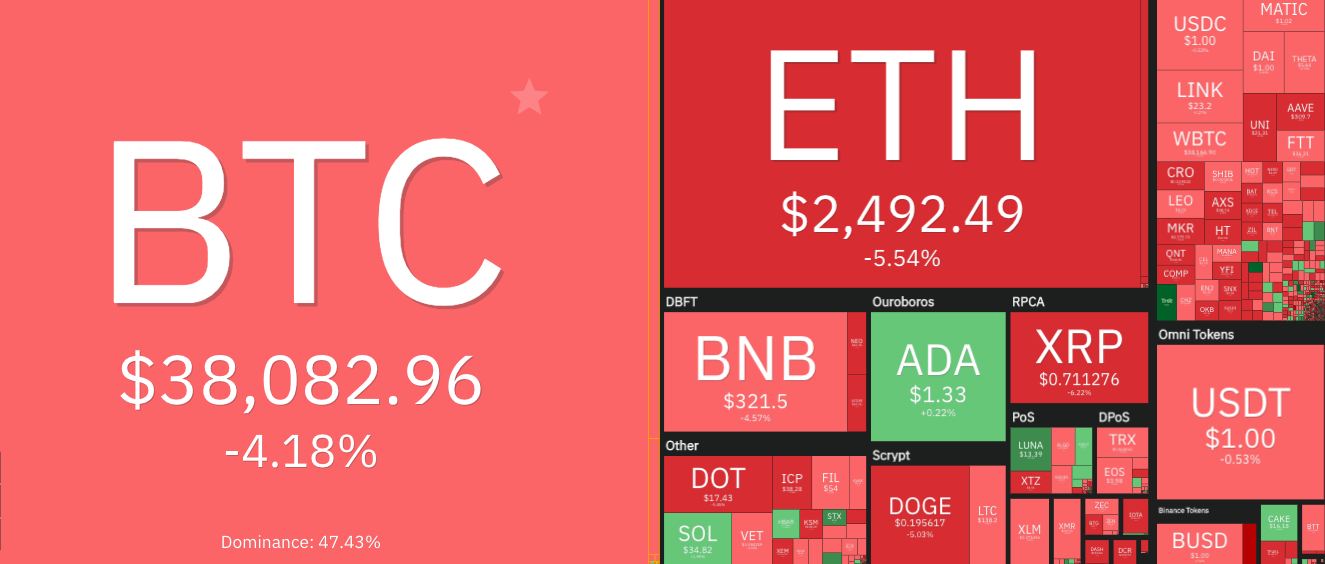

At the time of writing, the entire crypto market is down 3% in the past 24 hours. Bitcoin (BTC) is negative 4.18% on the day and is trying its level best to maintain a level – US$38K, pretty much where it’s trading at for now.

Ethereum (ETH) has also taken a long walk off a short pier, down 5.54% in the past 24 hours and changing hands for US$2,492 at press time.

However, while the big two have been dipping, some analysts were looking for silver linings, with a tinge of green, amid talk of a “healthy correction” and murmurings here and there of possible pumpage for the alts.

In line with an oft-posited theory that altcoins tend to make their best moves after a Bitcoin pump and a bit of a lie-down, US trader and investor Scott Melker posted a positive outlook…

ALT/BTC pairs look strong. This gives me more confidence that this #Bitcoin move is a healthy retrace after overbought RSI and a first retest of 42K.

Bitcoin retrace, alts thrive for a bit, Bitcoin pushes again, repeat.

If alts were also dropping, I would be concerned.

— The Wolf Of All Streets (@scottmelker) August 3, 2021

CryptoBull, a chart watcher with close to 100,000 followers, was also seeing things in a green light. Although with a Twitter handle like that, it’s to be expected.

Healthy correction here for #Bitcoin creating a falling wedge and putting in a higher low. 🚀 pic.twitter.com/L8yKndompb

— CryptoBull (@CryptoBull2020) August 3, 2021

As you can see from CryptoBull’s chart, Bitcoin has had 10 “green candle daily closes” in a row, plotting a decent rise for the OG crypto over the past week and a bit. A cool-off over the past day or so hasn’t really surprised too many onlookers.

A “higher low” level for Bitcoin is something several chartists have been looking out for. In other words, a comfortable area of support that could perhaps form more sideways movement and a base from which to launch again.

Naturally, it remains to be seen whether US$38K is it. Based on his technical analysis, Michaël van de Poppe has been discussing the $34.5K to $36K range as a solid, and perhaps more likely, lower-high Bitcoin pit stop.

News bits: Gary Gensler speaks, HSBC blocks Binance

Some bits and pieces from the past 12 hours or so that caught our attention…

• SEC Chairman Gary Gensler had a wide-ranging chat with Bloomberg today, hinting that he thinks crypto adoption can happen, but only with tightened regulatory rulings in place.

• Gensler had a busy one, also speaking online with the Aspen Security Forum. He said he agrees with his SEC predecessor Jay Clayton’s view that “every ICO I’ve seen is a security”.

• The CEO of crypto exchange FTX, Sam Bankman-Fried, meanwhile told CNBC that he believes regulatory clarity for the crypto industry is still three to five years away.

• Binance is still proving unpopular with UK banks. HSBC UK has joined the world’s most boring party, blocking customers from making credit card payments to the exchange.

Mooners and shakers: Cardano lists on Japanese exchange

Cardano (ADA), the popular smart-contract platform, Ethereum rival and no.5 crypto by market cap, has finally been listed on a Japanese exchange. And it’s been a long time coming, according to some ADA supporters, especially considering how popular the project is in Japan, which is where it found much of its initial funding support in its early days.

The exchange is called BITPoint and Emurgo’s Sebastien Guillemot, a prominent contributor to Cardano’s development, likened the news to being added to US exchange behemoth Coinbase, due to the rarity and strict nature of Japanese exchange listings.

Cardano was finally listed in Japan! 🇯🇵 $ADA

Japan has extremely strict rules for crypto exchange listings.

Only a small number of tokens can be listed in Japan, and ADA is now on that list! 🎉🎉 https://t.co/n2oxPHKa36

— Sebastien Guillemot (@SebastienGllmt) August 3, 2021

At the time of writing, Cardano was one of the few top 100 coins having a particularly solid day. A 2% gain in the past 24 hours may not look like anything to write home about from Camp Crypto, but it’s not too shabby when you look at the colour that’s dominating the Coin360 chart further up this article.

At press time ADA was inching up a bit further, trading at US$1.36. Usual caveat, though – by the time you read this, things may well have changed significantly.

Some other movers in the charts today… big movers: DeFi and stablecoin infrastructure project Terra (LUNA) is up 20% in the past 24 hours; crypto brokerage platform Voyager Token (VGX) is 19.8% to the good; and decentralised perpetual contracts project Perpetual Protocol (PERP) is having a +14.9% day.

The recent addition of TerraUSD (UST) to DinoSwap, a Polygon DEX, might have something to do with Terra’s price trajectory. That, and a community vote to whitelist bETH as collateral on the Anchor Protocol, which is built on the Terra blockchain. This will bring ETH staking rewards to the Anchor ecosystem.

As for Voyager, it has acquired Coinify, a crypto trading platform, and has launched its web swap 2.0 and staking portal.

Perpetual Protocol’s surge, meanwhile, can be attributed to the release of its v2 efficiency upgrade, dubbed Curie.