Key Insights:

-

Cardano (ADA) rallies by 6.23% on Tuesday.

-

Network updates and market risk appetite drove ADA to a day high of $0.9878.

-

Technical indicators are bullish following two consecutive days in the green.

It was a bullish session for Cardano (ADA) on Tuesday. ADA and the broader market made solid gains, supported by demand for riskier assets and Cardano network news updates.

Following a 4.68% gain on Monday, ADA rallied by 6.23% to end the day at $0.9758. A day high of $0.9878 saw ADA edge closer to $1.00. ADA last tested resistance at $1.00 on March 1, 2022.

Market Risk Appetite and Network News Updates Deliver Support

For ADA, Input Output HK provided price support this week. On Monday, the Cardano developer announced an upgrade to address scaling on the network.

Input Output HK tweeted,

“Today, an update proposal (submitted before the weekend) will trigger an increase in per-block #Plutus script units limit from 56M > 62M. This change will take effect on #Cardano mainnet at epoch boundary 328 today, 21 March at UTC 21:44:51.”

The team added.

“This incremental adjustment is the latest in a continuing series of optimizations and increases to network capacity that are being made as #Cardano continues to scale in 2022 for future growth.”

Adding to the upside was a pickup in demand for riskier assets. On Tuesday, the NASDAQ 100 rallied by 1.95%, delivering support for the broader crypto market.

ADA Price Action

At the time of writing, ADA was up by 1.21% to $0.9876. A bullish start to the day saw ADA test resistance at $1.00, with a morning high of $1.0010 before easing back.

Technical Indicators

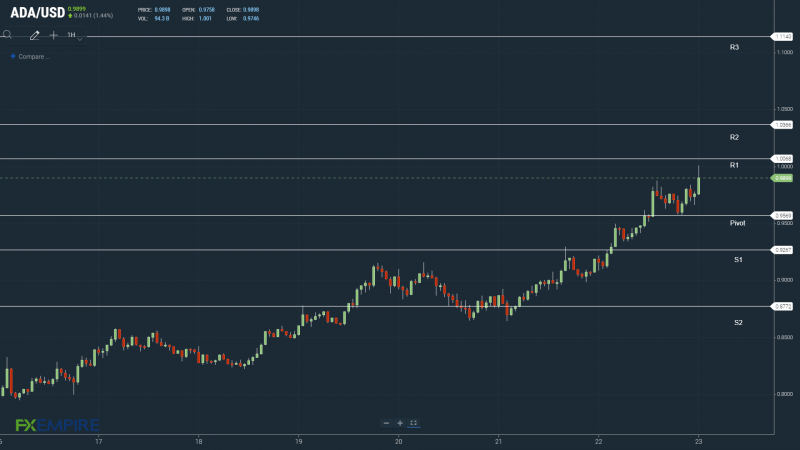

ADA will need to avoid the day’s $0.9569 pivot to make another run on the First Major Resistance Level at $1.0068. ADA would need the broader crypto market to support a move back through to $1.00.

An extended rally would test the Second Major Resistance Level at $1.0366 and resistance at $1.0500. The Third Major Resistance Level sits at $1.1140.

A fall through the pivot would test the First Major Support Level at $0.9267. Barring an extended sell-off, ADA should avoid a return to sub-$0.90. The Second Major Support Level sits at $0.8772.

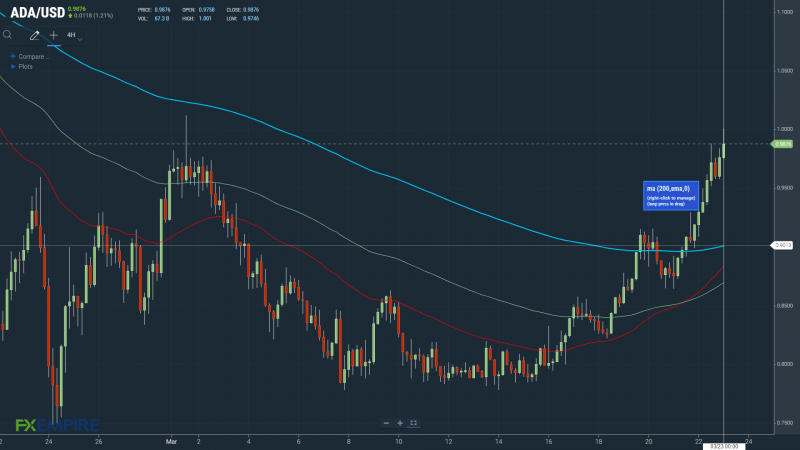

Looking at the EMAs and the 4-hourly candlestick chart (above), it is a bullish signal. ADA holds above the 200-day EMA at $0.9013. Following Monday’s bullish cross, the 50-day EMA continues to narrow on the 200-day EMA.

The 100-day EMA narrowed on the 200-day EMA, also price positive.

Avoiding the 200-day EMA and a return to $1.00 levels would bring $1.05 into play.

This article was originally posted on FX Empire