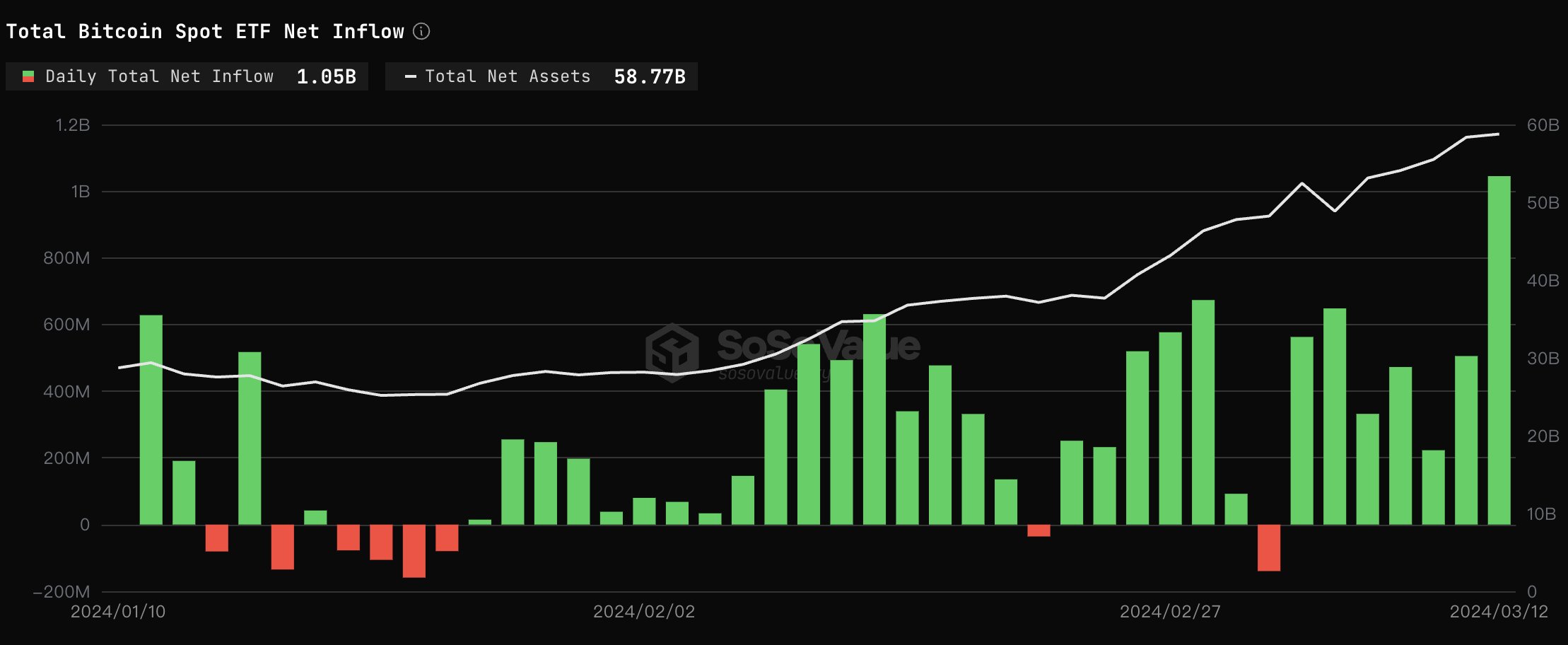

Spot Bitcoin ETFs set another record, witnessing the highest single-day net inflow since the launch of Bitcoin ETF in the United States. The record net inflow of over $1 billion helped Bitcoin rebound from a decline after hotter CPI inflation data and hit a new all-time high of $73K.

