At COOLLAUNCH rewarding our loyal community members with guaranteed allocations to projects launching through the platform is what we enjoy doing. Identical to our raise structure, projects that launch through us will host a wide distribution model, while sporting relatively low contribution caps per individual. Our design is built to maintain both foundational and proven economic structures shown to provide the highest opportunity for organic growth, while presenting a larger distribution to (potentially) risk averse contributors. Along with our native insurance policy, Coollaunch has made sure to implement user experience and protection as top priorities.

Tiers

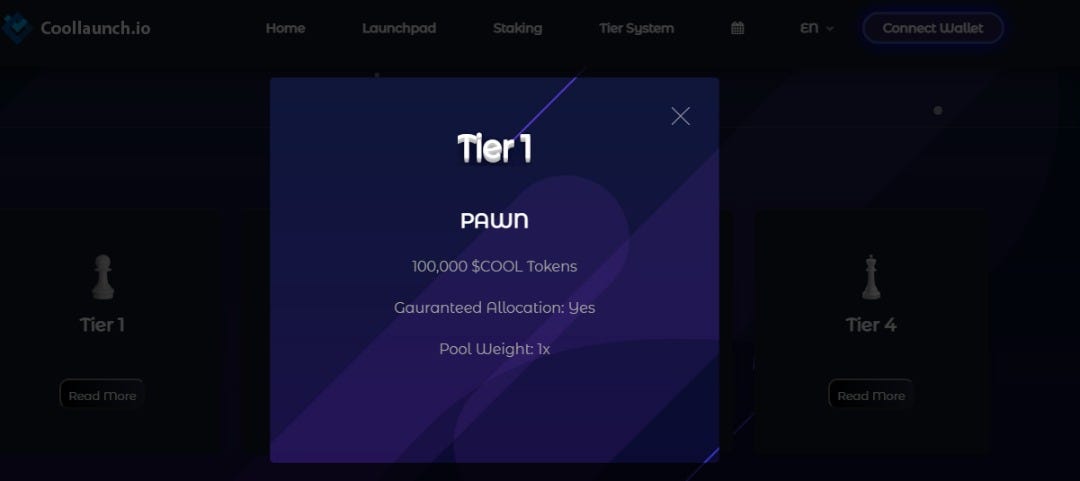

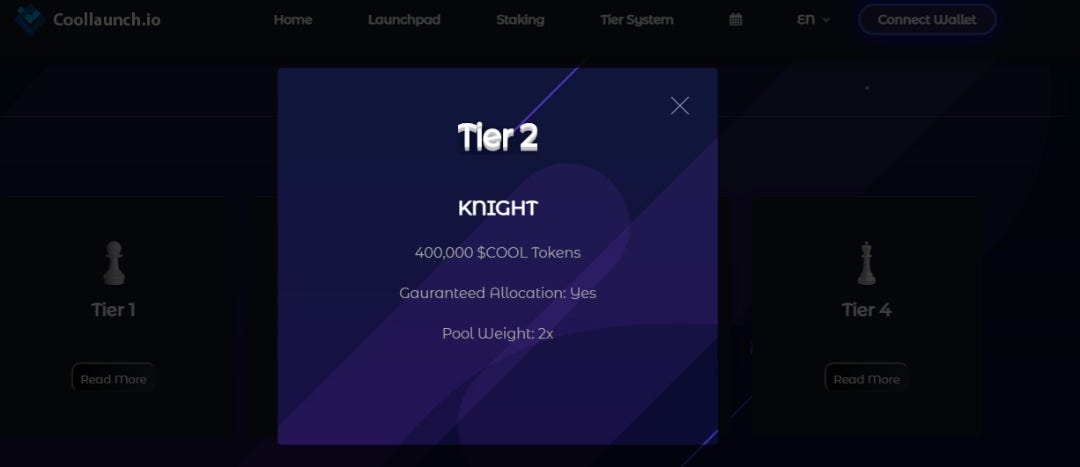

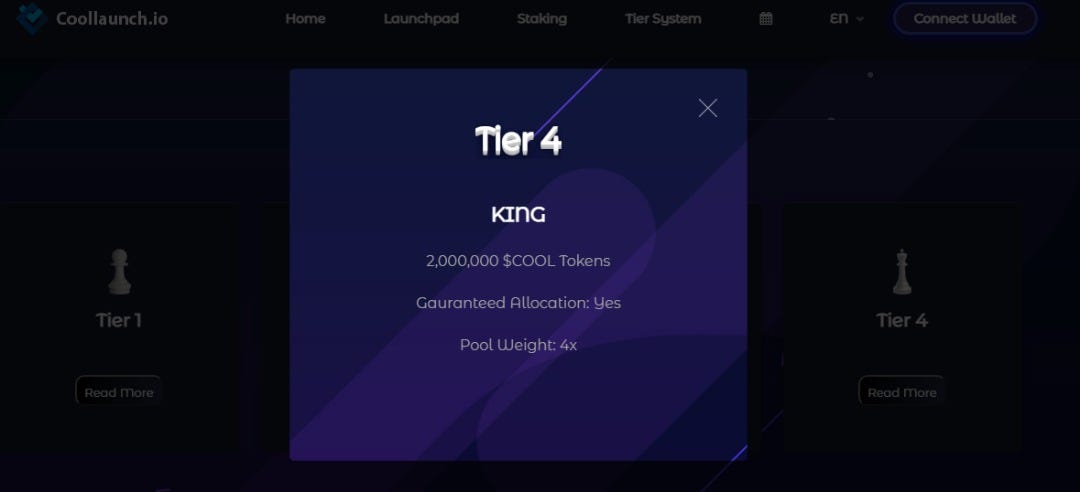

Currently there are 4 tier levels which our users qualify for. The requirements for each tier are detailed below:

Tier System

After much consideration and community deliberation that have gone into designing the tier system in a way that provides access to early adopters, while limiting the number of community members who can qualify for placement. As with any limited asset, tier positions should be expected to price out smaller holders for this reason, tier requirements are subject to governance. They may be restructured or reformatted to a model which allows the community to grow, and/or to make the tiers more accessible.

Staking

Projects launching through CoolLaunch platform will each have their own designated staking pool. COOL holders that wish to participate in the sale will be required to stake a minimum number of COOL in the respective pool for 7 days prior to a project’s sale to be guaranteed allocation for that project.

Pool Weight (Example)

Here’s an instance of how tiers and pool weight would enable us to calculate allocation for a sale:

Tier 1(PAWN)

Tier 2(KNIGHT)

Tier 3(BISHOP)

Tier 4(KING)

A project launching through CoolLaunch, say (Project Z) wants to sell 5,000,000 tokens in their initial raise. 200 COOL holders have staked their required amount to gain allocation to the sale of Project Z.

100 Pawn Members have staked their required 100,000 COOL each for 7 days

(Pool Weight 1X*100=100 Pool Shares)

