Cardano’s Monthly Chart

Above: Cardano (ADAUSD)

Cardano’s monthly chart shows one of explosive growth. While there remain another six days in August, if Cardano were to close the August candlestick at the present level, it would represent a +108.77% gain from the August 1st open. That would also mean August was the second highest gaining month for Cardano in 2021. Fundamentally, Cardano is doing phenomenal. The technical on the monthly chart could be pointing to some downside pressure soon, however. There is a regular bullish divergence between price and both the RSI and Composite Index. The third peak of regular bearish divergence is developing on the current monthly candlestick and could be a warning to some limited upside potential from these levels.

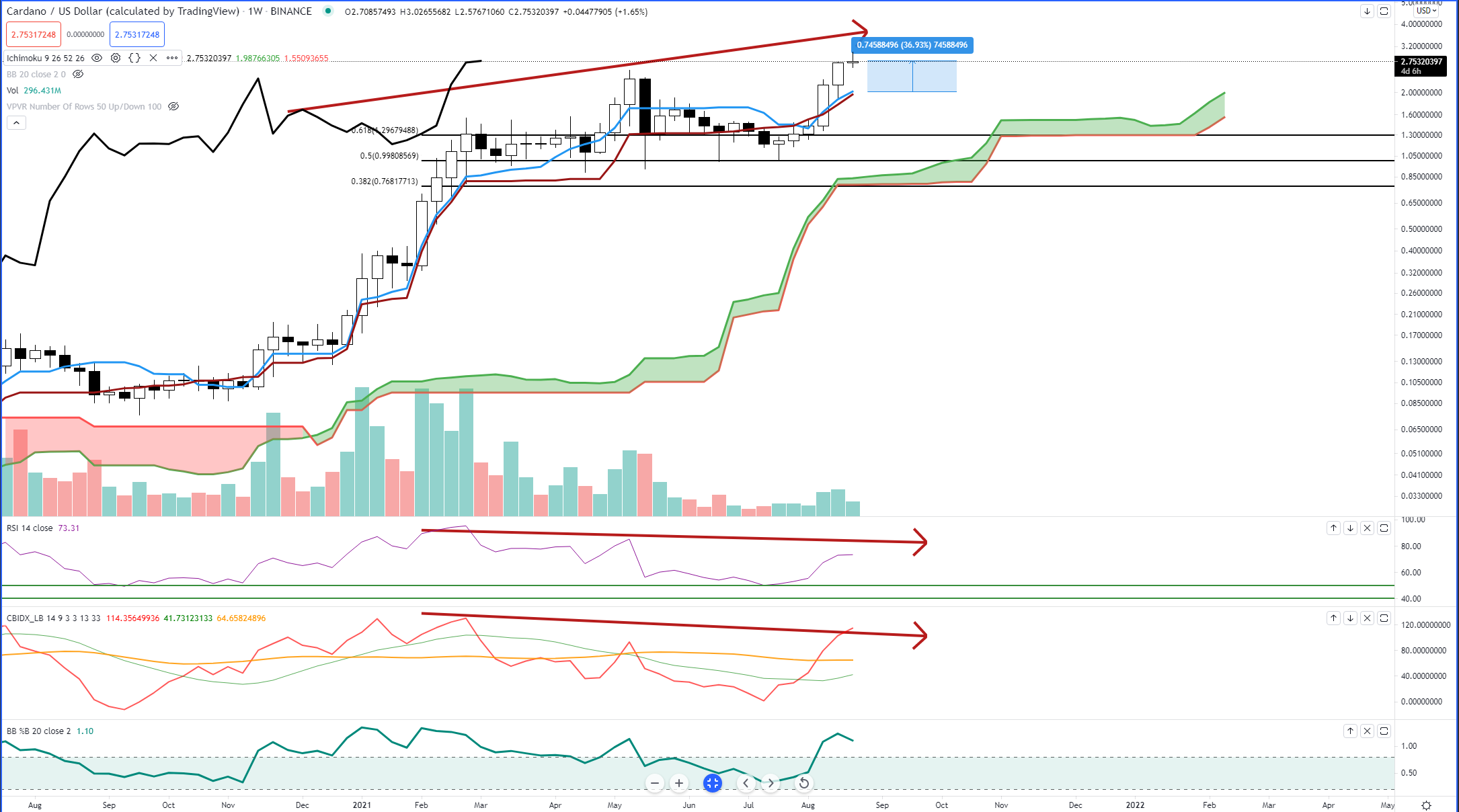

Cardano’s Weekly Chart

Above: Cardano (ADAUSD)

The weekly chart also shows regular bearish divergence. The RSI has a clear decline of three peaks compared to the three rising peaks on the candlestick chart – rarely do divergences (even regular divergences, which are more prone to failure) of three fail to create some time of the corrective move, especially on the weekly chart. A reasonably extreme slope on the %B indicates a dramatic move lower if Cardano fails to close higher. The Composite Index on the weekly chart is trading at an historical resistance level – another warning sign that upside potential and movement may be limited here. Notice, also, the substantial gap that exists between the current weekly candlestick and the weekly Tenkan-Sen. The Tenkan-Sen is very sensitive to gaps between the current price action and itself. Unlike the Kijun-Sen, where price can trade in a massive gap for an extended time, there is relatively little time before a gap closes between the current candlestick and the Tenkan-Sen.

