Bitcoin (BTC), the world’s largest and oldest cryptocurrency, has been grappling with a major pullback lately. The Bitcoin price recently extended lower than the $40,000 level before bouncing back. However, the rebound isn’t significant as BTC is still trading 19% below the high attained after the Spot Bitcoin ETF approval. Amidst the crash frenzy, a crypto analyst even warned against a BTC price dip to $38,130

Analyst Insight On Bitcoin Price Crash To $38,130

A popular crypto insights provider on X, Ali Martinez, suggested that the recent Bitcoin price dip could extended below $38,130. In a recent post on X, he also stated that it would trigger panic selling mode among short investors. The analyst noted that the price crash below the above-mentioned threshold would indicate losses for short-term BTC holders.

Hence, he anticipates a “new wave of panic selling” to occur as these short traders would seek ways to minimize their losses. However, the bearish turn is momentarily as Martinez expects the Bitcoin bull cycle to top in late 2025.

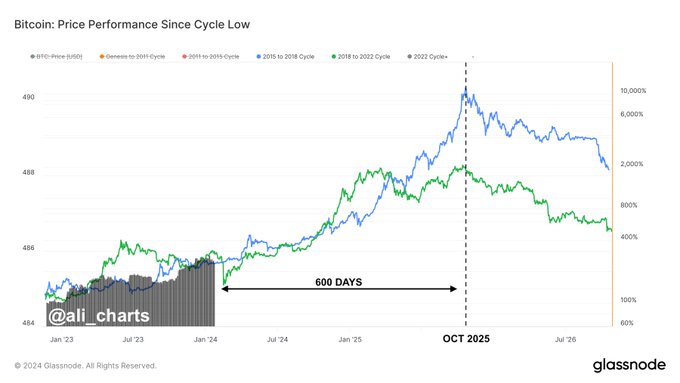

In another post, he mentioned that Bitcoin is currently mirroring historical bull runs stretching from 2015-2018 and 2018-2022. Thereafter, he noted that market projections indicate a potential peak in October 2025. He went on to conclude, “This implies $BTC still has 600 days of bullish momentum ahead!” Therefore, long-term Bitcoin HODLers can relax and enjoy humongous gains when this bull cycle tops.

In addition, Martinez also mentioned that all Bitcoin price corrections during a bull run are followed by an upswing, according to historical patterns. He advised that traders who want to capitalize on Bitcoin’s potential growth could leverage the “buy the dip” opportunity.

Also Read: Bitcoin Eyes $42K Surge as BlackRock’s Head Sees ETF Impact

BTC Price Struggles To Rebound

The Bitcoin price is struggling to sustain over the $40,000 mark as it’s hit by a pullback after every attempt to rebound. BTC was trading at $40,111.13 at press time on Thursday, January 25, indicating a 0.25% increase. Whilst, the crypto boasted a market cap of $786.18 billion.

On the other hand, the 24-hour trade volume for Bitcoin plummeted 34.75% to $20.09 billion. Also, it plunged as low as $39,508.80 before rebounding. Furthermore, the Bitcoin price is considerably lower than its 10-day and 50-day EMAs of 41038 and 41749, respectively, according to data from TradingView.

Earlier, Martinez underscored the significance of the $38,000 threshold on the weekly chart. The analyst cautioned that a close below this crucial level may serve as a signal for a potential downturn in Bitcoin’s value, which could target the strong support cluster around $33,000.

This critical zone is based on a host of key technical indicators, including the lower boundary of a parallel channel, the 0.5 Fibonacci retracement level, and the 50-week simple SMA. However, the analyst noted that these “factors together form a significant line of defense that could potentially halt further #BTC price declines.” This implies that a BTC price drop below $32,000 is not on the cards as of now.

Also Read: Bitcoin Whales Have Been Buying Every Dip, BTC Price Recovers to $40,000

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.