- Capital gain — Those who buy digital assets focus on two types of return: capital gain and yield. Capital gain refers to the rise in the value of an asset. For example, a person buys one share of stock XYZ for $10. Two months later, the price of stock XYZ is now trading at $20. The buyer decides to sell their share at $20, which is 100% higher than the purchase price. The 100% increase is a capital gain. Many people buy stocks, bonds, real estate, or cryptocurrencies are hoping to make a capital gain.

- Yield — Yield refers to investment income generated over a period of time. Yield could be the dividends on a stock, interest payments on a bond or loan, or rental income from a house. For example, a bank could offer you a yearly interest rate of 0.01% for storing your money with them in a savings account. When you apply for a 30-year fixed rate mortgage loan through the same bank to purchase a house, the bank agrees, giving you a loan with a 4% interest rate. Interestingly, the 0.01% is the annual yield you receive from the bank for your savings account and the 4% is the annual yield the bank receives from you on the mortgage loan.

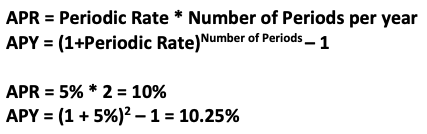

- APR vs APY — Depending on the asset, income may be generated or realized on a daily, weekly, monthly, quarterly, or yearly basis. In order to compare the yield on different assets, the returns are typically listed as APR (Annual Percentage Rate) or APY (Annual Percentage Yield), which represents the annual yield per year for an asset.

The difference between the two measures is that APY takes into effect compounding, while APR does not. For example, at the start of the year you make a $100 investment in an asset that advertises a 10% APR, with interest paid to you semiannually. The periodic rate is 5% and the number of payment periods per year is 2. Let’s calculate the APR and APY.

Note: APY is higher than APR because returns include the impact of compounding. The higher number of periods that compound, the greater the difference between APY and APR. Compounding is the reallocation of realized yield for additional yield, allowing a person to collect additional interest on their initial principal plus any income already generated. If yield is realized and compounded more than once per year, APY is the most accurate measurement of yield.

Capital appreciation, is backward looking, which means it is based on the past and is historically accurate. In the previous example, the person knows the exact date and price they bought and sold the share of stock, which allows them accurately calculate their capital gain. However, the APR or APY is a forward-looking measure, which is based on future estimates. For cryptocurrencies, many factors such as supply, demand, liquidity, and fees can change the APR or APY throughout the year.

Since we have a good understanding of yield now, let’s talk about the yield available through cryptocurrencies. The three types of yields usually refer to yield farming, liquidity mining, and staking.

- Yield Farming — Providing liquidity to a platform in return for a portion of the fees generated by its use. LPs (Liquidity Providers) can provide their funds to a liquidity pool on a DEX (Decentralized Exchange) or a lending platform, receiving a portion of the trading or lending fees generated. Each LP can claim transaction fees generated by the liquidity pool, proportionate to the liquidity they provided to the pool. Popular DEXs on Ethereum include Uniswap and Sushiswap, where billions of dollars have been deposited by LPs to collect transaction fees. In addition, yield farming can be made from borrowing and lending platforms. MELD, one of the most anticipated DeFi protocols for lending and borrowing of crypto and fiat, plans to distribute 40% of all protocol fees to LPs.

- Liquidity Mining — Liquidity mining is similar to yield farming, but includes the DeFi protocol rewarding LPs with its native token plus the fees generated by the liquidity pool. For DEXs or lending platforms, liquidity mining is used to incentivize LPs to provide liquidity that is crucial to the viability of the protocol. For example, SundaeSwap provided its native token to LPs for providing liquidity to certain pools. In addition, Genius Yield plans to provide liquidity mining incentives for its planned DEX release in 2Q2022.

- Staking — Typically refers to participants delegating or locking up their funds in a proof of stake (PoS) consensus protocol, such as Cardano, Ethereum’s Beacon Chain, or Polkadot. In exchange for users delegating or locking up their coins in the protocol, which helps secure decentralized PoS protocols, participants receive rewards in the form of the protocol’s coin. Rewards are usually directly proportional to the amount of the participant’s stake.

- Problem — In the Cardano ecosystem, there are currently over 100 dapps (decentralization applications) in development. These include various DEXs and lending/borrowing protocols. Many of these platforms will offer LPs the chance to yield farm. For some protocols, such as DEXs, the APYs for LPs will vary based on transaction cost, liquidity, demand and supply. As the number of yield farming opportunities increase, many LPs won’t have the time or skill needed to a continually seek the highest yield for their funds.