50 Knight Members have staked their required 400,000 COOL each for 7 days

(Pool Weight 2X*50=100 Pool Shares)

40 Bishop Members have staked their required 1,000,000 COOL each for 7 days

(Pool Weight 3X*40=120 Pool Shares)

10 King Members have staked their required 2,000,000 COOL each for 7 days

The total number of pool shares for all tier members is (Ts=100 +100+120+40=360). Therefor, the 5,000,000 tokens available in Project Z’s sale would be divided by 360 (5,000,000/360=13,888.8) Each share of pool weight equals 13888.8 tokens, meaning that Pawn Members (Pool Weight 1X) would have the ability to buy 13,888.8 tokens, Knight Members (Pool Weight 2X) would be able to buy 27,777.6 tokens, and Bishop Members (Pool Weight 3X) would have a 41,666.4 tokens

King Members (Pool Weight 4X) would have a 55,555.2 tokens in Project Z’s sale.

Reservations:

Vesting, soft/hard caps for projects will be determined on a case-by-case basis to meet the requirements of our launchpad partners.

Although a COOL member may stake and be qualified for allocation in a project’s sale, it’s possible that not all community members will fulfill their allocation. If a project’s first sale round closes, and they haven’t achieved their hard cap, the remaining tokens will be released in a second round. The tokens will be available in this round on a first come first serve basis (FCFS), and are accessible to both COOL community members and non COOL members, alike.

The Pawn Pool Weight Allocation that was calculated the first round will carry over to round two, establishing the new maximum cap per individual.

Continued Staking and Insurance Policy

COOL community backers who participate in project sales are eligible for coverage under Coollaunch’s insurance policy. This feature will be built to provide community members a sense of financial protection in the case of a project that is failing to deploy. To be eligible for insurance coverage, a COOL backer must keep their COOL staked in a project’s designated staking pool following the completion of a sale.

Terms, conditions, and requirements for Coollaunch’s Insurance Policy will be expressed further in a subsequent article.

Our Official Links:

Website | Telegram | Twitter | Instagram | Medium