Spot Bitcoin ETF Records $1.05 Billion New Inflow

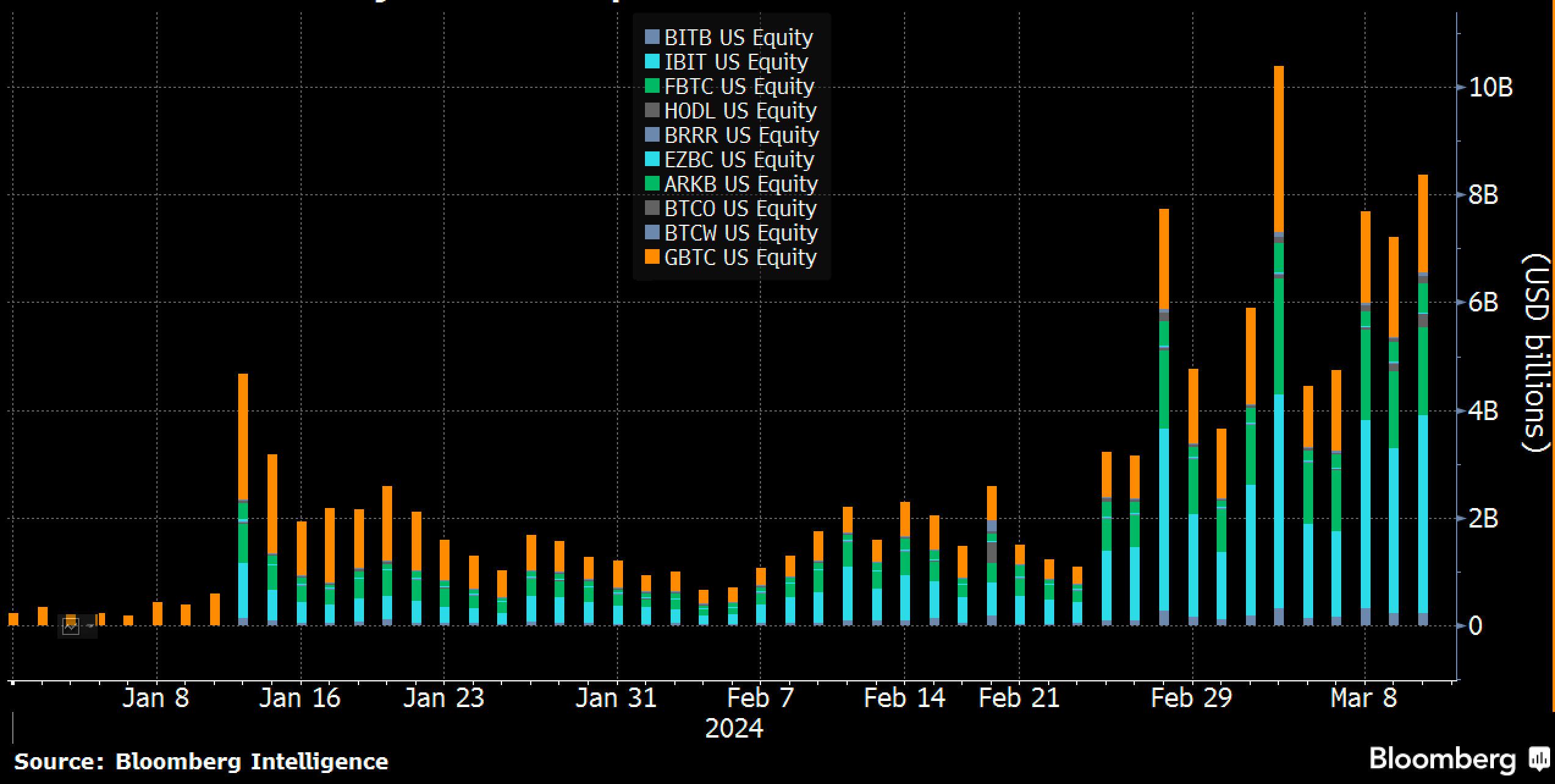

Net inflow into spot Bitcoin exchange-traded funds (ETF) reaches $1.05 billion on March 12, according to data by SoSoValue. The massive inflow came on the back of the second-highest volume day for the 10 Bitcoin ETFs. In fact, it was the best day in the past five weeks, with $8.5 billion.

Bloomberg senior ETF analyst Eric Balchunas said only five stocks have recorded higher trading volumes than $8.5 billion. BlackRock’s iShares Bitcoin ETF (IBIT) nearly $4 billion in volume, VanEck Bitcoin Trust ETF (HODL) and Invesco Galaxy Bitcoin ETF (BTCO) recording $150 million and $250 million volumes indicate huge demand in other ETFs. VanEck recently cut its Bitcoin ETF management fees to 0% for the next twelve months.

BlackRock’s iShares Bitcoin ETF (IBIT) saw $849 million inflow, breaking records of the highest inflow to date. Following the latest inflow, BlackRock’s net inflow hit over $11.44 billion and asset holdings jumped over $14.5 billion.

Fidelity Bitcoin ETF (FBTC) and Ark 21Shares (ARKB) Bitcoin ETF saw $51.6 million and $93 million inflows, respectively. Bitwise (BITB) and other spot Bitcoin ETFs saw marginally low inflows. VanEck Bitcoin ETF (HODL) saw an inflow of $82.9 million due to 0% fees amid higher competition.

In addition, GBTC recorded another outflow of $79 million, a welcomed fall indicative of Genesis’ GBTC selloffs reaching the end. Crypto lender Genesis received bankruptcy court approval to sell 35 million GBTC shares worth $1.3 billion. Notably, GBTC net outflow to date has reached over $11.12 billion.

Also Read: Bitcoin Leveraged Bets Surge Amid Strong Demand for Bitcoin Futures ETFs

Bitcoin Price Hits $73K

BTC price jumped over 2% in the past 24 hours to hit a new all-time high, with the price currently trading at $73,067. The 24-hour low and high are $68,728 and $73,182, respectively. Furthermore, the trading volume has increased slightly in the last 24 hours, indicating a rise in interest among traders.

Bitcoin futures and options open interests (OI) remain at record levels, with total futures OI rising over 3% to $36.97 billion, as per Coinglass data. CME Bitcoin futures OI hits new record high $11.47 billion. Bitcoin price to $100K prediction remains intact despite sentiment towards consolidation due to sky-high funding rates.

Also Read: Ethereum Put Options Demand Surges, ETH Price Correction Soon?

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.