- Solution — A yield optimizer is a tool that attempts to obtain the highest yield possible by shifting funds between various DeFi protocols in an ecosystem. Previously, LPs would have to monitor the APYs of multiple DeFi protocols, constantly shifting their funds between liquidity pools to obtain the highest yield. In addition, LPs also had to deal with different harvesting schedules among the different protocols, manually reinvesting LP fees gained. However, yield optimizers could handle reallocation of funds to other protocols and auto-compound any harvested yield paid to the LPs. For the Cardano ecosystem, Genius Yield plans to release an Artificial Intelligence (AI)-powered yield optimizer that will execute different strategies based on the LP’s market views and risk tolerance. To understand the potential for the Cardano ecosystem, let’s look at Yearn Finance, which is one of the biggest yield optimizers on the Ethereum platform with a current TVL (Total Value Locked) of $4 billion.

Note: Harvesting is when a strategy or liquidity pool realizes profit, such as transaction fees or lending fees, that the LP will receive as their yield or earnings. Auto-harvesting, similar to auto-compounding, is reinvesting the LP”s realized profit back into the strategy, allowing the LP to collect interest on their realized profit. TVL, an acronym for Total Value Locked, is the total market value of assets deposited, committed, or locked to a DeFi protocol through a smart contract.

As mentioned earlier, the APYs of liquidity pools can change throughout the year based on multiple factors such as liquidity, supply, and demand. To illustrate, two weeks ago SundaeSwap’s yield farming pools had APRs around 300%. At the time of this article, the APRs have dropped to 128%. Why? LPs, seeing the high APR, provided more liquidity to the pools. LPs receive transaction fees in proportion to their liquidity provided. If total trading fees remain flat, there is less fee revenue to split among a growing liquidity pool. If the APR gets too low, some users would like to shift their funds to other yield farming opportunities. Each user would have to continuously monitor the yield on SundaeSwap’s pools while researching other opportunities. In addition to manually having to reallocate liquidity, each LP would have to stay knowledgeable about SundaeSwap’s harvesting schedule to make sure they don’t unintentionally withdraw their funds early and miss out on receiving their harvested yield. A yield optimizer could handle all of these tasks, including auto-compounding, for the LP.

- AI-powered yield optimizer — The yield optimizer, powered by Artificial Intelligence, will use complex algorithms to automatically allocate the users’ funds on different protocols. The yield optimizer will handle the complete allocation of each user’s funds, including depositing, exchanging, and withdrawing tokens on multiple protocols and across multiple liquidity pools. The yield optimizer implements these strategies through Smart Liquidity Vaults.

- Smart Liquidity Vaults — Users can passively yield farm by depositing their funds into these vaults that implement different strategies based on the users’ risk tolerance and market outlook. Genius Yield will have strategies such as DCA (Dollar Cost Averaging) and Smart Rebalance. Advanced strategies being looked are based on modeling volatility and forecasting trend reversals. A backtested ML platform that utilizes blockchain data streams and historical data is used develop each strategy. Vaults will leverage dynamic and algorithmic order types available on on the Genius DEX to execute the strategy and optimize yield for the user.

- Community-produced Vaults — The community will eventually be able to design their own vaults in the future, creating strategies that could even compete with Genius Vaults.

- Fees — Genius Yield hasn’t announced its fee structure, but vaults will have a management fee based on each vault’s TVL and a performance fee on each vault’s profit.

- Genius Yield Staking Program — GENS holder will have the option to stake their GENS in a Genius pool to earn yield. GENS tokens staked will be able to receive 20% of Genius Yield’s platform fees and liquidity mining incentives. The platform fees will be 20% of all Genius DEX fees and 20% of the management and performance fees charged for the Smart Liquidity Vaults.

To learn more about some of the unique attributes of Genius Yield’s DEX, see my previous article here.

Figure 1: TVL of Yearn Finance $YFI from DeFiLlama, as of 2/23/2022

- Yield optimization — Yearn Finance offers a suite of DeFi products that provide yield farming opportunities on the Ethereum and Fantom blockchains. Launching in July 2020, its vault product that automated yield farming is widely known as the initiator of yield farming aggregators. The TVL has grown to $4 billion since its inception. Its core products include yVaults and Zap. Zap allows users to deposit your funds into certain vaults one transaction, instead of a multiple transactions, thereby saving on gas fees, which can expensive on the Ethereum platform.

- yVaults — yVaults is the most popular product on Yearn Finance and the most similar to Genius Yield’s Smart Liquidity Vaults. Users can deposit their funds into yVaults, which are pools are funds with specific strategies to maximize yield for assets in the fund. yVaults allow the users to passively pursue complex active strategies by shifting the user’s capital to different DeFi products, auto-compounding gains, and rebalancing. Each yVault can have up to 20 strategies.

- Fees — A 20% performance fee is deducted on any yield gained every time a vault is harvested. A 2% management flat fee is charged annually on vault deposits to pay for Yearn’s operating expenses and gas costs related to implementing the vault strategies.

- Community Lead Vaults and DAO Treasury— New yVaults and their strategies are approved by the community. Anyone can create a strategy, which undergoes an extensive vetting process, audit, and approval by the community. The Strategist, or the person who created the strategy, gets half of the 20% performance fee. The other half of the performance fee goes to the Yearn DAO (Decentralized Autonomous Organization) Treasury, which is managed by the Yearn community.