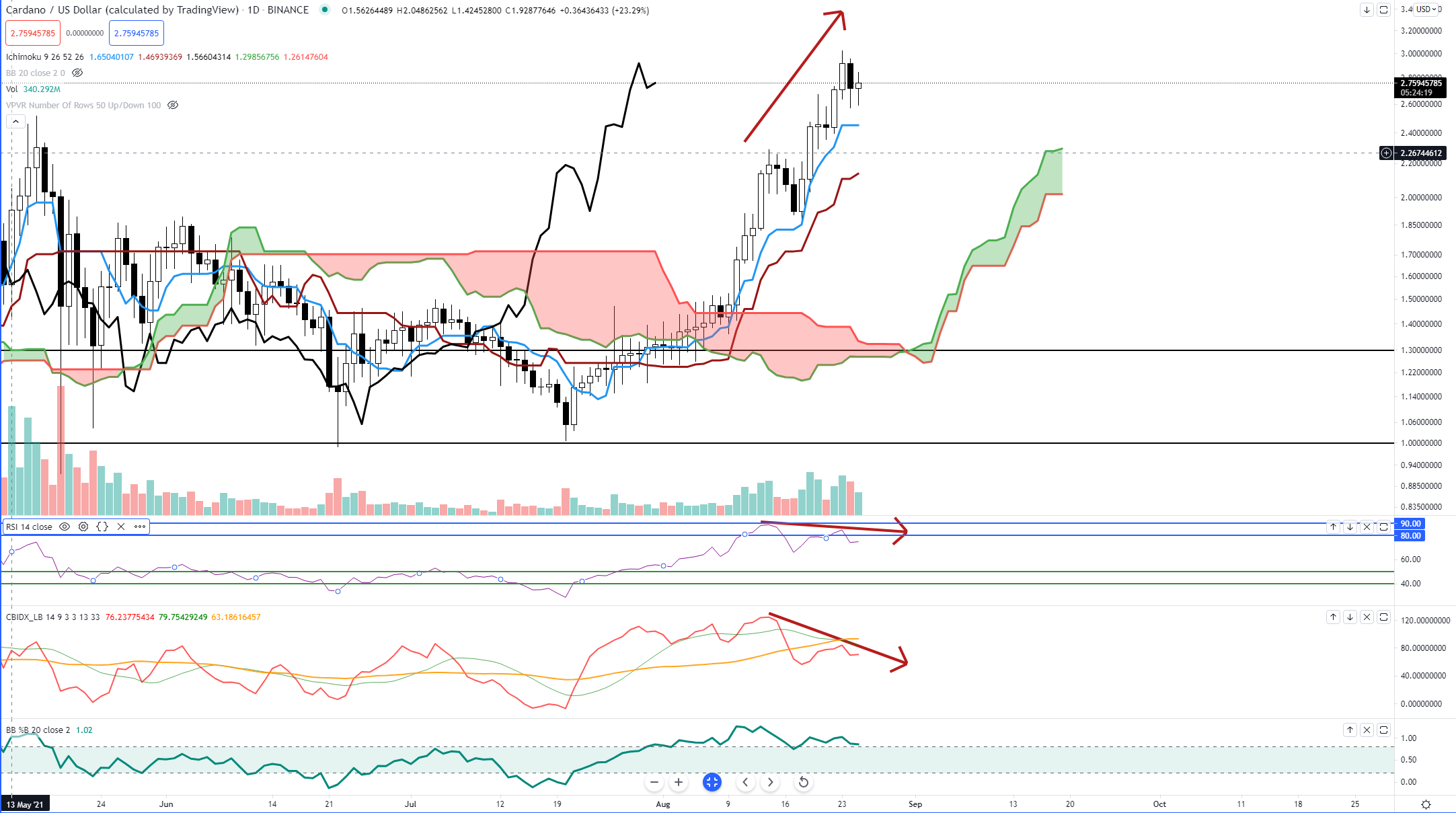

Cardano’s Daily Chart

Above: Cardano (ADAUSD)

Continuing this pattern of regular bearish divergence, you’ll see it also exists on the daily chart. The RSI was most recently trading against the last overbought condition at 90 between August 13th and August 15th before dropping back to the 65 area and rising again to a lower swing high of 83. Not shown are some time cycles I’ve discussed in recent articles and recordings – Cardano is trading inside a confluence zone of Gann time cycles that could indicate a termination of the current trend, or at least a correction.

It is essential to understand that even though the monthly, weekly, and daily charts all show regular bearish divergence, it is not a certainty that a sell-off is imminent. On the contrary, it is very often the case that continued overbought conditions are signs of strength and continued price momentum. Nevertheless, when all three of these timeframes point to extremes and divergences against those extremes, it pays to be vigilant for a move in either direction.

Advertisement

Save money on your currency transfers with TorFX, voted International Money Transfer Provider of the Year 2016 – 2020. Their goal is to connect clients with ultra competitive exchange rates and a uniquely dedicated service whether they choose to trade online or over the telephone.

Find out more here.