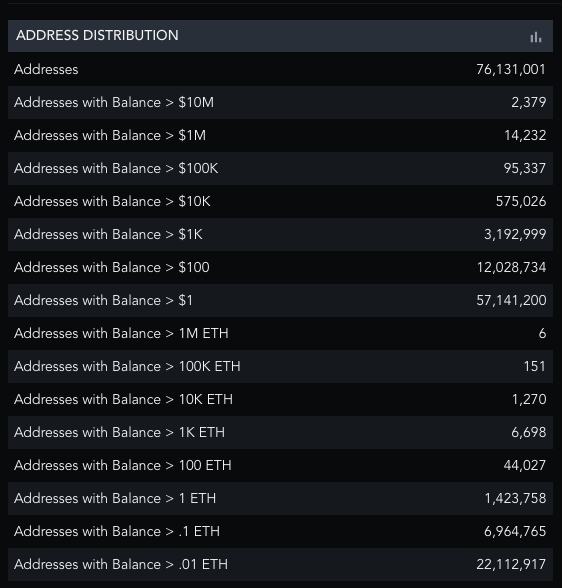

Figure 2: Ethereum address distribution from Messari, as of 2/23/2022

- High gas fees limit participants—Ethereum gas fees can be high, reducing returns. In addition, smart contracts that require more computational work require higher gas fees. Users have to pay gas fees to the network to deposit or withdraw their funds. For example, Curve Frax is a popular yVault on Ethereum that currently has $129 million in assets and a net APY of 4.2%. Etherscan shows that over the last 90 days the median transaction fee is around $20 . If a user wanted to deposit and withdraw $1,000 to this vault over a one-year time period, the $40 in transaction fees would give eliminate his yield gain of $42, leaving him with $1,002, or at (0.2%) gain after all fees. Assuming rational participants with $10,000 or more would not use these vaults due to the high gas fees, around 75 million people would be seeking alternative sources for yield.

- Vault strategies limited by fees — Harvesting, due to the high gas cost, reduces APY and the flexibility of vault strategies. To counter this, various yVault strategies on Ethereum limit the number of times they harvest yield or shift capital. For vaults with lower TVLs, frequent harvesting or shifting capital between assets can make the vault economically unfeasible.

- Yearn DAO — Yearn has a sophisticated DAO where the Yearn community governs the use of the Treasury, fund operations, enlists and compensates key independent developers and contributors, and has created an extensive review process to add or remove new vaults and strategies.

- Partnerships — Yearn has integrated the Fantom blockchain and made a partnership with Curve Finance to access its liquidity mining opportunities through liquidity pools. These decisions significantly lowered transaction costs and provided yield boosted opportunities for Yearn’s users. Since Fantom’s integration in September 2021, the TVL on yVaults utilizing Fantom have grown to $700 million.

- Yield opportunities available to more users — Looking at Figure 2, over 70 million addresses hold ether valued at $1,000 or less. Due to the fees on the Ethereum platform, it is highly unlikely they can use yVaults and be profitable after paying the $10-$200 in gas transaction fees, the 20% performance fee, and the 2% management fee. However, for basic Cardano transactions, the network fee is typically between 0.16 to 0.18 ADA and current smart contract transactions are around 0.5 ADA to 2.0 ADA.

- eUTXO model design lowers fees for higher APY— Cardano’s eUTXO model allows on-chain transactions to be from one to many addresses or from many to many addresses, which vastly increases the throughput of the network. In an account model, such as Ethereum’s, every transaction must be serialized and executed in order, because each transaction effects the global state. When Smart Liquidity Vaults are shifting capital, harvesting, or sending funds back to users, Genius Yield could lower transaction costs and increase APY for users by grouping multiple payments in single transactions.

- Determinism — As mentioned in my previous article, Cardano’s platform allows determinism, concurrency, and parallelism. For Smart Liquidity Vaults, transaction fees are known beforehand and cannot be altered after submitted, providing clarity on the impact to APY. During periods of congestion on Ethereum’s network, higher transaction costs could reduce the APY of yVaults as the strategies shift capital or harvest.

- Programmability of Smart Liquidity Vaults allow more complex strategies — Genius Yield has the advantage of having its own eUTXO based order-book DEX to implement its Smart Liquidity Vaults. Similar to the stock market, strategies as limit, stop, dynamic, and algorithmic orders will be possible.

- Similar to Yearn-Curve vaults, Genius Yield could potentially partner with lending platforms such as MELD or others to offer yield boosting opportunities through collateralized debt positions.

- Will users be able to buy insurance on their funds deposited into Smart Liquidity Vaults?

Additional Sources:

Genius Yield SORS vs SundaeSwap Scoopers

Source: https://medium.com/@The_Eze/genius-yield-the-yearn-finance-of-cardano-or-something-more-14c1c6876f4e